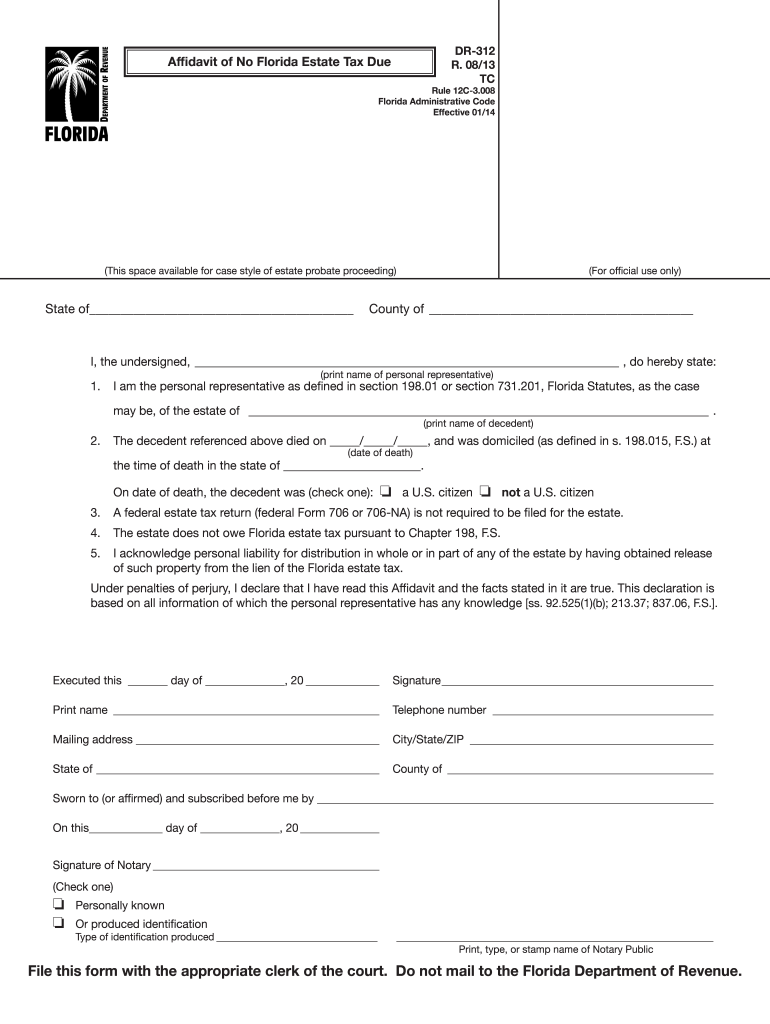

Who needs a DR-312 form?

Let’s imagine a situation in which you’ve inherited real estate in Florida. If you are sure that Florida estate tax is not due and a federal estate tax return is not required, you should fill out the DR-312 form.

What is the DR-312 form for?

This form is called the Affidavit of No Florida Estate Tax Due. It serves as an evidence of non-liability for Florida estate tax and will remove the Department’s estate tax lien. Use this form when the estate you inherited is not subject to Florida estate tax, and you don’t need to file a federal estate tax return (Form 706 or 706-NA). There is no need to complete this form if the estate you inherited will be detailed in filed federal form 706 or 706A.

Is the DR-312 accompanied by other forms?

There is no need to include other forms with DR-312.

When is the DR-312 due?

The lawful heir of the estate should complete the form right after he inherits it.

How do I fill out the DR-312 form?

The form has one page and includes detailed instructions. It’s filled by the personal representative who should provide the following information:

-

State and country of residence

-

Full name

-

Full name of the deceased divisor

-

Date of the divisor’s death

-

If the decedent was a US citizen on date of death

-

Date of execution of this form

-

Address

The form should be certified by the notary as well.

What do I do with the DR-312 form after its completion?

Once the form has been signed and completed, the heir must file it with the relevant clerk of the court. The form should not be sent to the Florida Department of Revenue.