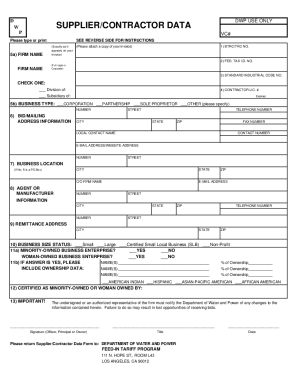

NC DoR D-403 2012 free printable template

Show details

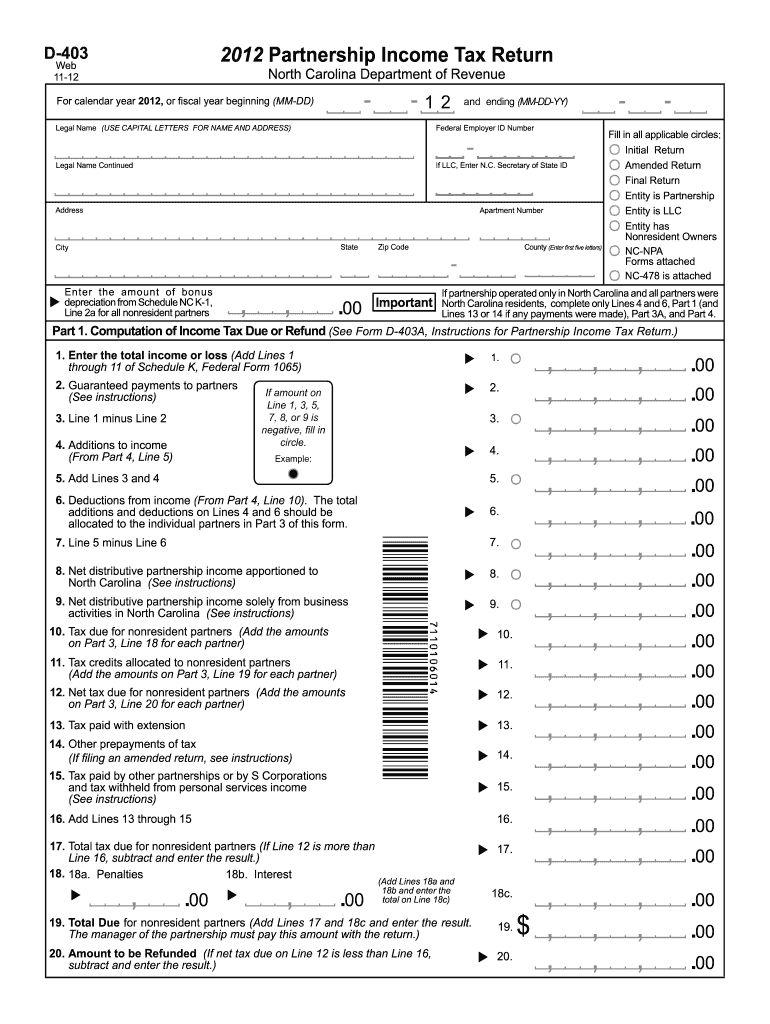

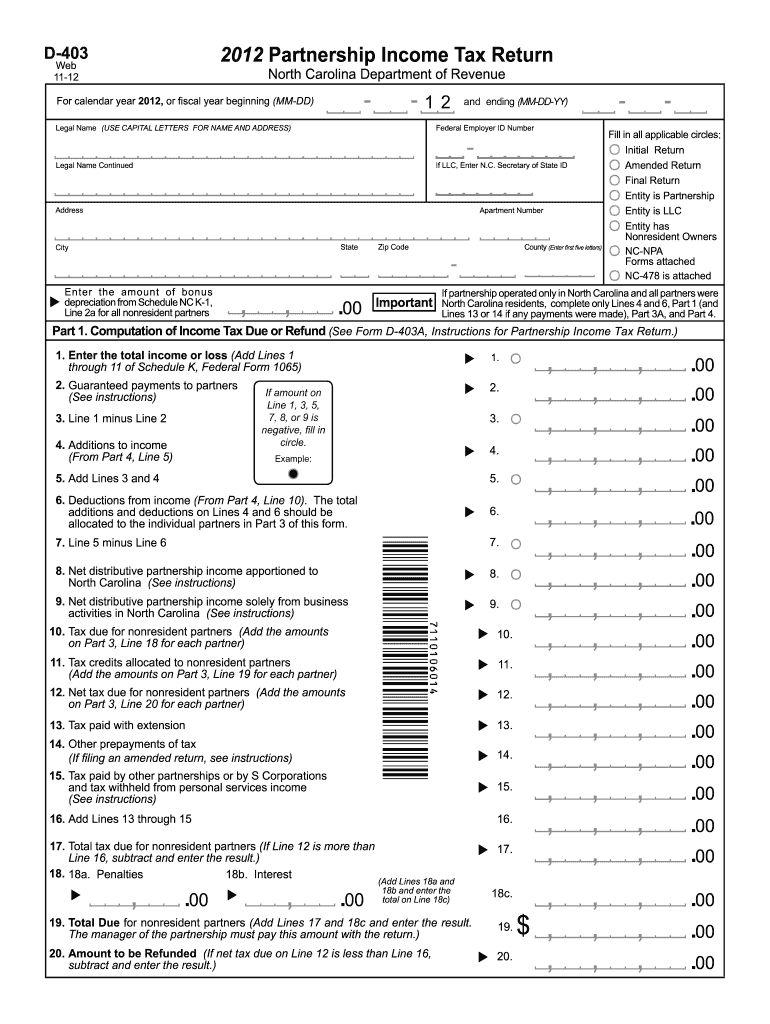

2012 Partnership Income Tax Return D-403 Web 11-12 North Carolina Department of Revenue 12 For calendar year 2012, or fiscal year beginning (MM-DD) and ending (MM-DD-YY) Legal Name (USE CAPITAL LETTERS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR D-403

Edit your NC DoR D-403 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR D-403 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR D-403 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NC DoR D-403. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR D-403 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR D-403

How to fill out NC DoR D-403

01

Gather all necessary documents, including your tax information and relevant financial records.

02

Obtain the NC DoR D-403 form from the North Carolina Department of Revenue website or local office.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Enter your income information in the sections provided, ensuring accuracy and consistency with your records.

05

Complete the required calculations for tax credits and deductions as outlined in the instructions.

06

Review the entire form for any errors or omissions.

07

Sign and date the form to certify that the information provided is true and complete.

08

Submit the completed form to the appropriate North Carolina tax authority by the due date.

Who needs NC DoR D-403?

01

Individuals or businesses in North Carolina who are required to report certain tax information.

02

People seeking to claim tax credits or deductions specific to the state of North Carolina.

03

Any resident or entity engaged in activities that necessitate filing this particular form with the state.

Fill

form

: Try Risk Free

People Also Ask about

What form do I use for sales tax reimbursement in NC?

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

What is form E-588 NC sales tax refund?

Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. This form is for use by taxpayers who have overpaid tax on retail sales or overaccrued use tax on purchases.

