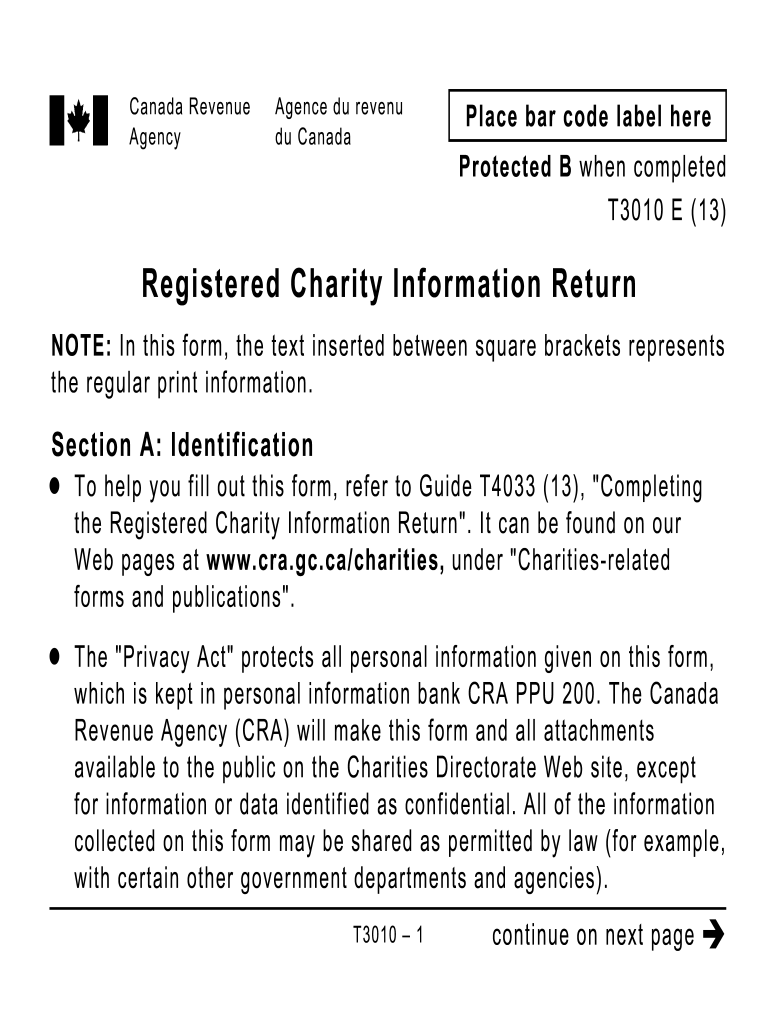

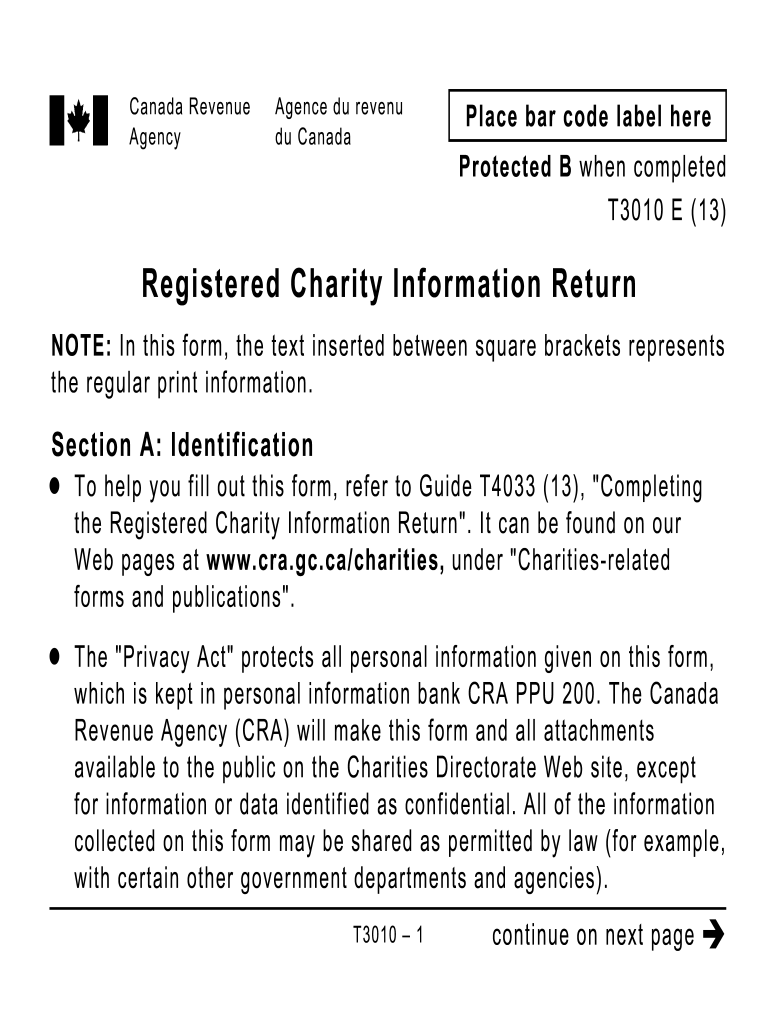

Canada T3010 E 2013 free printable template

Get, Create, Make and Sign t3010 2013 form

How to edit t3010 2013 form online

Uncompromising security for your PDF editing and eSignature needs

Canada T3010 E Form Versions

How to fill out t3010 2013 form

How to fill out Canada T3010 E

Who needs Canada T3010 E?

Instructions and Help about t3010 2013 form

What is the information return well basically each year a charity is required to submit a 30-10 registered charity information return a complete return is composed of a variety of components basically we have the information return which captures a lot of the financial information that exists in an organized fashion then we also have something called a basic information sheet which is called a bis we also have a copy of the charity's financial statements that need to be submitted there's a list of directors trustees or like officials that need to be submitted and there are other worksheets that might apply to that charity for example if they had provided funds to qualify don't ease than they need to submit a worksheet that relates to the funds that they transferred over to qualify don't ease some of the information that relates to this information return is that basically a charity will receive this package in the month following their fiscal and year then they've got six months from that time to complete the information return and forwarded back to CRA charities really need to develop processes to ensure they can capture the information they need and be able to move this over into the information return in a timely way as we mentioned things like having separate spreadsheets for certain lines or linking accounting lines to the information return reporting lines are really part of this preparatory component, and they really need to make sure they've got processes to ensure completion of this and filing within the designated time this wedding also include things like making sure the board is aware of this and has time to look over any financial