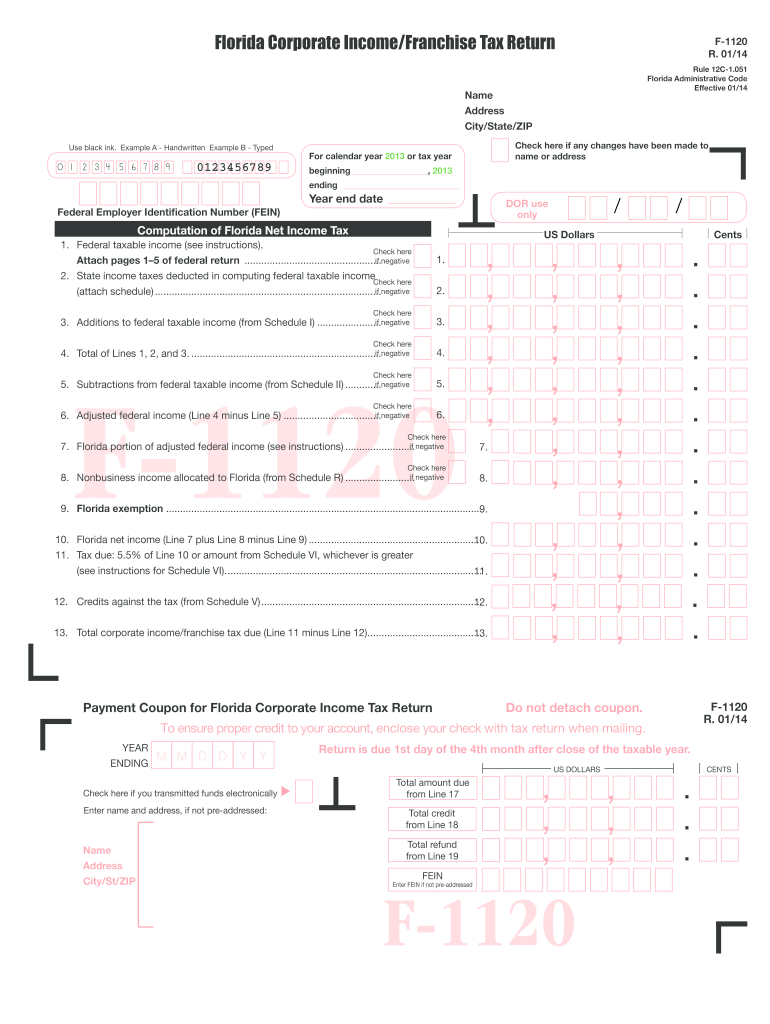

Who needs F-1120 Form?

Form F-1120 is the Florida Corporate Income/Tax Franchise Return that is to be submitted by all corporations (including tax-exempt organizations) doing business, earning income, or existing in Florida.

What is the purpose of the Florida F-1120 form?

The Corporate Income/Tax Franchise Return form is used to report the income the eligible corporations and business entities make operating in the State of Florida, so that the proper amount of taxes can be withdrawn.

Is the F-1120 Form accompanied by any other forms?

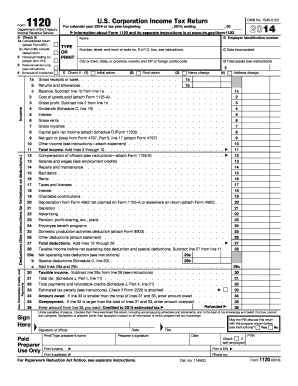

While filing the F-1120 form with the Florida Department of Revenue, there is one obligatory form that must accompany the tax return report, which is a copy of the actual federal income tax return that is submitted with the IRS. According to the instructions about the f-1120 form located here: http://dor.myflorida.com/Forms_library/current/f1120n.pdf, there is a list of other attachments that might be required too:

A copy of federal form 4562 (Depreciation and Amortization);

A copy of form 851 or F-851;

Form 1122 and 1125-A;

Form 4626;

Schedule D;

Schedule M-3, etc.

When is the Florida Corporate Income/Tax Franchise Return due?

-

The F-1120 form must be filed on or prior to the first day of the fourth month after the close of the tax year. Therefore, typically, the deadline falls on April 1, unless it is a day off. If April 1 is not a business day, the deadline is postponed until the following business day.

How to fill out the F-1120 Form?

Even though the Florida Corporate Income/Tax Franchise Return is a rather lengthy form demanding much attention to detail, it is not that complicated to fill out, as there is comprehensive instructions accompanying the form. More useful instructions can also be found here: http://dor.myflorida.com/Forms_library/current/f1120n.pdf.

Where to send Florida Form F-1120?

The filled out F-1120 and the payment of the taxes due by check must be directed to the Florida Department of Revenue, at their address: 5050 W Tennessee St Tallahassee FL.