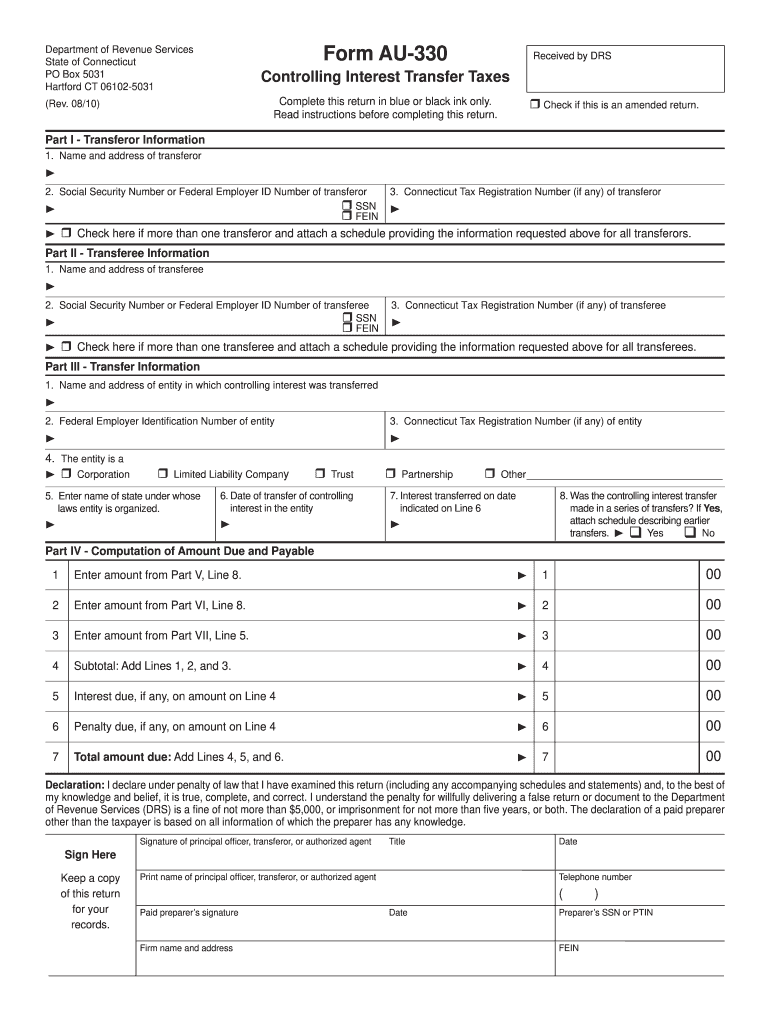

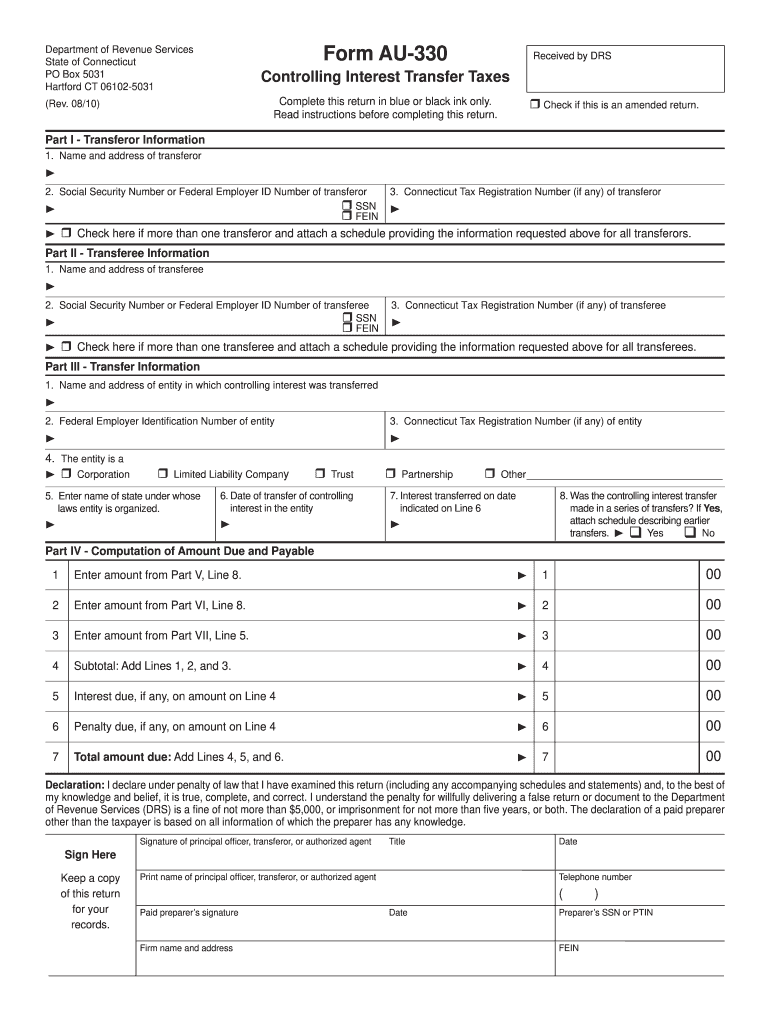

CT DRS AU-330 2010 free printable template

Get, Create, Make and Sign CT DRS AU-330

Editing CT DRS AU-330 online

Uncompromising security for your PDF editing and eSignature needs

CT DRS AU-330 Form Versions

How to fill out CT DRS AU-330

How to fill out CT DRS AU-330

Who needs CT DRS AU-330?

Instructions and Help about CT DRS AU-330

It's with great sorrow that we assumed to be fare welled to the top-selling Ozzy Bill Commodore what could possibly take its place in the hearts of the rear-wheel-drive big sin and loving fraternity of Australia has been a topic of debate for quite some time well that is until now that car breaks our website every single time we mention it and the comments section descends into a war zone thankfully they'll love it or loathe it of course by the time you watch this Holden will have pretty much shut the front door and Elizabeth with the question on everyone's lips is how does the Stinger compare one of Australia's best ever locally produced sports cars today we're going to find out, but we're going to do things a little differently, and now you're all here for performance figures, so we're going to get through those first before we see whether the Stinger has what it takes to take on the Commodore first up the quarter mile sprint in that will get the 0 to 100 kilometer an hour time and that'll be followed by an emergency stop from a little over a hundred kilometers an hour it should be interesting because both come with Bremen brakes finally it's our slalom torture test small cars love this little setup but big cars will hate it so let's get into it so the quarter mile first up is the stinger it was a quite staggering 12.7 nine seconds to the quarter-mile and have blistering 4.8 seconds to a hundred kilometers an hour that beats even the claim time from Kia given the Commodore doesn't have launch control it takes a little more effort to get it cleanly off the line but after three shots we finally managed to get there it is 5.3 seconds to 113 point three two seconds over the quarter mile that's a full half second or so slower on both sets for the Ozzy icon let's see how it fares in the braking test they can both get