Get the free 2290online

Show details

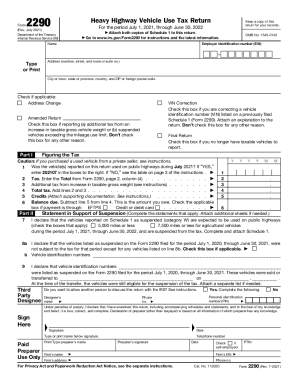

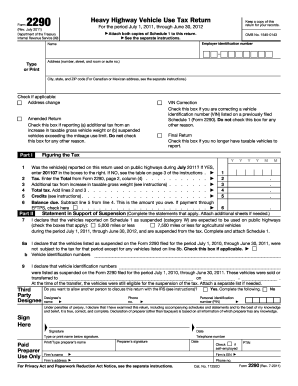

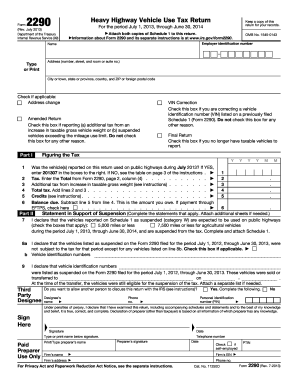

Form 2290 due dates have been stated in the following table for tax year 2013-2014. E-file Form 2290 for just 9. IRS Form 2290 Due Dates for the Tax Year 2013-2014 The IRS Form 2290 for Heavy Vehicle Use Taxes HVUT must be filed annually for each taxable vehicle that is used on public highways during the current tax period. The normal tax period for heavy vehicles begins on July 1st and ends on June 30th of the following year. A Form 2290 must al...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2290 online form

Edit your form 2290 online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2290online form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2290online form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2290online form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2290online form

How to fill out 2290 form:

01

Gather necessary information: Before starting to fill out the 2290 form, ensure you have all the required information at hand. This includes your Employer Identification Number (EIN), the taxable vehicle information such as Vehicle Identification Number (VIN), and the gross weight of the vehicle.

02

Determine the filing method: Decide whether you want to file the 2290 form electronically or by paper. Electronic filing is usually faster, more convenient, and can provide you with immediate proof of receipt. If you choose electronic filing, you can utilize the IRS e-file system or use an authorized third-party service provider.

03

Complete the required sections: The 2290 form consists of several sections that need to be completed. Start by providing your name, address, and EIN. Then, move on to entering the taxable vehicle information, such as the VIN and the gross weight. Additionally, if the vehicle is being reported for the first time during the tax period, you may need to provide the date it was first used.

04

Calculate the tax amount: Use the provided tax table or the HVUT calculator to determine the amount of Heavy Vehicle Use Tax (HVUT) you owe. The tax is based on the gross weight of the vehicle, and if your vehicle falls under any exemptions, ensure you provide the necessary details to claim them.

05

Choose payment method: Decide on the payment method for your HVUT. Electronic payment options include direct debit, Electronic Federal Tax Payment System (EFTPS), or payment by credit/debit card. If opting for paper filing, attach a check or money order payable to the "United States Treasury" along with the completed form.

06

Review and submit: After completing the form, review all the provided information for accuracy and correctness. Any errors or missing information could lead to delays or penalties. Once satisfied, sign and date the form and submit it either electronically or by mail, depending on the chosen filing method.

Who needs 2290 form:

01

Truck owners: Individuals or businesses that own and operate heavy vehicles with a gross weight of 55,000 pounds or more are required to file Form 2290 and pay the HVUT. This includes trucks, truck tractors, and buses used on public highways.

02

Agricultural vehicles: Farmers and agricultural businesses that operate vehicles with a gross weight of 55,000 pounds or more and are primarily used for farming purposes are also required to file Form 2290. However, the HVUT amount may differ, and there might be certain exemptions applicable.

03

Logging vehicles: Logging vehicles, including trucks or truck tractors that are exclusively used for the transportation of harvested forest products, have different HVUT rates and must also file Form 2290.

Overall, anyone who owns heavy vehicles meeting the weight requirements and uses them on public highways is typically required to file Form 2290 and pay the associated HVUT.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2290online form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 2290online form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete 2290online form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2290online form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete 2290online form on an Android device?

Use the pdfFiller mobile app and complete your 2290online form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is 2290 form?

The 2290 form is a form used by truck owners to report and pay the federal vehicle use tax.

Who is required to file 2290 form?

Truck owners who operate vehicles with a gross weight of 55,000 pounds or more are required to file the 2290 form.

How to fill out 2290 form?

To fill out the 2290 form, truck owners need to provide details about their vehicle, such as VIN number, taxable gross weight, and proof of payment.

What is the purpose of 2290 form?

The purpose of the 2290 form is to collect the federal vehicle use tax from truck owners to help maintain the highways.

What information must be reported on 2290 form?

Truck owners must report vehicle details, such as VIN number, taxable gross weight, and proof of payment on the 2290 form.

Fill out your 2290online form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2290online Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.