LA Webster Parish Sales and Use Tax Report 2017-2025 free printable template

Show details

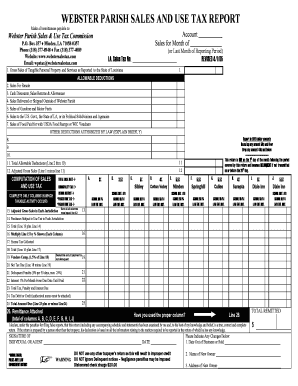

REVISED 01/01/17 WEBSTER PARISH SALES AND USE TAX REPORT Make all remittances payable to: Account Sales for Month of Webster Parish Sales & Use Tax Commission P.O. Box 357 Minded, LA 710580357 Phone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA Webster Parish Sales and Use

Edit your LA Webster Parish Sales and Use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA Webster Parish Sales and Use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing LA Webster Parish Sales and Use online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit LA Webster Parish Sales and Use. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA Webster Parish Sales and Use Tax Report Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA Webster Parish Sales and Use

How to fill out LA Webster Parish Sales and Use Tax

01

Obtain the LA Webster Parish Sales and Use Tax form from the official website or a local tax office.

02

Fill in the business information including name, address, and tax identification number.

03

Indicate the reporting period for the tax (monthly, quarterly, etc.).

04

Calculate the total sales and use tax due based on your sales during the reporting period.

05

Provide itemized details of taxable sales, exempt sales, and any adjustments.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form along with the payment to the appropriate tax authority.

Who needs LA Webster Parish Sales and Use Tax?

01

Businesses operating within Webster Parish that sell tangible personal property.

02

Retailers who are required to collect sales tax from customers.

03

Service providers that charge sales tax on taxable services.

04

Individuals or businesses that purchase taxable goods for use in Webster Parish.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax in Minden Louisiana?

What is the sales tax rate in Minden, Louisiana? The minimum combined 2023 sales tax rate for Minden, Louisiana is 11.95%. This is the total of state, parish and city sales tax rates.

What is Louisiana's highest sales tax?

The 2023 Tax Foundation rankings list Louisiana at the top in combined state and local sales taxes at 9.55%, five times higher than Alaska at 1.76%, the state with the lowest sales tax, USA Today Network reports.

What parish in Louisiana has the highest sales tax?

There are a total of 263 local tax jurisdictions across the state, collecting an average local tax of 5.097%. Click here for a larger sales tax map, or here for a sales tax table. Combined with the state sales tax, the highest sales tax rate in Louisiana is 12.95% in the cities of Monroe and Sterlington.

What is the sales tax in Webster Parish?

What is the sales tax rate in Webster Parish? The minimum combined 2023 sales tax rate for Webster Parish, Louisiana is 7.95%. This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently 4.45%.

Which parish has the highest taxes?

Orleans Parish topped the list with a millage rate of 154.1, with St. Tammany the next highest in the metro area at 146.8 mills, followed by St. Bernard at 143.2, the report shows. Keep in mind that the tax commission's list does not include additional property taxes collected in municipalities.

What is the retail sales tax in Louisiana?

Louisiana has a 4.45 percent state sales tax rate, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 9.55 percent. Louisiana's tax system ranks 39th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the LA Webster Parish Sales and Use electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your LA Webster Parish Sales and Use in seconds.

Can I create an electronic signature for signing my LA Webster Parish Sales and Use in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your LA Webster Parish Sales and Use and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete LA Webster Parish Sales and Use on an Android device?

On an Android device, use the pdfFiller mobile app to finish your LA Webster Parish Sales and Use. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is LA Webster Parish Sales and Use Tax?

LA Webster Parish Sales and Use Tax is a tax imposed on the sale of tangible personal property and certain services within Webster Parish in Louisiana. It is collected by the local government to fund various public services and infrastructure.

Who is required to file LA Webster Parish Sales and Use Tax?

Any business or individual that makes taxable sales or uses taxable goods and services within Webster Parish is required to file LA Webster Parish Sales and Use Tax.

How to fill out LA Webster Parish Sales and Use Tax?

To fill out the LA Webster Parish Sales and Use Tax form, you must provide details of all taxable sales, total sales, the amount of tax collected, and any applicable exemptions. The form typically requires you to calculate the total tax owed and submit it by the due date.

What is the purpose of LA Webster Parish Sales and Use Tax?

The purpose of LA Webster Parish Sales and Use Tax is to generate revenue for local government services, including education, public safety, infrastructure, and community development.

What information must be reported on LA Webster Parish Sales and Use Tax?

The information that must be reported includes the seller's name and address, type of business, gross sales, tax collected, exempt sales, and total amount due.

Fill out your LA Webster Parish Sales and Use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA Webster Parish Sales And Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.