Canada T3010 E 2017 free printable template

Show details

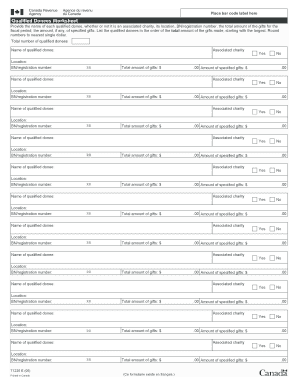

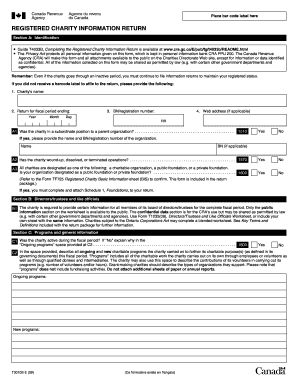

Ongoing programs New programs T3010 E 17 Ce formulaire existe en fran ais. W organizations described in the Income Tax Act. Checklist A charity s complete annual information return includes Form T3010 Registered Charity Information Return and all applicable schedules Form T1236 Qualified Donees Worksheet/Amounts Provided to Other Organizations if applicable and Form TF725 Registered Charity Basic Information Sheet a copy of the charity s financial statements Form T1235 Directors/Trustees and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t3010

Edit your t3010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t3010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t3010 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit t3010. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T3010 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t3010

How to fill out Canada T3010 E

01

Obtain the Canada T3010 E form from the Canada Revenue Agency (CRA) website.

02

Fill in the organization's name and address at the top of the form.

03

Provide the Business Number (BN) assigned by the CRA.

04

Fill out the reporting period, indicating the start and end dates.

05

Complete the section detailing the organization’s revenue, expenses, and net assets.

06

Include information regarding the organization’s activities and accomplishments.

07

Provide the contact information for the person responsible for the form’s submission.

08

Sign and date the form to certify that the information is complete and accurate.

09

Submit the completed form by mail to the address indicated by the CRA.

Who needs Canada T3010 E?

01

Registered charities in Canada that are required to file an annual information return.

02

Non-profit organizations that wish to maintain their tax-exempt status.

03

Organizations applying for or retaining charitable status in Canada.

Fill

form

: Try Risk Free

People Also Ask about

What is a T3010 form?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Where do I send my charity return Canada?

Mail the return to: Charities Directorate. Canada Revenue Agency. Ottawa ON K1A 0L5.

What is the due date of T3010?

Many charities that receive government funds have a March 31 year-end. It is important the T3010 is filed both accurately and on time. We assist charities in reviewing their T3010.

What is a T3010 annual return?

Why file a T3010 Return? It is published by Canada Revenue Agency (CRA) and available to the public. It provides information to the CRA regarding activities and/or assets held for assessment of sanctions and/or revocation of charity status. It is used to calculate the disbursement quota.

What is form T3010?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

What is a T3010 form for registered charities in Canada?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I adjust my T3010?

Form T3010, Registered Charity Information Return. You can also use Section B to change the charity's mailing address. canada.ca/charities-giving, select Operating a registered charity, and see Making changes, or call Client Service at 1-800-267-2384.

What is a T3010 annual return?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I submit a T3010?

You or an authorized representative can file your charity's return online using My Business Account. You can also file a paper return. To find Form T3010 and other forms and publications, go to CRA forms and publications. You can also call Client Service at 1-800-267-2384.

What is a T3010 return?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my t3010 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your t3010 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit t3010 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign t3010. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete t3010 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your t3010, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is Canada T3010 E?

Canada T3010 E is a charity information return that registered charities in Canada must file annually with the Canada Revenue Agency (CRA). It provides detailed information about the charity's activities, finances, and compliance with the income tax regulations.

Who is required to file Canada T3010 E?

All registered charities in Canada are required to file the T3010 E form annually with the CRA. This includes charities that have received registered status under the Income Tax Act.

How to fill out Canada T3010 E?

To fill out the Canada T3010 E, charities should gather financial statements, details of their programs, and information about their governance. The form can be completed online through the CRA's website or by using a paper form, entering the required data in the appropriate sections, and submitting it by the deadline.

What is the purpose of Canada T3010 E?

The purpose of Canada T3010 E is to ensure transparency and accountability of registered charities in Canada. It helps the CRA monitor compliance with the rules and regulations governing charities and provides the public with information about charitable activities and finances.

What information must be reported on Canada T3010 E?

The information that must be reported on Canada T3010 E includes the charity's name and contact information, a description of its programs and activities, financial statements (including revenue and expenses), details about the board of directors, and any changes in status or operations during the year.

Fill out your t3010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t3010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.