Get the free Forms and Schedules for tax year 2013 AL - Alabama - Intuit

Show details

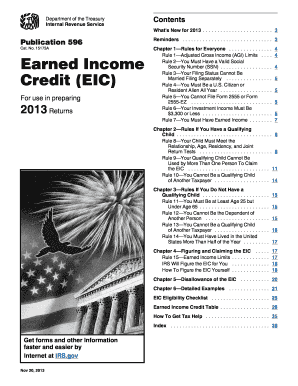

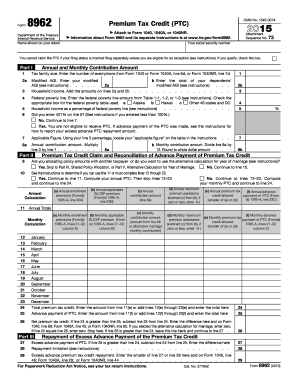

Forms and Schedules for tax year 2013 AL - Alabama The following forms and schedules are supported in the ProSeries Tax program for the state of Alabama. Corporate 20C Sch BC 20C-CRE Sch G 2848A BIT-V CPT Sch AL-CAR Sch BPT-IN BPT-V AL8453-C Corporate Income Tax Return AL Business Credits Election to File Consolidated Return AL Bus Privilege Tax-Financial Inst Group Comp Sch Power of Attorney Dec of Representative Business Income Tax Payment Vouc...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forms and schedules for

Edit your forms and schedules for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forms and schedules for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing forms and schedules for online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit forms and schedules for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forms and schedules for

01

To fill out forms and schedules, start by gathering all necessary information and documents. This can include personal details, identification numbers, financial records, and any other relevant data.

02

Carefully review the instructions provided with the form or schedule to understand the required information and format. Pay attention to any specific guidelines or documentation that may be required.

03

Begin filling out the form or schedule by entering the requested information accurately and legibly. Use black or blue ink if filling out a printed form. If filling out an online form, ensure that all required fields are completed.

04

Follow the provided format or layout while entering data. For instance, if a schedule requires dates or times, input them consistently using the specified format, such as MM/DD/YYYY or HH:MM AM/PM.

05

Double-check the completed form or schedule for any mistakes, missing information, or inconsistencies. Make sure to review all sections thoroughly, including any additional pages or attachments.

06

If applicable, provide any supporting documents or evidence as required. These might include receipts, contracts, proofs of income, or any other relevant paperwork that substantiates the information provided.

07

Before submitting the completed form or schedule, make a copy for your records. This ensures that you have a backup and can refer to it if needed in the future.

08

Forms and schedules are needed by various individuals and organizations. Some common examples include employees filing tax forms, businesses completing financial statements, students registering for courses, individuals applying for government benefits or permits, and many more. Forms and schedules are essential for legal compliance, record-keeping, organizational purposes, and to facilitate efficient communication and transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit forms and schedules for from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your forms and schedules for into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete forms and schedules for online?

pdfFiller has made it simple to fill out and eSign forms and schedules for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out forms and schedules for on an Android device?

Use the pdfFiller app for Android to finish your forms and schedules for. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is forms and schedules for?

Forms and schedules are used to report income, deductions, credits, and other relevant information to the IRS for tax purposes.

Who is required to file forms and schedules for?

Individuals, businesses, and organizations that have income or expenses that need to be reported to the IRS are required to file forms and schedules.

How to fill out forms and schedules for?

Forms and schedules can be filled out manually or electronically, following the instructions provided by the IRS for each specific form.

What is the purpose of forms and schedules for?

The purpose of forms and schedules is to accurately report financial information to the IRS in order to calculate tax liability or eligibility for tax credits.

What information must be reported on forms and schedules for?

Forms and schedules typically require information such as income, expenses, deductions, credits, and other financial details.

Fill out your forms and schedules for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forms And Schedules For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.