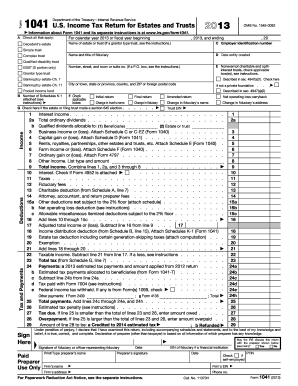

IRS 1041-ES 2013 free printable template

Show details

2013 Department of the Treasury Internal Revenue Service Form 1041-ES Estimated Income Tax for Estates and Trusts Section references are to the Internal Revenue Code unless otherwise noted. Future

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1041-ES

Edit your IRS 1041-ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1041-ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1041-ES online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1041-ES. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1041-ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1041-ES

How to fill out IRS 1041-ES

01

Obtain IRS Form 1041-ES from the IRS website or a tax professional.

02

Fill out the top section with your name, address, and tax identification number.

03

Determine the estimated income for the estate or trust for the year.

04

Use the estimated income to calculate the expected tax liability using the current tax rates.

05

Complete the payment vouchers included in the form.

06

Submit the completed form and payments by the appropriate deadlines throughout the year.

Who needs IRS 1041-ES?

01

Estates or trusts that expect to owe at least $500 in tax for the year.

02

Fiduciaries responsible for the management of estates or trusts.

03

Individuals or entities that have income generated from the estate or trust.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay 1040-ES on Eftps?

Entities and individuals can pay all their federal taxes using EFTPS, including quarterly Form 1040-ES estimated taxes, and they can make payments weekly, monthly, or quarterly. Both business and individual payments can be scheduled in advance.

How do trusts pay taxes?

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Can I pay IL 1040 ES Online?

Pay your IL taxes online to avoid late payment penalties before, or on April 18, 2023 at MyTax Illinois and not have to mail in Form IL-505-I.

Do trusts need to make estimated tax payments?

Trusts and estates are required to make estimated tax payments. However, an estate or a grantor trust to which the residue of the decedent's estate passes under the will is not required to make estimated tax payments for tax years ending before the second anniversary of the decedent's death (IRC § 6654(l)(2) ).

Why is there a 1040-ES on my tax return?

Use Form 1040-ES to figure and pay your estimated tax for 2023. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

Do trusts pay taxes quarterly?

Trusts. The trust may pay all of its estimated tax by April 18, 2022, or in four equal installments due by the following dates.

Can I pay my Illinois estimated taxes online?

- Pay Illinois Taxes Online. ACI Payments, Inc. makes it easy to pay your Illinois State income tax, property taxes, federal income tax and other bills using a debit or credit card. Just click a button above or visit Who Can I Pay? to search bills by zip code.

Why did the IRS send me a 1040-ES V?

Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR.

Who generally does not need to pay estimated taxes?

When can I avoid paying estimated taxes? If you expect to owe less than $1,000 in income tax this year after applying your federal income tax withholding, you don't have to make estimated tax payments.

Why am I being asked to pay estimated taxes?

If the amount of income tax withheld from your salary or pension is not enough, or if you receive income such as interest, dividends, alimony, self-employment income, capital gains, prizes and awards, you may have to make estimated tax payments.

How do I make an extension payment electronically?

You can get an automatic extension when you make a payment with Direct Pay, the Electronic Federal Tax Payment System or by debit or credit card. When paying electronically, you must select Form 4868 as the payment type and the payment date to get the automatic extension.

Are estimated tax payments required for trusts?

Estimated tax is the amount of tax the fiduciary of an estate or trust expects to owe for the year. Generally, a fiduciary of an estate or trust must make 2021 estimated tax payments if the estate or trust expects to owe at least $500 in tax for 2021 (after subtracting withholding and credits).

What happens if I don't pay 1040-ES?

What does the tax underpayment penalty for quarterly taxes work? Once a due date has passed, the IRS will typically dock 0.5% of the entire amount you owe. For each partial or full month you don't pay the tax in full, the penalty increases. It's capped at 25%.

Can you pay 1041-ES electronically?

Online or by phone - Use the Electronic Federal Tax Payment System (EFTPS). Payments can be made using the phone or through the Internet and can be scheduled up to a year in advance. There is no charge for this payment option when paid via the U.S. Department of the Treasury.

Why did I get a 1040-ES V in the mail?

We'll automatically include four quarterly 1040-ES vouchers with your printout if you didn't withhold or pay enough tax this year. We do this to head off a possible underpayment penalty on next year's taxes. You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 1041-ES?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IRS 1041-ES and other forms. Find the template you need and change it using powerful tools.

How do I execute IRS 1041-ES online?

pdfFiller has made filling out and eSigning IRS 1041-ES easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the IRS 1041-ES in Gmail?

Create your eSignature using pdfFiller and then eSign your IRS 1041-ES immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is IRS 1041-ES?

IRS 1041-ES is a form used to estimate and pay income taxes for estates and trusts, allowing them to make estimated tax payments for the year.

Who is required to file IRS 1041-ES?

Estates and trusts that expect to owe tax on income that is not fully withheld are required to file IRS 1041-ES.

How to fill out IRS 1041-ES?

To fill out IRS 1041-ES, you need to provide information about the income of the estate or trust, calculate estimated taxes, and report the payment amounts based on your estimates.

What is the purpose of IRS 1041-ES?

The purpose of IRS 1041-ES is to facilitate estimated tax payments for estates and trusts, ensuring that taxes are paid periodically throughout the year.

What information must be reported on IRS 1041-ES?

IRS 1041-ES must report estimated income, any tax credits or deductions applicable, and the total estimated tax liability for the estate or trust.

Fill out your IRS 1041-ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1041-ES is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.