VI 720-B 2008 free printable template

Show details

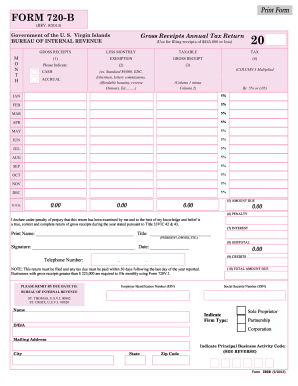

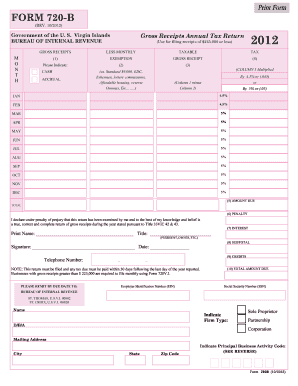

FORM 720-B REV. 10/2008 Gross Receipts Annual Tax Return Government of the U. S. Virgin Islands BUREAU OF INTERNAL REVENUE Use for filing receipts of 120 000 or less GROSS RECEIPTS LESS MONTHLY TAXABLE TAX M O N T H EXEMPTION Please Indicate CASH ACCRUAL ex.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2018 virgin islands bureau

Edit your 2018 virgin islands bureau form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 virgin islands bureau form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2018 virgin islands bureau online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2018 virgin islands bureau. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VI 720-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2018 virgin islands bureau

How to fill out 720b vi:

01

Start by gathering all the necessary information required to complete the form.

02

Carefully read the instructions provided on the form to ensure accurate completion.

03

Begin by filling out your personal information, including your name, address, and contact details.

04

Provide detailed information about the incident or event that prompted the need to fill out form 720b vi.

05

If applicable, specify the date, time, and location of the incident.

06

Describe the nature of the incident and the parties involved, providing as much detail as possible.

07

Attach any supporting documentation or evidence that may be required or helpful in understanding the incident.

08

Review the completed form to ensure all necessary sections have been filled out accurately and completely.

09

Sign and date the form where indicated to certify the information provided is true and accurate.

10

Submit the form according to the instructions provided or as directed by the relevant authority.

Who needs 720b vi:

01

Individuals who have been involved in a particular incident or event that requires official documentation.

02

Law enforcement agencies or legal authorities who may require detailed information about an incident for investigation or legal proceedings.

03

Organizations or institutions that may be involved in reviewing or taking action based on the information provided in form 720b vi.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file form 720 V?

You can electronically file Form 720 through any electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP) participating in the IRS e-file program for excise taxes. For more information on e-file, go to Excise Tax e-File & Compliance (ETEC) Programs - Forms 720, 2290, and 8849.

What is the penalty for form 720?

The penalty is 15% of the amount of tax you should have reported on your tax return for each additional month or part of a month you didn't file your return. The total penalty may not be more than 75% of the tax you didn't pay.

Why would a business need to file a Form 720?

Your business needs to fill out IRS Form 720 if you sell goods or services that incur excise taxes. These products and services can include, but are not limited to: Telephone communications. Air transportation.

What is a 720 form used for?

Businesses that are subject to excise tax generally must file a Form 720, Quarterly Federal Excise Tax Return to report the tax to the IRS. Many excise taxes go into trust funds for projects related to the taxed product or service, such as highway and airport improvements. Excise taxes are independent of income taxes.

Do trucking companies file Form 720?

Most trucking companies will have to file this. If you purchase glider kits for a truck, you are required to file retail sales tax. That's included on form 720. Not every trucking company is liable for that, so it's not as big an issue as the form 2290 excise tax for large vehicles.

Is Form 720 still required?

A paid preparer must sign Form 720 and provide the information in the Paid Preparer Use Only section at the end of the form if the preparer was paid to prepare the form and isn't an employee of the filing entity. The preparer must give you a copy of the form in addition to the copy to be filed with the IRS.

Do I need to file form 720 for my LLC?

If you own a business that deals in goods and services subject to excise tax, you must prepare a Form 720 quarterly to report the tax to the IRS.

Who needs to file IRS Form 720?

Businesses that are subject to excise tax generally must file a Form 720, Quarterly Federal Excise Tax Return to report the tax to the IRS. Many excise taxes go into trust funds for projects related to the taxed product or service, such as highway and airport improvements. Excise taxes are independent of income taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2018 virgin islands bureau for eSignature?

When you're ready to share your 2018 virgin islands bureau, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute 2018 virgin islands bureau online?

pdfFiller makes it easy to finish and sign 2018 virgin islands bureau online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in 2018 virgin islands bureau?

With pdfFiller, it's easy to make changes. Open your 2018 virgin islands bureau in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is 720b vi?

720b vi is a form used to report certain transactions with foreign entities.

Who is required to file 720b vi?

Any individual or entity that has engaged in reportable transactions with foreign entities is required to file 720b vi.

How to fill out 720b vi?

720b vi can be filled out online or submitted through mail. It requires detailed information about the transactions with foreign entities.

What is the purpose of 720b vi?

The purpose of 720b vi is to provide transparency on transactions with foreign entities and to ensure compliance with regulations.

What information must be reported on 720b vi?

Information such as the type of transaction, name of the foreign entity, date of transaction, and amount must be reported on 720b vi.

Fill out your 2018 virgin islands bureau online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Virgin Islands Bureau is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.