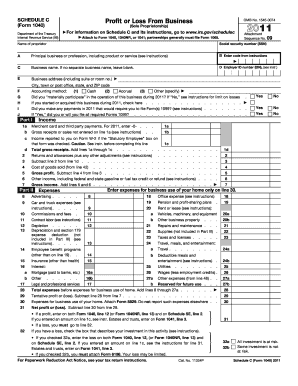

IRS 990 or 990-EZ - Schedule C 2013 free printable template

Show details

Department of the Treasury

Internal Revenue Service2012 Instructions for Schedule C

Profit or Loss

From Businesses Schedule C (Form 1040) to report income or loss from a business you operated or

a

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

To edit IRS 990 or 990-EZ - Schedule forms, use pdfFiller’s comprehensive editing tools. You can upload your completed form and make necessary changes directly on the platform. Once your edits are finalized, you can save the updated version for your records or proceed with submission. Ensure that the changes comply with IRS regulations and accurate representation of your information.

How to fill out IRS 990 or 990-EZ - Schedule

Filling out IRS 990 or 990-EZ - Schedule requires careful attention to ensure accuracy and compliance. Start by gathering all necessary financial information about your organization, including total revenue and expenses. Use the specific line items on the form to report this data accurately, following the provided instructions closely. Always check your entries to avoid common mistakes before submitting the form to the IRS.

About IRS 990 or 990-EZ - Schedule 2013 previous version

What is IRS 990 or 990-EZ - Schedule?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 or 990-EZ - Schedule 2013 previous version

What is IRS 990 or 990-EZ - Schedule?

IRS 990 or 990-EZ - Schedule is a tax form used by tax-exempt organizations to report financial information to the IRS. This form allows organizations to provide transparency about their activities, funding, and expenditures. It is crucial for maintaining compliance with federal tax regulations and for public accountability.

What is the purpose of this form?

The primary purpose of IRS 990 or 990-EZ - Schedule is to ensure that tax-exempt organizations operate in accordance with their stated exempt purposes. The form collects data on income, expenses, and programmatic activities, offering insights into how the organization uses its resources. It also helps the IRS monitor compliance with tax laws and assess the public benefit provided by these organizations.

Who needs the form?

Organizations that are recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code typically need to file IRS 990 or 990-EZ - Schedule. This includes charities, educational institutions, and certain religious organizations. Smaller organizations with gross receipts under a specified threshold may qualify to file a simplified version of the form.

When am I exempt from filling out this form?

Exemptions from filing IRS 990 or 990-EZ - Schedule can occur for various reasons. Organizations with annual gross receipts below a specified threshold and those classified as specific types of 501(c) organizations may not be required to file. It’s essential to consult IRS guidelines or a tax professional to determine your specific filing obligations.

Components of the form

IRS 990 or 990-EZ - Schedule comprises several key components, including details on revenue, expenses, net assets, and program services. Organizations must also disclose information about their governance, policies, and operational structure. Completing each section accurately is vital for fulfilling IRS requirements and ensuring proper compliance.

Due date

The due date for filing IRS 990 or 990-EZ - Schedule typically falls on the 15th day of the 5th month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is due on May 15. Organizations may request a six-month extension, but it is important to file the extension properly to avoid penalties.

What payments and purchases are reported?

IRS 990 or 990-EZ - Schedule requires organizations to report certain payments and purchases within the context of their operations. This includes compensation paid to officers, directors, and key employees, as well as expenses related to grants, contracts, and other programmatic activities. Accurate reporting helps maintain transparency and accountability to the IRS and the public.

How many copies of the form should I complete?

Organizations typically need to complete one copy of IRS 990 or 990-EZ - Schedule for submission. However, it is advisable to retain additional copies for your organization's records. Having multiple copies protects against loss and ensures that you have documentation available for reference or in case of an audit.

What are the penalties for not issuing the form?

Failing to file IRS 990 or 990-EZ - Schedule can result in significant penalties, including fines imposed by the IRS. Noncompliance may also jeopardize an organization's tax-exempt status. It is crucial for organizations to understand their obligations and file accurately and timely to avoid these penalties.

What information do you need when you file the form?

To file IRS 990 or 990-EZ - Schedule, organizations need comprehensive financial data, including revenue sources, expenses, and net assets. Additionally, organizations should gather details about their programs and governance structure. Ensuring all data is readily available leads to a more efficient filing process.

Is the form accompanied by other forms?

IRS 990 or 990-EZ - Schedule may be accompanied by other supporting documents or schedules, depending on the organization's specific activities. For instance, additional schedules may be required to disclose specific financial details or activities related to certain types of income or expenditures. Review IRS guidelines to determine the necessity of additional forms.

Where do I send the form?

The submission address for IRS 990 or 990-EZ - Schedule depends on the location of your organization. Forms can be mailed directly to the IRS based on the instructions provided for your specific state. Ensure that you check the IRS website for the most current mailing addresses and requirements based on your organization's circumstances.

See what our users say