LA Webster Parish Sales and Use Tax Report 2005 free printable template

Show details

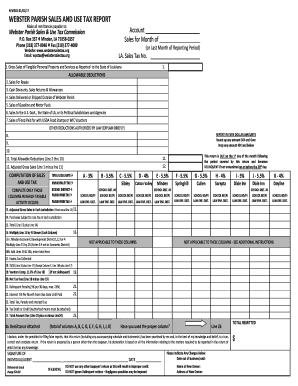

WEBSTER PARISH SALES AND USE TAX REPORT Make all remittances payable to: Account Sales for Month of Webster Parish Sales & Use Tax Commission P.O. Box 357 Minded, LA 710580357 Phone (318) 3778948

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA Webster Parish Sales and Use

Edit your LA Webster Parish Sales and Use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA Webster Parish Sales and Use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing LA Webster Parish Sales and Use online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit LA Webster Parish Sales and Use. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA Webster Parish Sales and Use Tax Report Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA Webster Parish Sales and Use

How to fill out LA Webster Parish Sales and Use Tax

01

Obtain the LA Webster Parish Sales and Use Tax form from the official website or local tax office.

02

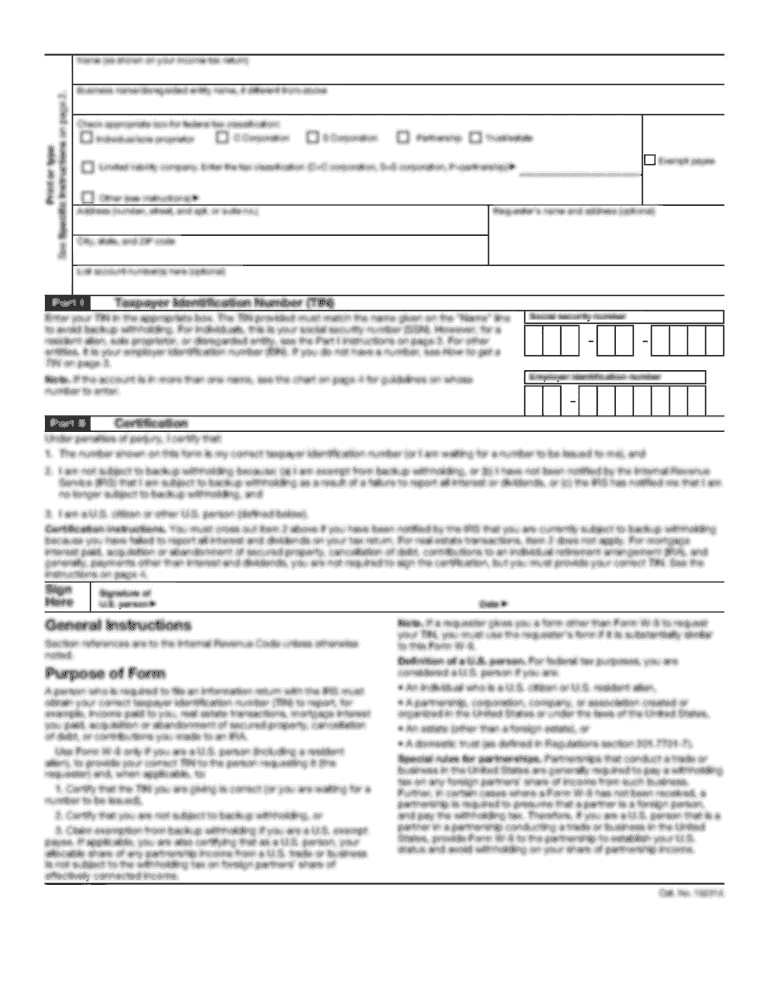

Enter your business information, including name, address, and tax identification number.

03

List the type of sales made during the reporting period, including gross receipts.

04

Calculate the total sales tax collected based on the applicable tax rate.

05

Deductions may be applicable; list any exempt sales or deductions if necessary.

06

Add the total sales tax collected and any other applicable charges.

07

Submit the completed form along with payment by the due date.

Who needs LA Webster Parish Sales and Use Tax?

01

Businesses operating in Webster Parish that sell tangible goods or taxable services.

02

Any individual or entity that engages in retail sales within Webster Parish.

03

Businesses making online sales to customers residing in Webster Parish.

04

Service providers who charge sales tax on their services in Webster Parish.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax in Minden Louisiana?

What is the sales tax rate in Minden, Louisiana? The minimum combined 2023 sales tax rate for Minden, Louisiana is 11.95%. This is the total of state, parish and city sales tax rates.

What is Louisiana's highest sales tax?

The 2023 Tax Foundation rankings list Louisiana at the top in combined state and local sales taxes at 9.55%, five times higher than Alaska at 1.76%, the state with the lowest sales tax, USA Today Network reports.

What parish in Louisiana has the highest sales tax?

There are a total of 263 local tax jurisdictions across the state, collecting an average local tax of 5.097%. Click here for a larger sales tax map, or here for a sales tax table. Combined with the state sales tax, the highest sales tax rate in Louisiana is 12.95% in the cities of Monroe and Sterlington.

What is the sales tax in Webster Parish?

What is the sales tax rate in Webster Parish? The minimum combined 2023 sales tax rate for Webster Parish, Louisiana is 7.95%. This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently 4.45%.

Which parish has the highest taxes?

Orleans Parish topped the list with a millage rate of 154.1, with St. Tammany the next highest in the metro area at 146.8 mills, followed by St. Bernard at 143.2, the report shows. Keep in mind that the tax commission's list does not include additional property taxes collected in municipalities.

What is the retail sales tax in Louisiana?

Louisiana has a 4.45 percent state sales tax rate, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 9.55 percent. Louisiana's tax system ranks 39th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the LA Webster Parish Sales and Use electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your LA Webster Parish Sales and Use and you'll be done in minutes.

How do I edit LA Webster Parish Sales and Use straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing LA Webster Parish Sales and Use.

How do I complete LA Webster Parish Sales and Use on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your LA Webster Parish Sales and Use. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is LA Webster Parish Sales and Use Tax?

LA Webster Parish Sales and Use Tax is a tax imposed on the sale of goods and services within Webster Parish, Louisiana. It is collected by sellers and remitted to the local government to fund various public services and infrastructure.

Who is required to file LA Webster Parish Sales and Use Tax?

Businesses and individuals who sell tangible personal property or provide taxable services within Webster Parish are required to file LA Webster Parish Sales and Use Tax. This includes both resident and non-resident sellers.

How to fill out LA Webster Parish Sales and Use Tax?

To fill out the LA Webster Parish Sales and Use Tax form, gather your sales records, complete the tax calculation based on total sales, and report the amounts in the designated sections of the form. Ensure to include your business information and any deductions or exemptions applicable.

What is the purpose of LA Webster Parish Sales and Use Tax?

The purpose of LA Webster Parish Sales and Use Tax is to generate revenue for local government services, such as public safety, education, infrastructure, and community development.

What information must be reported on LA Webster Parish Sales and Use Tax?

The information that must be reported includes total sales, taxable sales, exempt sales, purchases subject to use tax, deductions, and the total amount of tax collected. Additionally, businesses must provide their identifying information and account number.

Fill out your LA Webster Parish Sales and Use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA Webster Parish Sales And Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.