Canada T3010 E 2013 free printable template

Show details

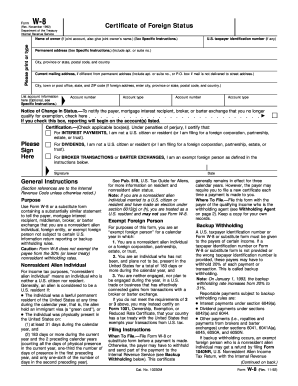

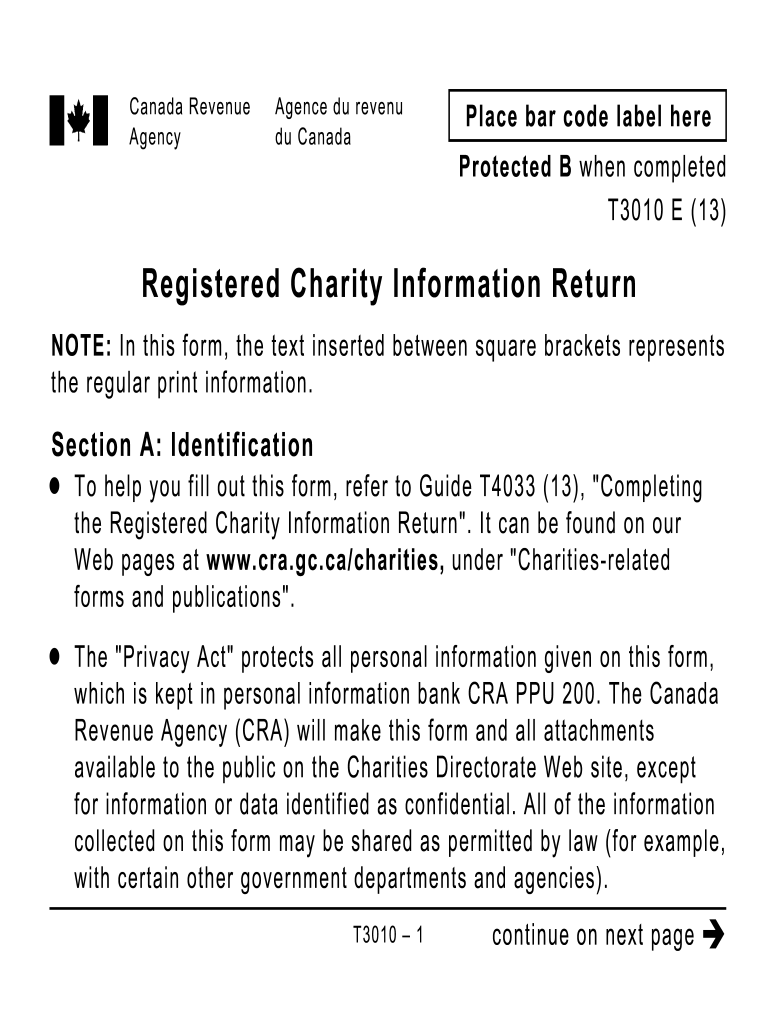

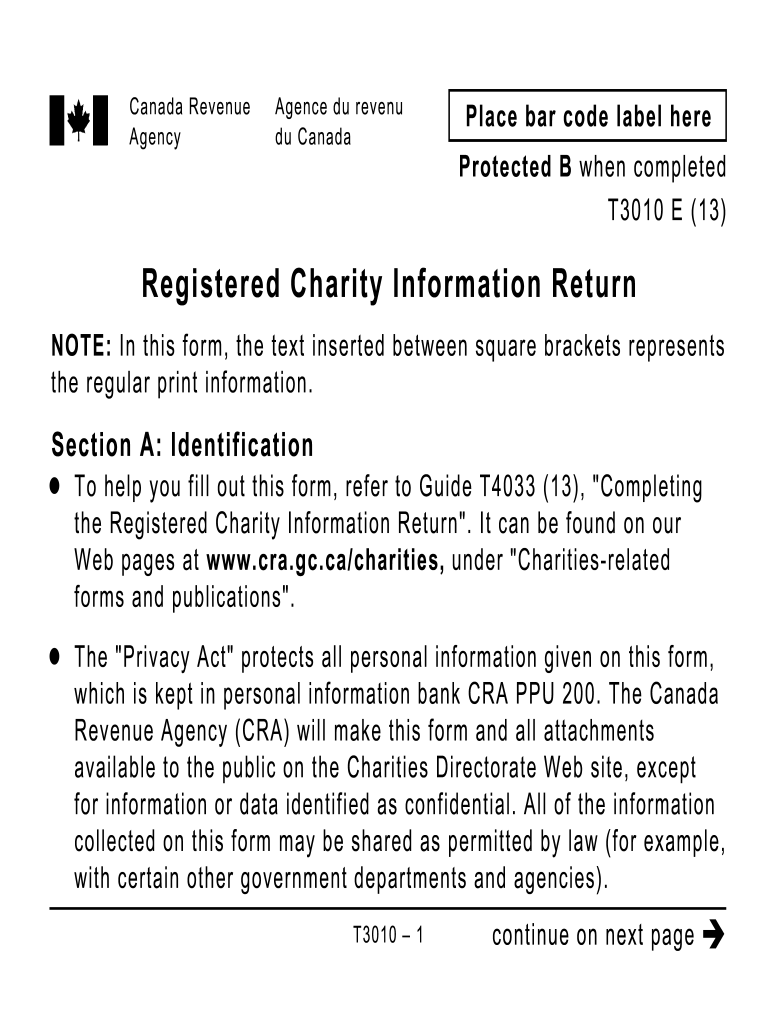

Canada Revenue Agency Agence du revenu du Canada Place bar code label here Protected B when completed T3010 E 13 Registered Charity Information Return NOTE In this form the text inserted between square brackets represents the regular print information. Section A Identification To help you fill out this form refer to Guide T4033 13 Completing the Registered Charity Information Return. Return for fiscal period ending Year Month Day 3. BN/registration number Business Number RR 4. Web address if...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T3010 E

Edit your Canada T3010 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T3010 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T3010 E online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada T3010 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T3010 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T3010 E

How to fill out Canada T3010 E

01

Obtain the Canada T3010 E form from the Canada Revenue Agency website or authorized distributor.

02

Fill in your organization's name, address, and registration number at the top of the form.

03

Provide details about your organization’s activities during the fiscal year in the appropriate section.

04

Report your organization’s financial information, including revenue, expenditures, and net assets.

05

Indicate any changes in your organization’s structure or governance, if applicable.

06

Complete the signature section, ensuring it’s signed by an authorized person in your organization.

07

Submit the completed form by the deadline, either online through the CRA’s portal or by mail.

Who needs Canada T3010 E?

01

Registered charities in Canada are required to complete the Canada T3010 E form annually to report their financial activities and maintain their registered status.

Fill

form

: Try Risk Free

People Also Ask about

What is a T3010 form?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Where do I send my charity return Canada?

Mail the return to: Charities Directorate. Canada Revenue Agency. Ottawa ON K1A 0L5.

What is the due date of T3010?

Many charities that receive government funds have a March 31 year-end. It is important the T3010 is filed both accurately and on time. We assist charities in reviewing their T3010.

What is a T3010 annual return?

Why file a T3010 Return? It is published by Canada Revenue Agency (CRA) and available to the public. It provides information to the CRA regarding activities and/or assets held for assessment of sanctions and/or revocation of charity status. It is used to calculate the disbursement quota.

What is form T3010?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

