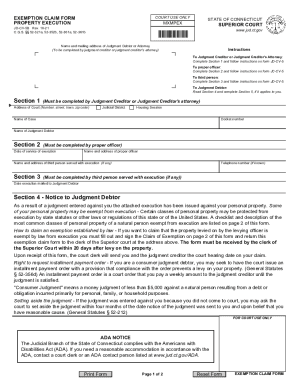

CT DRS AU-330 2005 free printable template

Show details

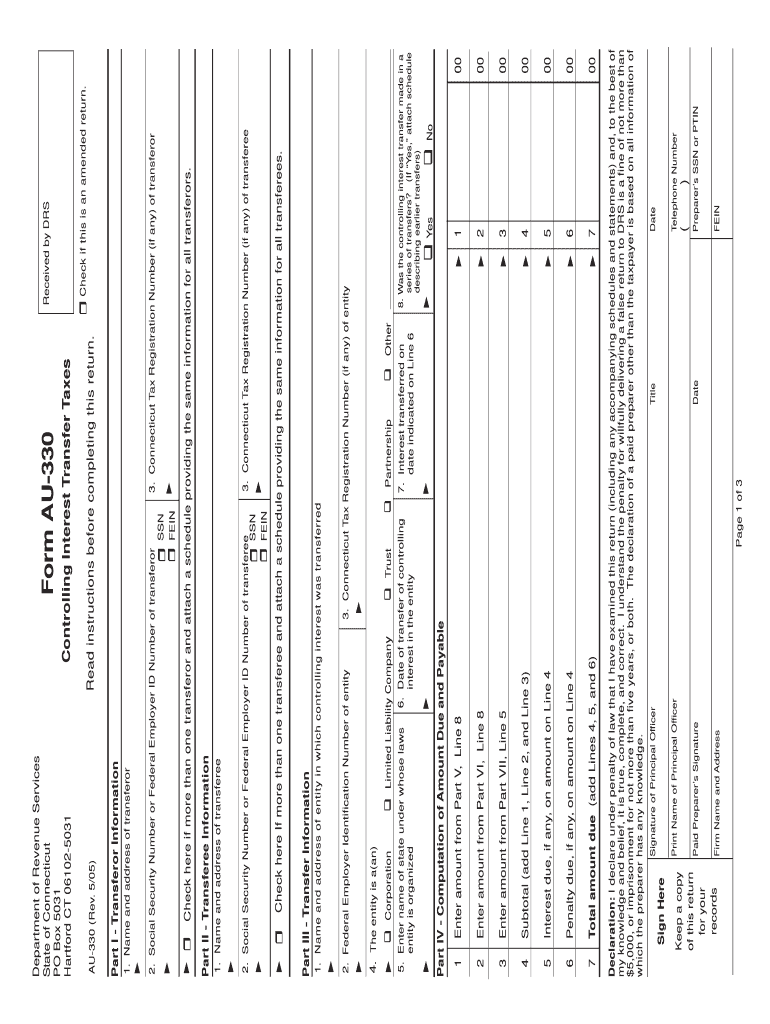

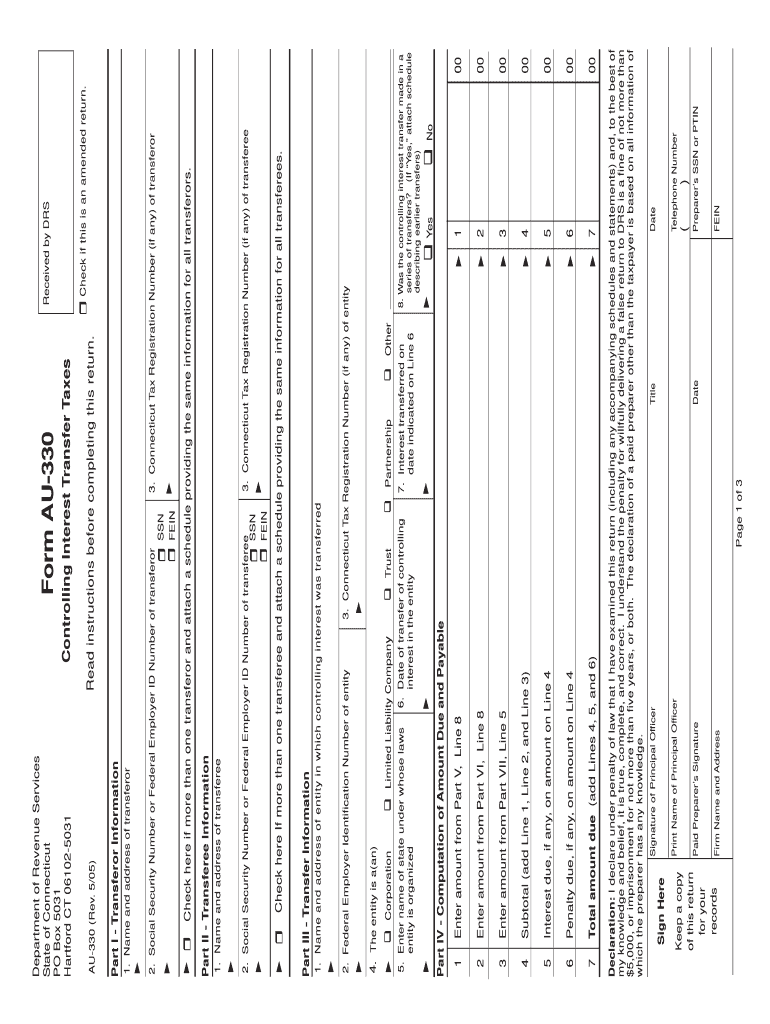

2. Social Security Number or Federal Employer ID Number of transferee SSN Read instructions before completing this return. Controlling Interest Transfer Taxes Form AU-330 AU-330 Rev. 5/05 Department of Revenue Services State of Connecticut PO Box 5031 Hartford CT 06102-5031 Name of Transferor Transferor s CT Tax Registration Number Date of Transfer Part V. 3. Connecticut Tax Registration Number if any of transferor Check if this is an amended return* Received by DRS Trust Enter amount from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS AU-330

Edit your CT DRS AU-330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS AU-330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS AU-330 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS AU-330. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS AU-330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS AU-330

How to fill out CT DRS AU-330

01

Step 1: Obtain the CT DRS AU-330 form from the Connecticut Department of Revenue Services website or local office.

02

Step 2: Fill out your personal information including name, address, and contact details in the designated fields.

03

Step 3: Provide the requested financial information, including income and deductions, as specified in the form instructions.

04

Step 4: Review all entries for accuracy, ensuring that all required fields are completed.

05

Step 5: Sign and date the form, certifying that the information provided is accurate to the best of your knowledge.

06

Step 6: Submit the completed form via mail, email, or online submission as required by the Connecticut Department of Revenue Services.

Who needs CT DRS AU-330?

01

Individuals or entities who are claiming a tax credit, specifically in relation to the Connecticut property tax or certain tax exemptions.

02

Taxpayers who are required to report specific financial information to the Connecticut Department of Revenue Services.

Fill

form

: Try Risk Free

People Also Ask about

What is the conveyance tax in Stamford CT?

Conveyance Tax Information City conveyance tax for Stamford is . 0035 of sales price up to $999,999.99. City conveyance tax is . 0050 above $1,000,000.00.

What is controlling interest transfer tax?

The controlling interest transfer tax is imposed on the person selling or transferring the controlling interest at the rate of 1.11% of the present true and actual value of the interest in real property possessed, directly or indirectly, by the entity.

