Get the free

Show details

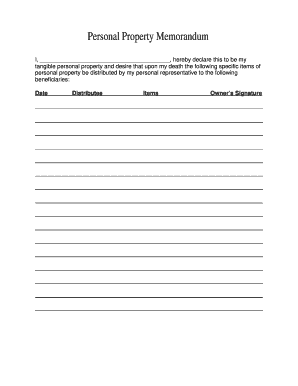

This document provides instructions on how to use a separate writing or memorandum for the disposition of tangible personal property in accordance with Florida probate law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal property memorandum template pdf form

Edit your personal property memorandum template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal property memorandum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable personal property memorandum template online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit printable personal property memorandum form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal property memorandum pdf form

How to fill out instructions for use of separate list for the disposition of tangible personal property

01

Gather all relevant information about the tangible personal property you intend to dispose of.

02

Create a separate list that includes the description of each item.

03

For each item, include its current value or estimated value.

04

Specify the intended method of disposition (e.g., sale, donation, disposal).

05

Indicate the date of disposition for each item.

06

Ensure that each item is clearly distinguishable and accurately reflects your ownership.

07

Review the list for completeness and accuracy before finalizing.

Who needs instructions for use of separate list for the disposition of tangible personal property?

01

Individuals or organizations planning to dispose of tangible personal property.

02

Estate executors handling the distribution of property.

03

Businesses undergoing liquidation or asset sales.

04

Non-profit organizations wanting to document donated items.

05

Individuals preparing for tax reporting related to property disposition.

Fill

personal property memorandum sample

: Try Risk Free

People Also Ask about

How to use a list in English?

Punctuation for Lists of Items Within a Sentence Use commas after each item in a list of three or more items. Nurses monitor a patient's vital signs including temperature, blood pressure, respiratory rate, and pulse. Use semi-colons after each item in a list if one or more items already includes a comma.

How do you separate two lists in a sentence?

However, used correctly, the semicolon can bring both clarity and nuance to your writing. There are two essential ways to use a semicolon. The first is relatively straightforward and separates a list of items in a sentence; the second separates independent clauses, while connecting them as related ideas.

When to use semicolon to separate?

The semicolon is used to separate independent clauses in specific situations. It also separates a series of items which contain internal punctuation. 1. Use a semicolon between independent clauses when the clauses are closely related in meaning and when there is no coordinating conjunction between them.

When should you use a semicolon to separate items in a list?

Use a semicolon between items in a list or series if any of the items contain commas. There are basically two ways to write: with a pen or pencil, which is inexpensive and easily accessible; or by computer and printer, which is more expensive but quick and neat.

What is the use to separate items in a list?

Use a semicolon to separate items in a list in cases where one or more of the items contains commas or other punctuation. Usually, we use a comma to separate three items or more in a list.

How do you separate items in a list?

Semicolons separate items within a list, while a colon precedes and introduces a list.

When to use to separate a list?

Use a semicolon to separate items in a list in cases where one or more of the items contains commas or other punctuation. Usually, we use a comma to separate three items or more in a list.

When to use a comma to separate a list?

Commas are used to separate three or more words, phrases, or clauses in a series. This means that when three or more items are being listed in a sentence, a comma goes between each item in the list. For example: John went to the grocery store and bought bread, milk, butter, macaroni and cheese.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is instructions for use of separate list for the disposition of tangible personal property?

Instructions for use of a separate list for the disposition of tangible personal property provide guidelines on how to document the transfer or sale of physical assets, ensuring compliance with relevant regulations and proper accounting practices.

Who is required to file instructions for use of separate list for the disposition of tangible personal property?

Individuals or entities that are involved in the sale, transfer, or disposal of tangible personal property, particularly businesses and organizations required to maintain accurate records for tax or legal purposes, are required to file these instructions.

How to fill out instructions for use of separate list for the disposition of tangible personal property?

To fill out the instructions, one should list each item of tangible personal property being disposed of, including details such as a description of the item, the method of disposition, the date of disposition, and the recipient's information, if applicable.

What is the purpose of instructions for use of separate list for the disposition of tangible personal property?

The purpose of these instructions is to ensure transparent and accurate reporting of the disposition of assets, facilitate compliance with tax regulations, and provide a clear audit trail for financial records.

What information must be reported on instructions for use of separate list for the disposition of tangible personal property?

The information that must be reported includes the item description, condition, identification number, date of disposition, method of disposition (sale, donation, etc.), and the name or entity receiving the property.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Memorandum Of Disposition Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.