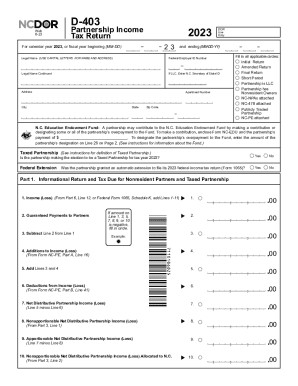

NC DoR D-403 2024-2025 free printable template

Show details

Web 8-24 D-403 Partnership Income Tax Return 2024 24 For calendar year 2024, or fiscal year beginning (MM-DD) DOR Use Only and ending (MM-DD-YY) Legal Name (USE CAPITAL LETTERS FOR NAME AND ADDRESS)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc 4 state tax form

Edit your 2024 nc d 403 return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north carolina d partnership income get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2024 north carolina d 403 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit north carolina d403 partnership. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR D-403 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out north carolina d403 partnership

How to fill out NC DoR D-403

01

Obtain the NC DoR D-403 form from the North Carolina Department of Revenue's website or local office.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide details about your income for the relevant tax year.

04

List any deductions or credits you are eligible for.

05

Calculate your total tax liability using the provided instructions.

06

Sign and date the form at the bottom.

07

Submit the completed form by mail or electronically, as per the instructions.

Who needs NC DoR D-403?

01

Individuals who are residents of North Carolina and need to report their income to the state.

02

Taxpayers seeking to apply for deductions or credits that require the use of the NC DoR D-403 form.

03

Any person required by North Carolina law to file a state income tax return.

Fill

form

: Try Risk Free

People Also Ask about

What if I miss tax deadline 2022 Canada?

Penalty for filing your tax return late The late-filing penalty is 5% of your 2022 balance owing, plus an additional 1% for each full month that you file after the due date, to a maximum of 12 months.

Has CRA extended the tax deadline for 2022?

For most people, the 2022 return has to be filed on or before April 30, 2023, and payment is due April 30, 2023.

What is the current income tax rate 2022?

When it comes to federal income tax rates and brackets, the tax rates themselves aren't changing from 2022 to 2023. The same seven tax rates in effect for the 2022 tax year – 10%, 12%, 22%, 24%, 32%, 35% and 37% – still apply for 2023.

What are the tax changes for 2022 Canada?

NEW FOR 2022 TAX RETURNS The CRA has created the T1B Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year. ing to the Canada Revenue Agency (CRA), if taxpayers repaid benefit amounts before January 1, 2023, they may choose when and how to claim the deduction on their tax return.

What is the NC state income tax bracket?

North Carolina Income Taxes North Carolina moved to a flat income tax beginning with tax year 2014. For tax year 2022, all taxpayers pay a flat rate of 4.99%.

When can I file my taxes for 2022 in 2023?

January 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns.

What is the extended tax deadline for 2022?

This means that taxpayers can skip making this payment and instead include it with the 2022 return they file, on or before Oct. 16. The Oct. 16 deadline also applies to 2023 estimated tax payments, normally due on April 18, June 15 and Sept. 15.

What is the penalty for late filing trust return?

A penalty of 5% of the tax due may be imposed for each month during which a return is not filed. This will continue to accrue up until a maximum of 25% of the tax due.

When can I file 2023 taxes Canada?

Filing and payment deadlines Since April 30, 2023, falls on a Sunday, your return will be considered filed on time if the Canada Revenue Agency (CRA) receives it, or it is postmarked, on or before May 1, 2023. If you or your spouse or common-law partner are self-employed, you have until June 15, 2023, to file on time.

Is NC getting rid of state income tax?

N.C. Tax Rate North Carolina law was amended to decrease the individual income tax rate to 4.99% for tax year 2022.

What is the 2022 NC state income tax?

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499). Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send north carolina d403 partnership for eSignature?

north carolina d403 partnership is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete north carolina d403 partnership online?

pdfFiller has made it easy to fill out and sign north carolina d403 partnership. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out north carolina d403 partnership on an Android device?

Complete your north carolina d403 partnership and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NC DoR D-403?

NC DoR D-403 is a form used for reporting certain tax information in the state of North Carolina.

Who is required to file NC DoR D-403?

Individuals or entities that have earned income in North Carolina and are subject to state income tax may be required to file NC DoR D-403.

How to fill out NC DoR D-403?

To fill out the NC DoR D-403, gather all relevant income information, follow the form's instructions carefully, and provide accurate data in the specified fields.

What is the purpose of NC DoR D-403?

The purpose of NC DoR D-403 is to facilitate the reporting of taxable income and ensure compliance with North Carolina's tax laws.

What information must be reported on NC DoR D-403?

NC DoR D-403 requires reporting of personal identification details, income earned, deductions, and any other relevant tax information as specified in the form instructions.

Fill out your north carolina d403 partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

North Carolina d403 Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.