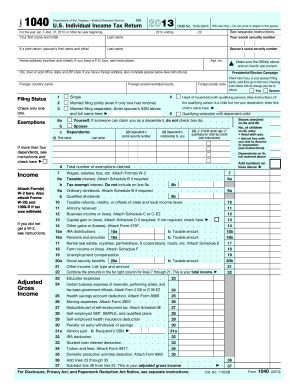

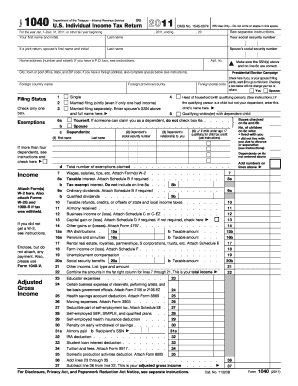

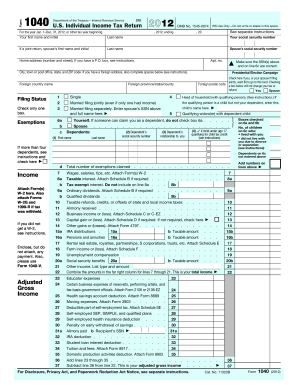

OH IT 1040 2013 free printable template

Show details

IT 1040. Individual. 2013. Use only black ink. 13000102. Income Tax Return ... Visit tax.Ohio.gov to try Ohio I-File. ... Schedule B credits from line 59 on page 4 of Ohio form IT 1040 (enclose page

pdfFiller is not affiliated with any government organization

Instructions and Help about OH IT 1040

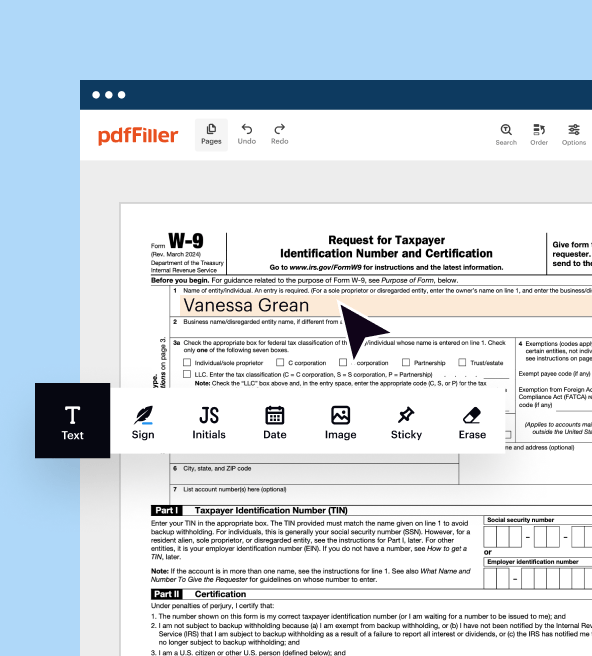

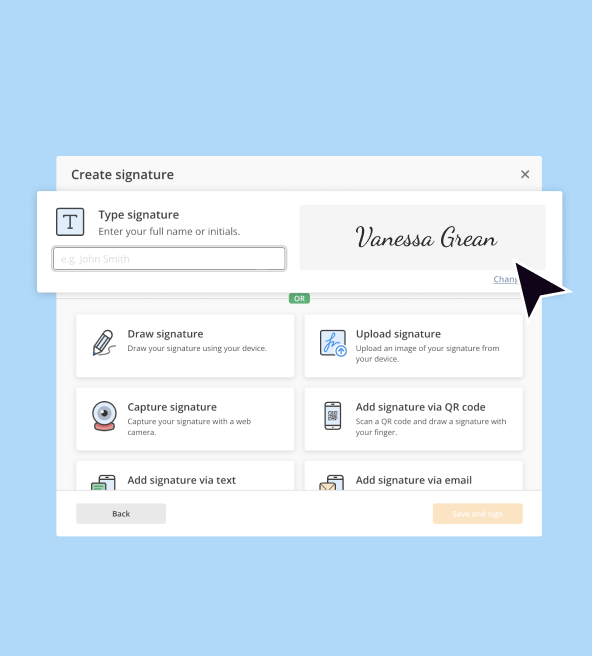

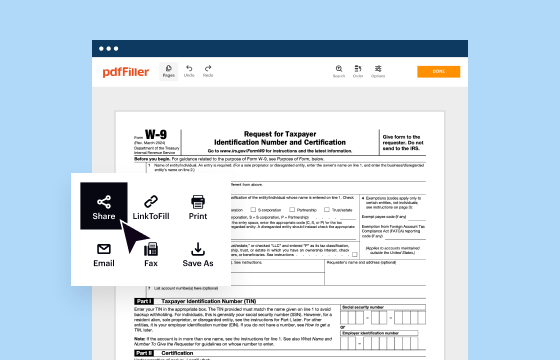

How to edit OH IT 1040

How to fill out OH IT 1040

Instructions and Help about OH IT 1040

How to edit OH IT 1040

To edit the OH IT 1040 tax form, utilize a PDF editing tool that allows you to modify text and fields directly. Ensure that any changes made are within the legal guidelines set by the Ohio Department of Taxation. After editing, save the modified document in a secure format for safe storage and future reference.