elements and make appropriate decisions, so that approval can occur within the timeframe required to submit it back information that is submitted to CRA is published on their website and this is really critical for maturity to recognize is that the public can access all of this information, and therefore it's you know part of their mark strategy so that you know to put their best foot forward, but also it's a point of accountability and transparency that is really required in terms of the operations of the charity some of the components that are involved one is called the basic information sheet and basically on this basic information sheet you've got all the information that relates to the charity the registration number there are registration date of the address stuff like mailing address telephone fax number email website information the public contact name the name of charity might be known on if it's different from what their registration name is and the program area is that the charity is involved with this information can actually be changed on the form when it's submitted because for example maybe the address changes or the public contact information changes and so it's logical that that can be changed, but there's other information that can't be changed on the form for example the legal name or...

People Also Ask about

What is a T3010 form?

Where do I send my charity return Canada?

What is the due date of T3010?

What is a T3010 annual return?

What is form T3010?

What is a T3010 form for registered charities in Canada?

How do I adjust my T3010?

What is a T3010 annual return?

How do I submit a T3010?

What is a T3010 return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify t3010 2013 form without leaving Google Drive?

How do I edit t3010 2013 form online?

How do I fill out t3010 2013 form on an Android device?

What is Canada T3010 E?

Who is required to file Canada T3010 E?

How to fill out Canada T3010 E?

What is the purpose of Canada T3010 E?

What information must be reported on Canada T3010 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.