Who pays the transfer tax in CT?

Connecticut's Real Estate Conveyance Tax The seller pays the tax when he or she conveys the property. Municipal town clerks collect the tax and remit the state share to the state Department of Revenue Services (DRS) (CGS §§ 12-494 et seq., as amended by PA 19-117, § 337).

Who pays CT conveyance tax?

This tax, typically paid by the seller at closing, is based on a percentage of the total sales price of a home. Sellers in some states pay multiple conveyance taxes, one to the state and another to the town and/or county. In Connecticut, sellers pay a state conveyance tax along with a municipal tax.

What is the local conveyance tax?

The California Revenue and Taxation Code states that all the counties in California have to pay the same rate. The current tax rate is $1.10 per $1,000 or $0.55 per $500. So, if your home sells for $600,000, the property transfer tax is $660.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT DRS AU-330 to be eSigned by others?

When you're ready to share your CT DRS AU-330, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit CT DRS AU-330 online?

The editing procedure is simple with pdfFiller. Open your CT DRS AU-330 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out CT DRS AU-330 using my mobile device?

Use the pdfFiller mobile app to complete and sign CT DRS AU-330 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CT DRS AU-330?

CT DRS AU-330 is a form used by certain entities in Connecticut to report information regarding alternative energy sources and to claim credits against their tax liabilities.

Who is required to file CT DRS AU-330?

Entities that participate in alternative energy programs in Connecticut and wish to claim tax credits are required to file the CT DRS AU-330.

How to fill out CT DRS AU-330?

To fill out CT DRS AU-330, taxpayers must provide detailed information on their alternative energy investments, including costs and credits sought. Instructions are provided on the form itself.

What is the purpose of CT DRS AU-330?

The purpose of CT DRS AU-330 is to facilitate the reporting and claiming of tax credits related to alternative energy investments in Connecticut.

What information must be reported on CT DRS AU-330?

The form requires the reporting of investment amounts, descriptions of the alternative energy projects, and calculations of eligible tax credits.

Fill out your CT DRS AU-330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS AU-330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.