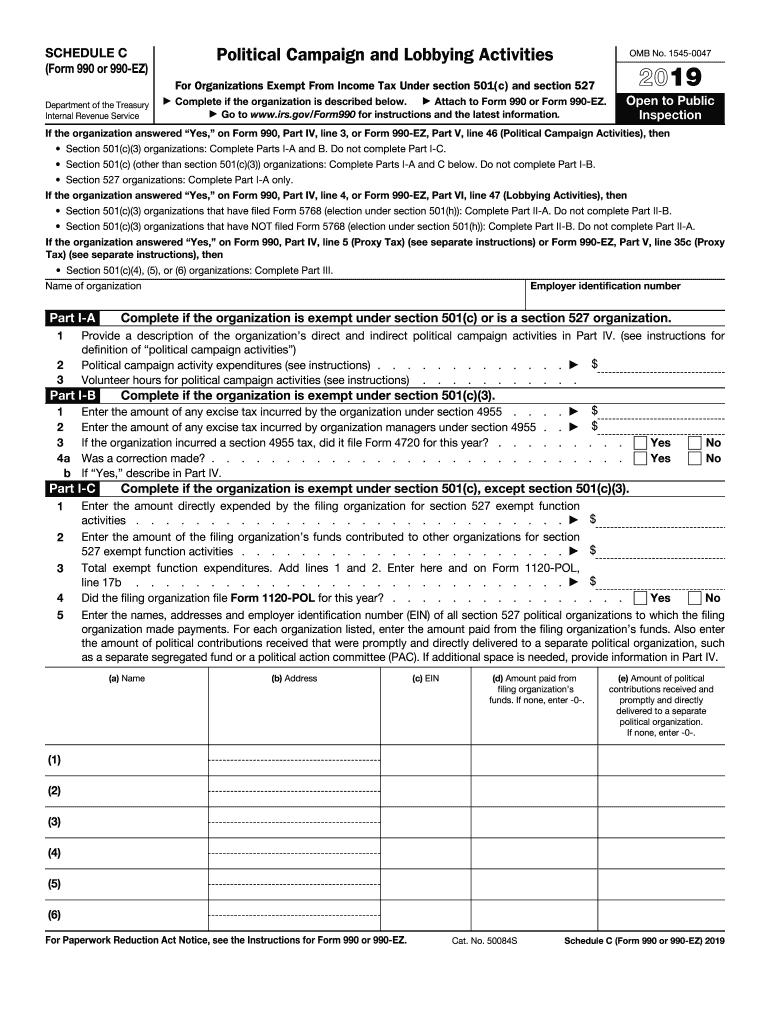

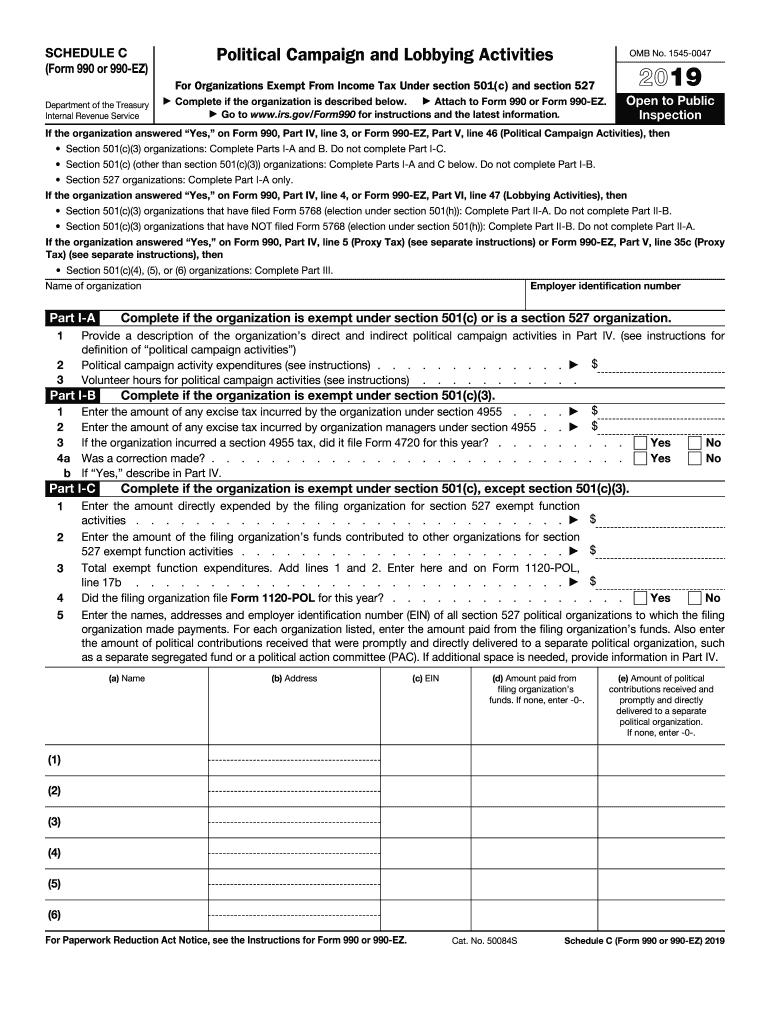

IRS 990 or 990-EZ - Schedule C 2019 free printable template

Get, Create, Make and Sign IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule online

Uncompromising security for your PDF editing and eSignature needs

IRS 990 or 990-EZ - Schedule C Form Versions

How to fill out IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule C

Who needs IRS 990 or 990-EZ - Schedule C?

Instructions and Help about IRS 990 or 990-EZ - Schedule

Hello my name is Katie senors with st Noor's wealth management and in this video we're going to do a walk through schedule c form 1040. Let's get going if you're using a tax preparation software or services of a tax accountant still you need to locate schedule c with the instructions you can type schedule c into your search engine whatever you're using and look for the IRS.gov website it will be about schedule c form 1040 or 1040 Sr it's profit or loss from business for sole proprietorship if you'll see here the top link is schedule c in PDF form and the second link is for the instructions for schedule c you can do print version and pd for e-book if you want the PDF is fillable I highly recommend using tax preparation software or tax accountant since it's complex just to do it on paper, but you should download and give the instructions for schedule c you're going to refer to them while you prepare new taxes you can choose the instructions that you can click and go buy items say grocery seats, and it will bring you to a specific place in the page or...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS 990 or 990-EZ - Schedule without leaving Chrome?

How can I edit IRS 990 or 990-EZ - Schedule on a smartphone?

Can I edit IRS 990 or 990-EZ - Schedule on an Android device?

What is IRS 990 or 990-EZ - Schedule C?

Who is required to file IRS 990 or 990-EZ - Schedule C?

How to fill out IRS 990 or 990-EZ - Schedule C?

What is the purpose of IRS 990 or 990-EZ - Schedule C?

What information must be reported on IRS 990 or 990-EZ - Schedule C?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.