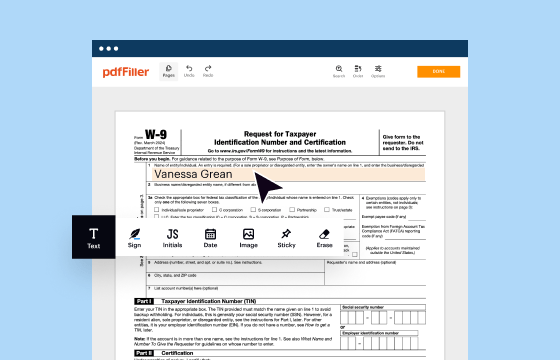

How to fill out OH IT 1040

Filling out the OH IT 1040 requires attention to detail and accuracy. Follow these steps:

01

Obtain the latest version of the OH IT 1040 form from the Ohio Department of Taxation website or authorized providers.

02

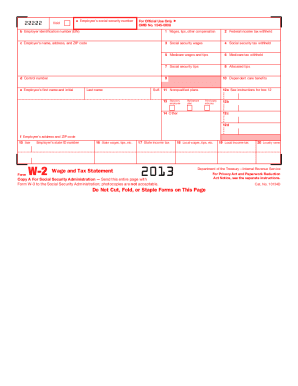

Gather necessary documentation such as W-2 forms, 1099 statements, and any other pertinent financial records.

03

Complete the required sections of the form, ensuring all information is accurate and corresponds to your tax records.

04

Review the form to ensure completeness, and sign where indicated before submission.

About OH IT previous version

What is OH IT 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH IT previous version

What is OH IT 1040?

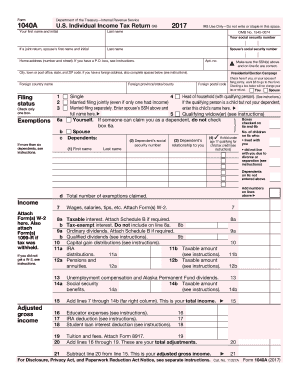

The OH IT 1040 is the tax form utilized by residents of Ohio for filing individual income taxes. It is specifically designed for reporting income, calculating tax liability, and claiming any applicable deductions or credits.

What is the purpose of this form?

The purpose of the OH IT 1040 is to enable individuals in Ohio to accurately report their income and determine their state tax obligations. It ensures compliance with Ohio tax laws and facilitates the proper assessment of personal income tax.

Who needs the form?

Individuals who are residents of Ohio and have earned income during the tax year must file the OH IT 1040. This includes employed individuals, self-employed persons, and those with any reportable income, including unemployment benefits or investment earnings.

When am I exempt from filling out this form?

You may be exempt from filling out the OH IT 1040 if your income falls below the filing threshold set by the state of Ohio. Additionally, certain individuals, such as those who qualify for specific deductions or tax credits, may not need to file if their tax liability is zero.

Components of the form

The OH IT 1040 consists of several key components:

01

Personal information section, which includes name, address, and Social Security number.

02

Income reporting section, where you disclose various sources of income.

03

Tax calculation section, used for determining total tax due or refundable credits.

04

Signature section, where you must sign and date the form after completing it.

What are the penalties for not issuing the form?

Failure to submit the OH IT 1040 by the tax deadline may result in penalties, including fines and interest on unpaid taxes. Additionally, the Ohio Department of Taxation may take action to collect any delinquent taxes owed.

What information do you need when you file the form?

When filing the OH IT 1040, prepare the following information:

01

Your total income for the tax year, including wages and other earnings.

02

Documentation regarding any tax credits or deductions you plan to claim.

03

Your Social Security number and that of any dependents.

04

Your bank information for direct deposit of any refund.

Is the form accompanied by other forms?

The OH IT 1040 may require accompanying schedules or additional forms if you are claiming specific deductions or credits. Review the instruction booklet for the OH IT 1040 for details on additional forms that may be required based on your financial situation.

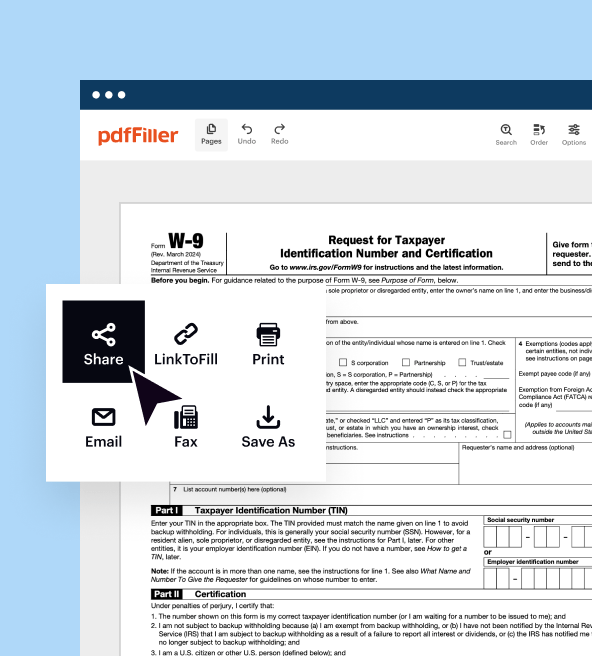

Where do I send the form?

The completed OH IT 1040 form should be mailed to the appropriate address based on your county of residence within Ohio. Refer to the Ohio Department of Taxation's website for the most accurate mailing information, as it varies depending on the method of payment and the specific tax situation.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

love learning everything. Problem with sending multiple pages in one email to have signed. Problems with getting the signature from the recepient because the codes don't work consistently.

I am selling my own piece of real estate and this has been awesome for the necessary forms.

See what our users say