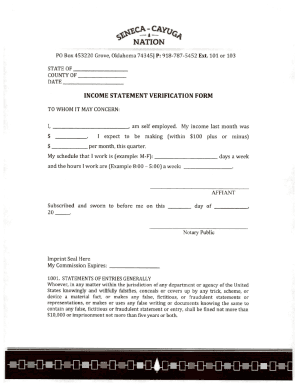

OK Seneca-Cayuga Nation Income Statement Verification Form 2012 free printable template

Show details

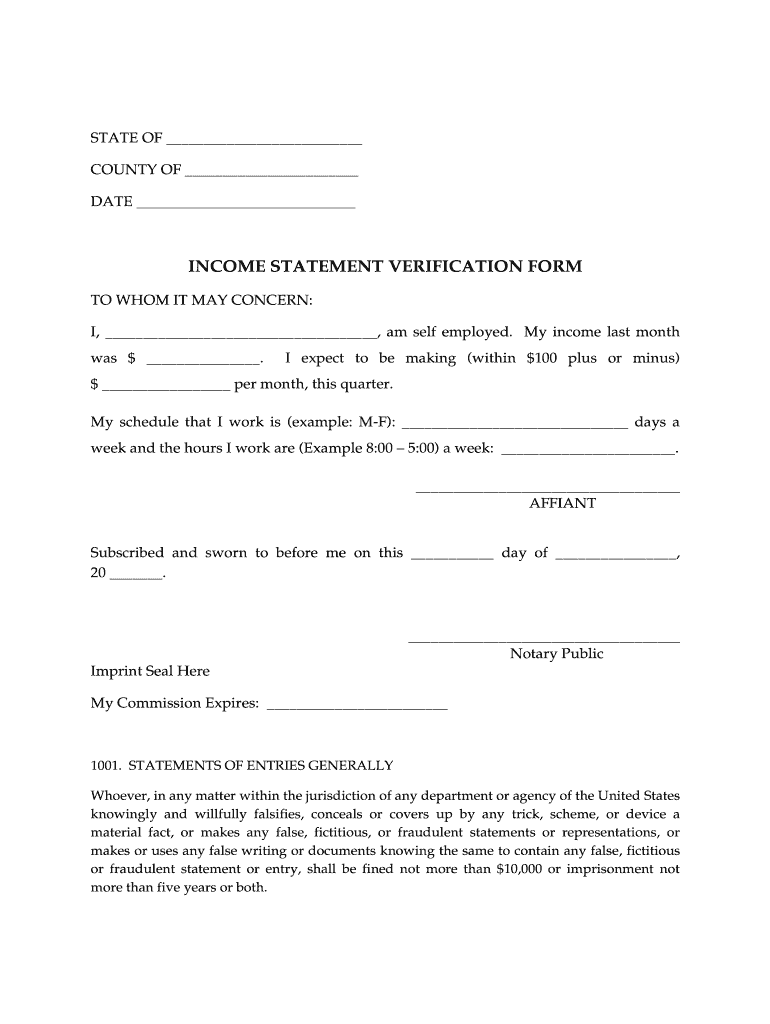

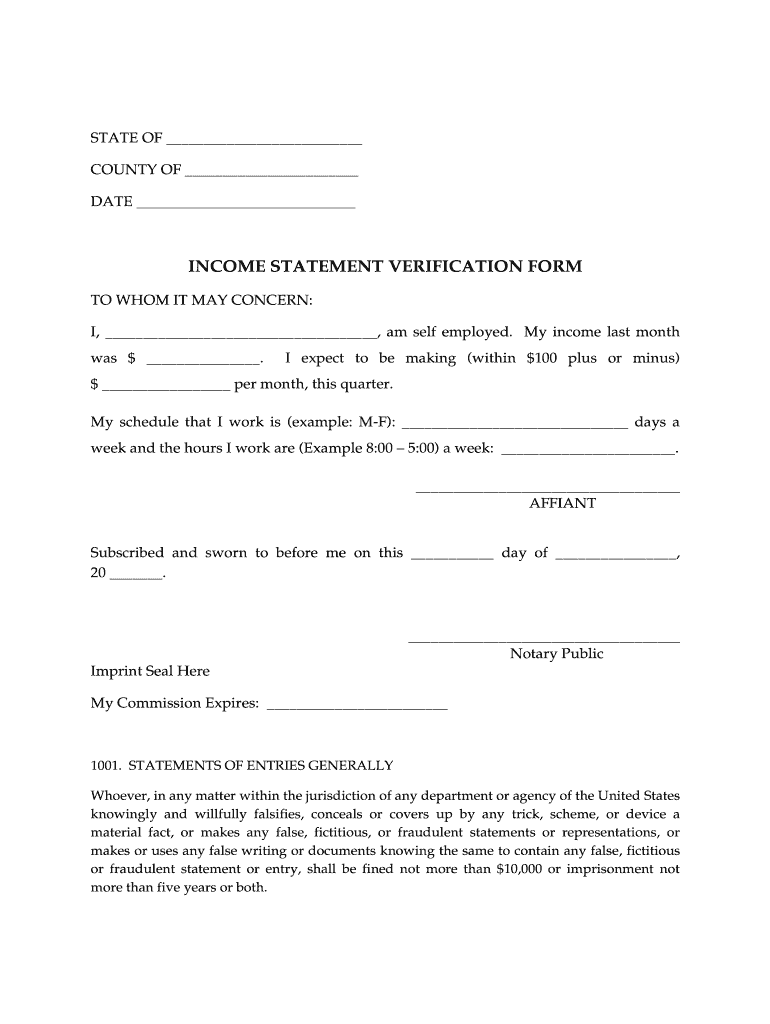

STATE OF COUNTY OF DATE INCOME STATEMENT VERIFICATION FORM TO WHOM IT MAY CONCERN: I, am self-employed. My income last month was $. I expect to be making (within $100 plus or minus) $ per month, this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Seneca-Cayuga Nation Income Statement Verification

