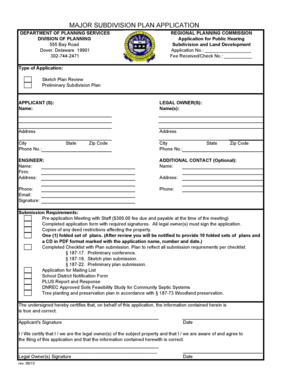

VI 720-B 2009 free printable template

Show details

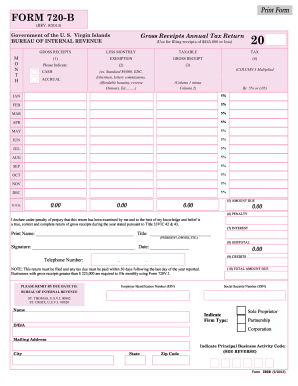

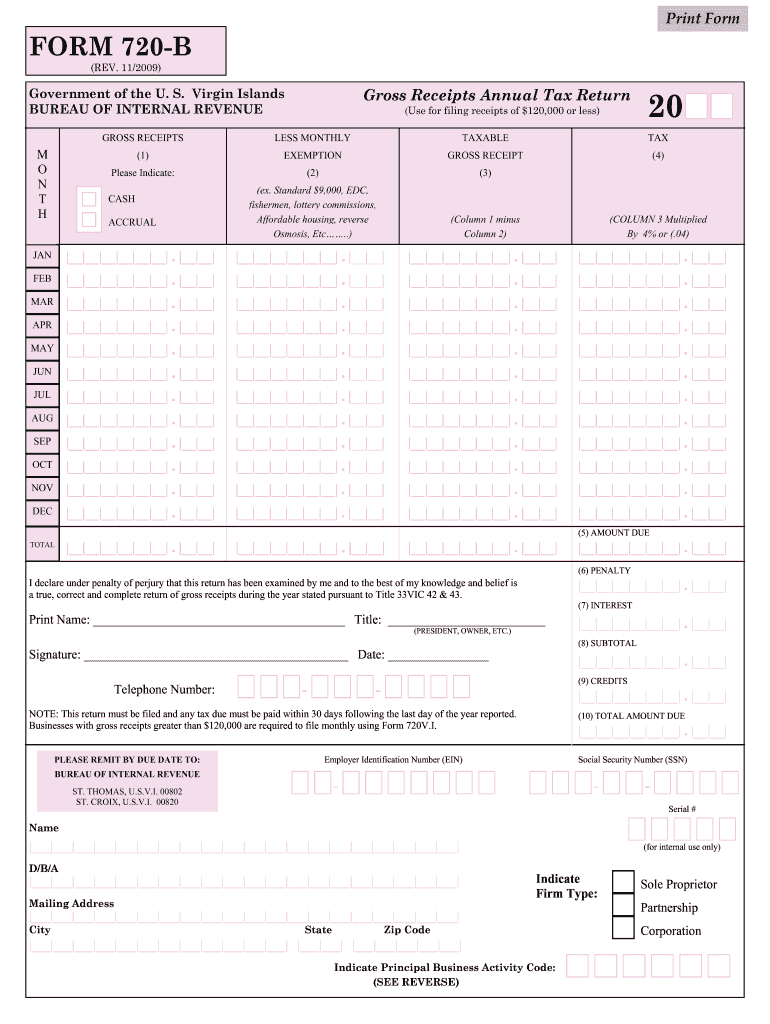

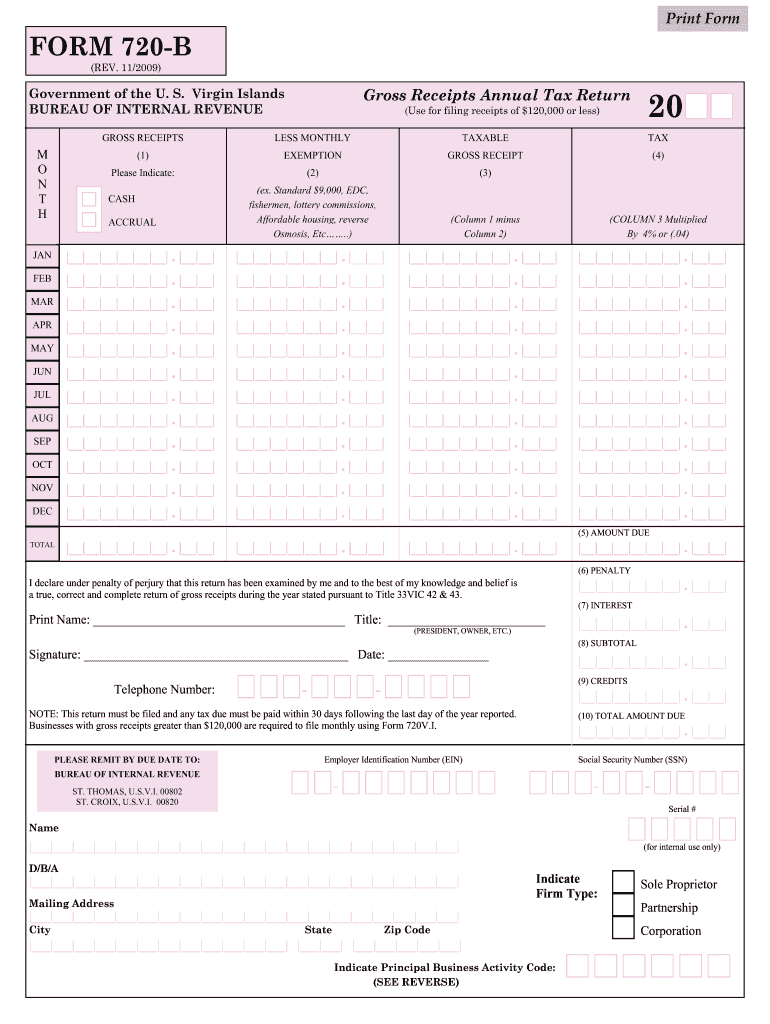

Print Form 720-B (REV. 11/2009) Gross Receipts Annual Tax Return Government of the U. S. Virgin Islands BUREAU OF INTERNAL REVENUE M O N T H (Use for filing receipts of $120,000 or less) 20 GROSS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 720 vi 2009 form

Edit your 720 vi 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 720 vi 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 720 vi 2009 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 720 vi 2009 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VI 720-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 720 vi 2009 form

How to fill out VI 720-B

01

Start by downloading the VI 720-B form from the official website or obtain a physical copy.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill in your personal information in the designated fields (name, address, etc.).

04

Provide the necessary financial details as required in the form.

05

Review each section to ensure all information is accurate and complete.

06

Attach any required supporting documentation as specified in the form instructions.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form by mailing it to the appropriate address or filing it online if available.

Who needs VI 720-B?

01

Individuals or entities who are reporting specific financial information as required by the regulations.

02

Tax professionals who are assisting clients with compliance and necessary submissions.

03

Businesses that need to disclose information for regulatory purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a 720 form for life insurance?

Form 720 (Excise Tax) The Form 720 is used to report the payment of foreign life insurance premiums to the IRS. The Internal Revenue Service charges a 1% excise tax.

What is form 720 and when must it be filed?

IRS Form 720, the Quarterly Federal Excise Tax Return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. IRS Form 720 consists of three parts, as well as Schedule A, Schedule T and Schedule C sections and a payment voucher (called Form 720-V).

What is 720 excise tax?