What is a T3010 form for registered charities in Canada?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I adjust my T3010?

Form T3010, Registered Charity Information Return. You can also use Section B to change the charity's mailing address. canada.ca/charities-giving, select Operating a registered charity, and see Making changes, or call Client Service at 1-800-267-2384.

What is a T3010 annual return?

What Is the T3010 Form? The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's activities and finances.

How do I submit a T3010?

You or an authorized representative can file your charity's return online using My Business Account. You can also file a paper return. To find Form T3010 and other forms and publications, go to CRA forms and publications. You can also call Client Service at 1-800-267-2384.

What is a T3010 return?

What Is the T3010? Also known as Registered Charity Information Return, the T3010 form is an income tax return form for registered charities. Unlike personal income slips, T3010 comes with a checklist to ensure taxpayers fill it out as required by the CRA.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada T3010 E without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your Canada T3010 E into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit Canada T3010 E online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada T3010 E to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out Canada T3010 E on an Android device?

Use the pdfFiller app for Android to finish your Canada T3010 E. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is Canada T3010 E?

Canada T3010 E is an annual information return that non-profit organizations and registered charities in Canada must file with the Canada Revenue Agency (CRA).

Who is required to file Canada T3010 E?

Registered charities and organizations that operate as non-profit entities in Canada and are registered with the CRA are required to file the T3010 E.

How to fill out Canada T3010 E?

To fill out Canada T3010 E, organizations must gather financial information, report on activities, disclose any changes in status, and ensure the form is completed according to CRA guidelines before submitting it electronically or by mail.

What is the purpose of Canada T3010 E?

The purpose of Canada T3010 E is to provide the CRA with necessary information regarding the financial status and activities of charities to ensure compliance with tax laws and regulations.

What information must be reported on Canada T3010 E?

The information that must be reported on Canada T3010 E includes financial statements, details about charitable activities, governance structures, and any changes in the organization’s status or objectives.

Fill out your Canada T3010 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t3010 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.