Edit your OK Seneca-Cayuga Nation Income Statement Verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Seneca-Cayuga Nation Income Statement Verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Seneca-Cayuga Nation Income Statement Verification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OK Seneca-Cayuga Nation Income Statement Verification. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Seneca-Cayuga Nation Income Statement Verification Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Seneca-Cayuga Nation Income Statement Verification

How to fill out OK Seneca-Cayuga Nation Income Statement Verification Form

01

Obtain the OK Seneca-Cayuga Nation Income Statement Verification Form from the official website or authorized office.

02

Start by filling out personal identification information at the top of the form, including your name, address, and contact details.

03

Indicate the period for which you are reporting your income.

04

List all sources of income, including wages, business income, rental income, etc.

05

For each source of income, provide the required details as specified, such as the amount received, frequency of payment, and any relevant documentation.

06

If applicable, include information about any other household members who contribute to the income.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the form to the appropriate office or department as instructed.

Who needs OK Seneca-Cayuga Nation Income Statement Verification Form?

01

Individuals applying for financial assistance or benefits from the OK Seneca-Cayuga Nation.

02

Residents of the Seneca-Cayuga Nation needing to verify their income for program eligibility.

03

Members of the Seneca-Cayuga Nation seeking assistance with housing, health services, or other support programs.

Fill

form

: Try Risk Free

People Also Ask about

What documents can be used to verify income?

Supporting Documents Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings. Bank statements demonstrating regular income. Attestation from a current or former employer.

How do I get an income verification document?

10 forms of proof of income Pay stubs. A pay stub, which most people who work corporate jobs receive at the end of each pay period, is the most common form of proof of income. Bank statements. Tax returns. W2 form. 1099 form. Employer letter. Unemployment documentation. Disability insurance.

How can I prove my income without pay stubs?

These are the most common ways to show proof of income without pay stubs; however, you can also use these methods: Provide W2s or wage and tax statements. Show your tax returns. Produce a letter from and signed by your clients. Provide an employment contract. Show proof of disability payments or social security benefits.

What is a verification letter for proof of income?

What is a Proof of Income Letter? A proof of income letter determines and confirms an individual's income and employment status. It is a formal, official letter usually composed by employers in order to confirm that an individual currently works for them or has worked for them in the past.

What is an income verification statement?

Pay stubs, earnings statement or W- 2 form identifying employee and showing amount earned period of time covered by employment. Signed and dated form or letter from employer specifying amount to be earned per pay period and length of pay period.

What can I use as income verification?

Pay stubs, earnings statement or W- 2 form identifying employee and showing amount earned period of time covered by employment. Signed and dated form or letter from employer specifying amount to be earned per pay period and length of pay period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OK Seneca-Cayuga Nation Income Statement Verification on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing OK Seneca-Cayuga Nation Income Statement Verification.

How do I fill out OK Seneca-Cayuga Nation Income Statement Verification using my mobile device?

Use the pdfFiller mobile app to fill out and sign OK Seneca-Cayuga Nation Income Statement Verification on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out OK Seneca-Cayuga Nation Income Statement Verification on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your OK Seneca-Cayuga Nation Income Statement Verification. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is OK Seneca-Cayuga Nation Income Statement Verification Form?

The OK Seneca-Cayuga Nation Income Statement Verification Form is a document used to verify the income of members of the Seneca-Cayuga Nation for various purposes, including eligibility for tribal services and benefits.

Who is required to file OK Seneca-Cayuga Nation Income Statement Verification Form?

Members of the OK Seneca-Cayuga Nation who need to verify their income for accessing tribal services, benefits, or assistance programs are required to file this form.

How to fill out OK Seneca-Cayuga Nation Income Statement Verification Form?

To fill out the OK Seneca-Cayuga Nation Income Statement Verification Form, members must provide accurate information regarding their income sources, amount earned, and any relevant documentation that supports their claims.

What is the purpose of OK Seneca-Cayuga Nation Income Statement Verification Form?

The purpose of the OK Seneca-Cayuga Nation Income Statement Verification Form is to ensure that income information is accurately reported, allowing the tribe to assess eligibility for programs, services, and benefits for its members.

What information must be reported on OK Seneca-Cayuga Nation Income Statement Verification Form?

The form must report details such as the member's name, date of birth, income sources, total income amount, and any supporting documentation like pay stubs, tax returns, or other relevant financial records.

Fill out your OK Seneca-Cayuga Nation Income Statement Verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Seneca-Cayuga Nation Income Statement Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.