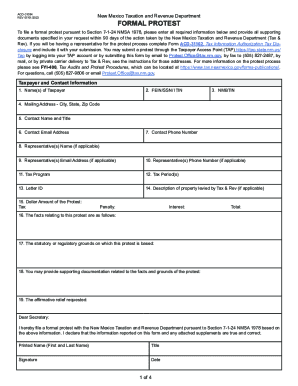

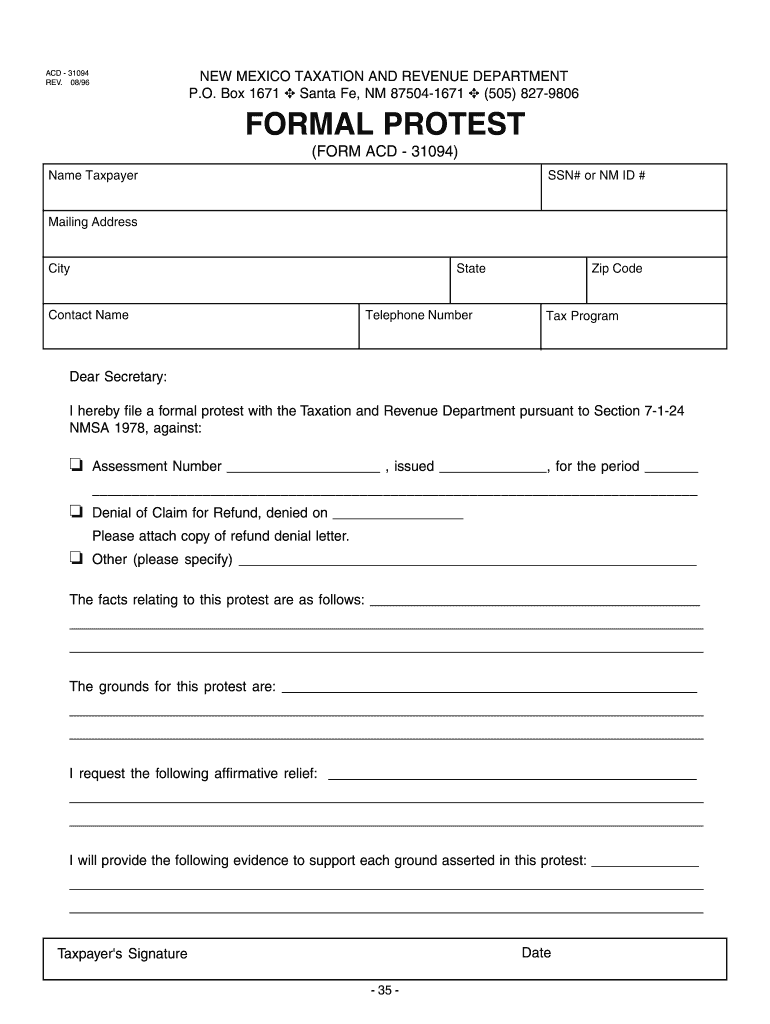

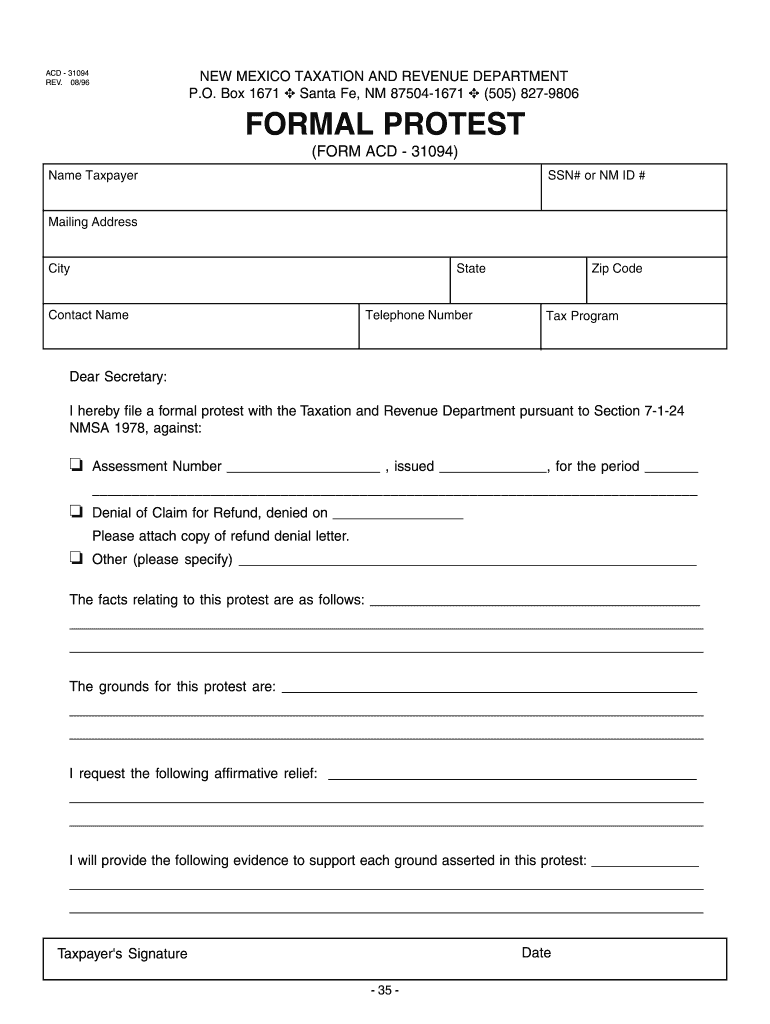

NM ACD-31094 1996 free printable template

Show details

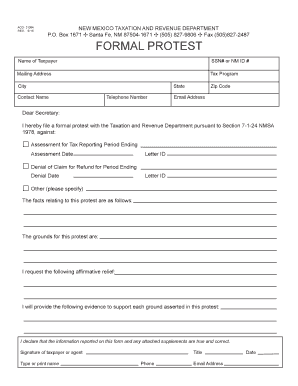

Taxpayer's Signature. Date. Dear Secretary: I hereby file a formal protest with the Taxation and Revenue Department pursuant to Section 7-1-24. NASA 1978 ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM ACD-31094

Edit your NM ACD-31094 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM ACD-31094 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM ACD-31094 online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NM ACD-31094. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM ACD-31094 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM ACD-31094

How to fill out NM ACD-31094

01

Obtain the NM ACD-31094 form from the official website or local tax office.

02

Fill in your name and contact information in the designated fields.

03

Provide accurate details about your business, including the type and location.

04

Enter the relevant tax identification numbers as required.

05

Complete the sections regarding income and expenses, ensuring all figures are accurate.

06

Review the form for completeness and accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form through the specified method (mail or online).

Who needs NM ACD-31094?

01

Individuals or businesses in New Mexico that are required to report or pay specific taxes.

02

Tax professionals who assist clients with their tax obligations.

03

New businesses seeking to comply with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Are the new tax forms available?

Need Products to Complete Your 2022 Tax Return? You can place your order here for tax forms, instructions and publications. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2023.

Where can I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

Where to get New Mexico State Tax Forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

What is New Mexico tax power of attorney Form ACD 31102?

New Mexico Tax Power of Attorney (Form ACD-31102), otherwise known as the “Taxation and Revenue Department Tax Information Authorization,” is a form used to appoint someone, usually a tax attorney or accountant, to represent your tax-related affairs.

Who is exempt from property taxes in New Mexico?

Head of Household Exemption Widow or Widower; Head of Household furnishing more than one half the cost of support of any related person; or. A single person; and. Must be the primary property owner residing in the State of New Mexico.