up to speed but how well do they stop only one way to find out first up the Pretender to the Commodores throne that's an impressive 2.7 seconds from 100 k's an hour down to naught and the stingers covered 36.7 meters in doing it so what about the red line at 2.8 seconds that's a hundredth of a second slower than the stinger from a hundred K's an hour at a zero and distance traveled a four hundred centimeters more at thirty-seven point seven meters this next test will really determine whether the Stinger has the depth of performance wedged into the much-loved Commodore car had three attempts to set its best time so let's see how they went twenty-one point nine seconds that's pretty impressive stuff from a big sedan now for the red line I have a feeling this is going to be a bit more of a handful through the slalom [Music] 22:15 well that's pretty much neck and neck on the slalom barely two hundredths of a second in it is really is hard to call the difference between these two right, so we've figured out the stinger is the performance King but had I stack up side-by-side so fifty-five thousand nine hundred and ninety bucks that's where...

People Also Ask about

How much is tax in usa?

What are the 4 main taxes?

Will I get a bigger tax refund in 2023?

How much is tax in usa 2022?

What is the purpose of tax?

How early can you file taxes 2022?

When can I file my taxes 2023?

What are the 4 types of taxes?

What are the 5 taxes?

What are 5 different types of tax?

What are 5 taxes in the US?

How much taxes do you pay on $10000?

What are the 5 taxes in the Philippines?

What is tax and how does it work?

When can I file my taxes for 2022 in 2023?

What do taxes mean?

What does taxes mean in simple words?

How much taxes do I pay on $7000?

How much salary is tax free in USA?

How do I file my 2022 2023 tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the CT DRS AU-330 in Chrome?

How can I fill out CT DRS AU-330 on an iOS device?

How do I fill out CT DRS AU-330 on an Android device?

What is CT DRS AU-330?

Who is required to file CT DRS AU-330?

How to fill out CT DRS AU-330?

What is the purpose of CT DRS AU-330?

What information must be reported on CT DRS AU-330?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.