IRS Form 720, Quarterly Excise Tax Return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. The form includes all items covered by excise taxes. A third party may collect the excise tax, file Form 720, and send the tax to the IRS.

What is tax form 720 for?

Use Form 720 and attachments to: Report liability by IRS number. Pay the excise taxes listed on the form.

How do you know if a company needs to file form 720?

Your business needs to fill out IRS Form 720 if you sell goods or services that incur excise taxes.These products and services can include, but are not limited to: Telephone communications. Air transportation. Gasoline. Passenger ship transportation. Coal. Fishing equipment. Indoor tanning services. Bows and arrows.

Who pays 720 excise tax?

Who files Form 720? Whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file a Quarterly Federal Excise Tax Return on Form 720 up to four times per year, depending on the circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 720 vi 2009 form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 720 vi 2009 form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit 720 vi 2009 form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 720 vi 2009 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the 720 vi 2009 form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 720 vi 2009 form in seconds.

What is VI 720-B?

VI 720-B is a tax form used in the United States Virgin Islands for reporting and paying specific excise taxes.

Who is required to file VI 720-B?

Individuals and businesses that are liable for excise taxes on certain goods and services in the U.S. Virgin Islands are required to file VI 720-B.

How to fill out VI 720-B?

To fill out VI 720-B, taxpayers must provide their general information, detail the types and quantities of goods measured for excise tax, calculate the total tax due, and then submit the completed form to the appropriate tax authority.

What is the purpose of VI 720-B?

The purpose of VI 720-B is to facilitate the reporting and payment of excise taxes on imported and locally manufactured goods.

What information must be reported on VI 720-B?

Taxpayers must report information such as their taxpayer identification number, the description and quantity of goods subject to excise tax, the applicable tax rate, total tax due, and any exemptions claimed.

Fill out your 720 vi 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

720 Vi 2009 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.