Can I get tax forms mailed to me?

You can place your order here for tax forms, instructions and publications. We will process your order and ship it by U.S. mail when the products become available.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Where can I get tax forms in my area?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

Should I staple or paperclip my tax return?

Is it OK to staple your tax return? The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

How do I assemble my tax return?

When assembling your tax return, place the forms in order of their sequence, with Form 1040 (or 1040A) on top. If you have any supporting statements or schedules, attach them all at the end, in the same order as the forms or schedules they refer to.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NC DoR D-403?

The editing procedure is simple with pdfFiller. Open your NC DoR D-403 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit NC DoR D-403 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NC DoR D-403 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete NC DoR D-403 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your NC DoR D-403, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is NC DoR D-403?

NC DoR D-403 is a form used by the North Carolina Department of Revenue for reporting tax information and compliance.

Who is required to file NC DoR D-403?

Individuals and businesses in North Carolina that have specific tax obligations are required to file NC DoR D-403.

How to fill out NC DoR D-403?

To fill out NC DoR D-403, taxpayers should gather necessary financial documents, carefully complete each section of the form, and ensure all figures are accurate before submission.

What is the purpose of NC DoR D-403?

The purpose of NC DoR D-403 is to provide the state with a record of a taxpayer's financial activities, ensuring compliance with state tax laws.

What information must be reported on NC DoR D-403?

The information that must be reported on NC DoR D-403 includes income details, deductions, credits, and any other relevant tax-related data.

Fill out your NC DoR D-403 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR D-403 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.