Get the free Affidavit of Collection - Minnesota Judicial Branch - mncourts

Show details

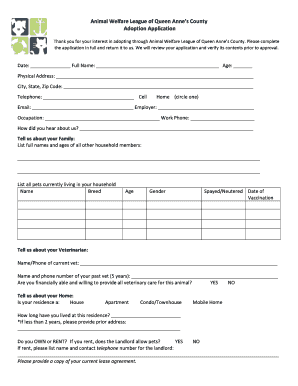

Affidavit for Collection of Personal Property Use this form and instructions only if the following factors apply to your situation: You are related to a person who died, or you have a legal interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit of collection

Edit your affidavit of collection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of collection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing affidavit of collection online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit affidavit of collection. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit of collection

How to fill out affidavit of collection:

01

Begin by obtaining the necessary affidavit of collection form. This form can usually be obtained from the probate court or the office of the county clerk.

02

Fill in your personal information, including your full name, address, and contact details. Make sure to provide accurate information to ensure the affidavit is valid.

03

Specify the details of the deceased individual, including their full name, date of birth, and date of death. Include any relevant identification or reference numbers, such as their social security number or driver's license number.

04

Provide a comprehensive list of all the assets that are included in the estate. This may include real estate properties, bank accounts, investment accounts, valuable possessions, and any outstanding debts owed to the deceased.

05

Include the estimated value of each asset, as well as any outstanding debts or liabilities associated with them. It is important to be as detailed and accurate as possible to ensure the proper distribution of the estate.

06

Sign and date the affidavit in the presence of a notary public. The notary public will then verify your identity and sign the document, officially acknowledging your signature.

07

Submit the completed affidavit of collection to the appropriate authority, such as the probate court or the office of the county clerk. Follow their instructions regarding any additional documents or fees that may be required.

Who needs affidavit of collection?

01

Executors or administrators of an estate may need an affidavit of collection to facilitate the distribution of assets to beneficiaries.

02

Family members or beneficiaries who are entitled to receive inheritances may need an affidavit of collection to provide proof of their entitlement.

03

Individuals or entities who are owed debts by the deceased may need an affidavit of collection to make a claim against the estate.

04

Any party involved in the probate process may require an affidavit of collection to satisfy legal requirements and ensure proper asset distribution.

Fill

form

: Try Risk Free

People Also Ask about

What is the statute for small estate affidavit in Minnesota?

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

What is the limit for a small estate affidavit in Minnesota?

This process is used in Minnesota to avoid probate court if the value of the estate is no greater than $75,000.

What is an affidavit for transfer without probate in Minnesota?

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

What is an affidavit of collection for small estate in Minnesota?

An affidavit for collection is a procedure that transfers assets of estates that would otherwise be probated and that have a net value of under $75,000. With the affidavit, there is no court appearance, no personal representative appointed, and no mailed notification to interested parties.

How do I fill out a small estate affidavit in MN?

How to Write (1) Name Of Minnesota Deceased. (2) County Of Minnesota Deceased. (3) Name of Minnesota Petitioner. (4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death. (6) Basis For Minnesota Petitioner Claim. (7) Minnesota Decedent Estate Assets. (8) Signature Date Of Minnesota Petitioner.

What is the small estate statute in Minnesota?

Requirements of small estate exemption in Minnesota First, the total value of the estate must be less than $75,000. That number is calculated by taking all the money, assets and real estate the decedent owned, minus debts, such as medical bills and mortgages on a house.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find affidavit of collection?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the affidavit of collection. Open it immediately and start altering it with sophisticated capabilities.

How do I execute affidavit of collection online?

pdfFiller has made filling out and eSigning affidavit of collection easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the affidavit of collection in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your affidavit of collection in seconds.

What is affidavit of collection?

It is a legal document used to collect debts or assets from a deceased person's estate.

Who is required to file affidavit of collection?

The person or entity who is entitled to collect debts or assets from a deceased person's estate.

How to fill out affidavit of collection?

You need to provide information about the deceased person, details of the debts or assets being collected, and your relationship to the deceased.

What is the purpose of affidavit of collection?

The purpose is to ensure that the debts or assets of a deceased person are properly collected and distributed to the rightful beneficiaries.

What information must be reported on affidavit of collection?

Details of the deceased person, the debts or assets being collected, and the relationship of the filer to the deceased.

Fill out your affidavit of collection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of Collection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.