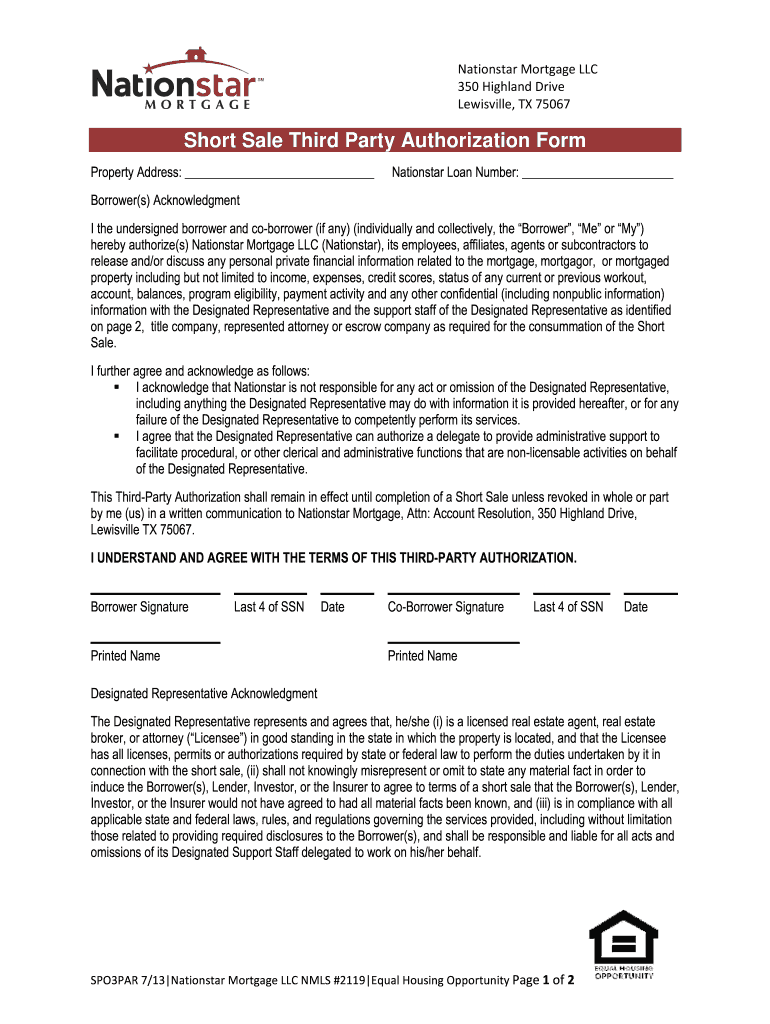

Nationstar Mortgage SPO3PAR 2013-2025 free printable template

Get, Create, Make and Sign party authorization nationstar form

Editing short sale authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short sale authorization form

How to fill out Nationstar Mortgage SPO3PAR

Who needs Nationstar Mortgage SPO3PAR?

Video instructions and help with filling out and completing short sale authorization form

Instructions and Help about short sale authorization form

Good morning everybody I'm Kevin Kaufman hey Dr Weaver we're good 4610 Arizona's premier short sale team and this is the infamous short sale power our comm we're making some friends and making some well especially here on mobile viewers this week especially on the let's hold banks accountable well it's Bank mindset week weird we're basically sharing with people the reality running up the bank's mindset is and there's a lot of different mindsets up there know speaking about something we've been through Owen this week we talked about B of a talked about ING we got yesterday which was a yeah so on, and I'm going to share another one today about SLS o specialized loans there nationalized Loan Servicing so if anybody isn't aware of whom SLS is it stands for specialized loan servicing I'm gonna just start this with the story which a couple of weeks ago is it back and relapsed well we should, you do that a couple of weeks ago we had a file that was a Capital One actually was a Capital One mortgage believe it or not they're like a credit card company okay they've got good commercials okay yeah that's where they spent all their money sorry commercials because here's the thing they can't even service their lungs anymore, so I had a Capital One service mortgage that somehow got transferred to SLS, and so we start begin the process with SLS, and we find out that the know what we didn't find out where he knew the sale date was rapidly approaching yes and SLS had this file for a couple of weeks and let us know that the there was nothing they can do was 400 short sale was concerned that even though we had a good offer the home was going to have to go through foreclosure unless our sellers wanted to pay a certain fee in order to have the foreclosure, so they correct me if I'm wrong we had a really strong offer we were netting them an approval amount of money for their I know when I say really strong offer I mean slightly above the BPO okay, so they did a BPO an offer was higher, so our net was probably like 88 87 yeah 5 of in their yeah, and so I found out they were working with one of our negotiators who wanted our seller to pay 2500 to have a sale they postponed well I got on phone that I actually brought this to the attention of senior several senior managers there SOS and got them to reconsider that that stupid decision and that stupid standpoint, so you disagreed with their mindset around wanting to foreclose or charge the homeowner to postpone a sale Dave I disagree with their stupidity okay I got brute stupidity equals mindset got it right I found this case yes, so they wanted to post they weren't 2500 postpone the sale day I said no they ordered a second they agreed to do it one time and order a second BPO on a rush because they oh the old people was actually done from the past service oh okay, so they had an idea what the home was worth it was right in line got and the second BPO came back equal to the first one so again slightly below our offer okay...

People Also Ask about

How long is a third party authorization form valid?

What is a buyer's authorization form?

What is a standard borrower authorization form?

How do I write a third party authorization letter?

What is a 3rd party authorization form?

What is a blanket authorization form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find short sale authorization form?

Can I create an electronic signature for signing my short sale authorization form in Gmail?

How do I edit short sale authorization form straight from my smartphone?

What is Nationstar Mortgage SPO3PAR?

Who is required to file Nationstar Mortgage SPO3PAR?

How to fill out Nationstar Mortgage SPO3PAR?

What is the purpose of Nationstar Mortgage SPO3PAR?

What information must be reported on Nationstar Mortgage SPO3PAR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.