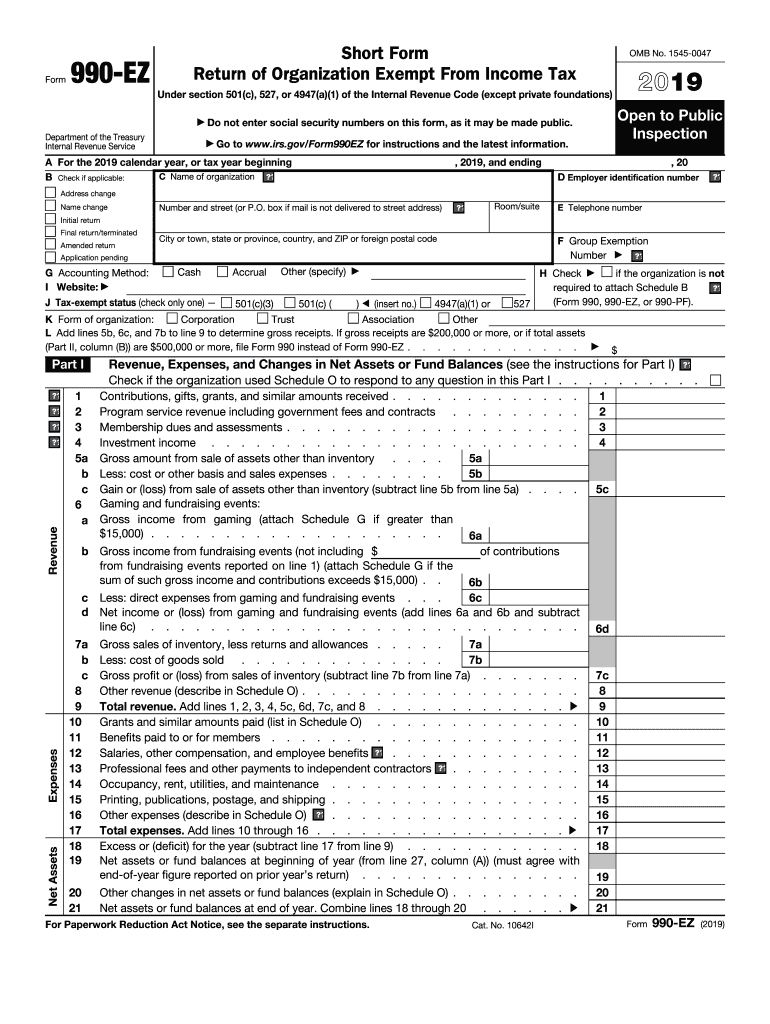

What is IRS 990-EZ?

IRS 990-EZ is a tax form used by eligible organizations, primarily non-profits, to report their financial activity to the Internal Revenue Service (IRS). This form provides a simplified reporting option for organizations with gross receipts under a specific threshold, typically less than $200,000 and total assets under $500,000. Filing this form is a requirement for maintaining tax-exempt status.

Who needs the form?

IRS 990-EZ is specifically designed for small tax-exempt organizations. Generally, organizations that have gross receipts below $200,000 and total assets below $500,000 at the end of the year are required to file this form. Charitable organizations, private foundations, and other non-profits may find this form applicable, whereas larger organizations must use the longer Form 990.

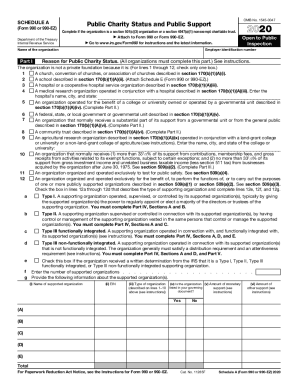

Components of the form

The IRS 990-EZ comprises several key components that organizations must complete. These include sections for reporting revenue, functional expenses, net assets, and information regarding the organization’s mission and accomplishments. Each section is crucial for providing a complete picture of the organization’s financial and operational status.

What are the penalties for not issuing the form?

Failing to file IRS 990-EZ on time can result in significant penalties. For organizations that do not file, the IRS imposes a penalty that can amount to $20 per day, with a maximum penalty of $10,000 or 5% of the organization’s gross receipts for the year, whichever is less. Continued failure to file could jeopardize the organization’s tax-exempt status.

Is the form accompanied by other forms?

IRS 990-EZ may need to be accompanied by other forms, depending on the organization’s activities and circumstances. Commonly, schedules may be required to provide additional details for certain income or expenditures. It's essential to refer to the complex structure of IRS requirements to determine if additional information is necessary.

What is the purpose of this form?

The purpose of IRS 990-EZ is to provide the IRS with essential information about the organization’s income, expenses, and operations. This data helps the IRS ensure compliance with tax regulations and maintain the organization’s tax-exempt status. Furthermore, IRS 990-EZ serves as an informational resource for the public about the organization’s financial health and activities.

When am I exempt from filling out this form?

Organizations may be exempt from filing IRS 990-EZ if they meet certain criteria. Common exemptions include organizations with gross receipts typically under $50,000 who can instead file the Form 990-N, also known as the e-Postcard. Additionally, some religious institutions and government agencies may not be required to submit this form. Always consult IRS guidelines to determine specific exemptions.

Due date

The due date for filing IRS 990-EZ is the 15th day of the 5th month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31st, the due date would be May 15th of the following year. Organizations can request an automatic extension for up to six months by filing Form 8868.

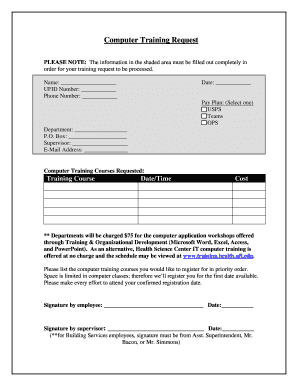

What information do you need when you file the form?

When preparing to file IRS 990-EZ, gather comprehensive financial data, including total revenue, total expenses, changes in net assets, and a list of board members. Additional information may include program service accomplishments and details about the organization’s mission and activities for the year. Ensuring all data is accurate is critical for compliance.

Where do I send the form?

The IRS 990-EZ must be sent to the appropriate address based on the organization’s location. Generally, this address is specified in the form’s instructions. Organizations can choose to file the form electronically through IRS e-file or send it via mail, ensuring that it is sent to the correct submission processing center.