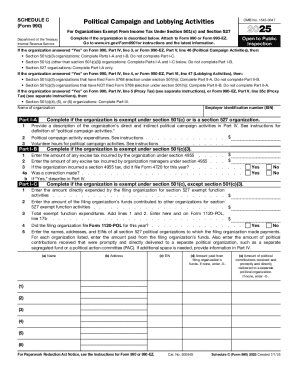

IRS 990 or 990-EZ - Schedule C 2022 free printable template

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

About IRS 990 or 990-EZ - Schedule 2022 previous version

What is IRS 990 or 990-EZ - Schedule?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 or 990-EZ - Schedule

What should I do if I notice an error after filing IRS 990 or 990-EZ - Schedule?

If you discover an error after submitting your IRS 990 or 990-EZ - Schedule, you can file an amended return. To do this, use the same form but mark it as 'Amended' and provide the corrected information. Ensure that you submit it as soon as possible to mitigate any potential issues.

How can I track the status of my e-filed IRS 990 or 990-EZ - Schedule?

To track your e-filed IRS 990 or 990-EZ - Schedule, you can use the IRS e-File Status tool available on their website. After submission, you will receive a confirmation, and you can use this information to verify whether your submission was accepted or rejected, along with the reason for any rejection if applicable.

Are e-signatures accepted when filing IRS 990 or 990-EZ - Schedule electronically?

Yes, e-signatures are accepted when filing IRS 990 or 990-EZ - Schedule electronically, provided that the software you use complies with IRS requirements. Ensure that the electronic signature solution meets security and authentication standards set by the IRS to avoid issues during processing.

What should I do if I receive a notice from the IRS regarding my IRS 990 or 990-EZ - Schedule?

If you receive a notice from the IRS concerning your IRS 990 or 990-EZ - Schedule, review the notice carefully for specific instructions on how to respond. Gather all relevant documentation and prepare a clear response, addressing the issues raised. If necessary, consult a tax professional to assist you in crafting an appropriate reply.