At what age do seniors stop paying property taxes in New Mexico?

All New Mexico seniors at least 65 years old may claim a special exemption.

How do I dispute property taxes in New Mexico?

A taxpayer must submit a protest in writing, being sure to identify the tax or taxes involved and to state the grounds for the protest and the relief desired. You must include a summary of the evidence that you intend to produce to support your position.

What is a tax power of attorney in New Mexico?

A New Mexico tax power of attorney (Form ACD-31102) is a form that gives a taxpayer authority to select up to two (2) representatives the power to handle tax matters on their behalf before the New Mexico Taxation and Revenue Department (TRD).

Is there a New Mexico state tax form?

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

What is a power of attorney for finances in New Mexico?

A New Mexico durable statutory power of attorney form lets a person (“principal”) choose someone else (“agent”) to handle their financial decisions and affairs during their life. The agent selected is commonly a spouse or family member that is also included as a beneficiary in the principal's last will and testament.

What is the power of attorney form for tax in New Mexico?

New Mexico Tax Power of Attorney (Form ACD-31102), otherwise known as the “Taxation and Revenue Department Tax Information Authorization,” is a form used to appoint someone, usually a tax attorney or accountant, to represent your tax-related affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NM ACD-31094 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NM ACD-31094 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out NM ACD-31094 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NM ACD-31094. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out NM ACD-31094 on an Android device?

Complete your NM ACD-31094 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NM ACD-31094?

NM ACD-31094 is a tax form used in New Mexico for reporting certain financial and tax-related information.

Who is required to file NM ACD-31094?

Individuals and businesses that meet specific criteria related to income, investments, or certain tax deductions may be required to file NM ACD-31094.

How to fill out NM ACD-31094?

To fill out NM ACD-31094, you should follow the instructions provided with the form, ensuring that all relevant information is accurately completed and any necessary documentation is attached.

What is the purpose of NM ACD-31094?

The purpose of NM ACD-31094 is to gather financial information from individuals or businesses to ensure compliance with New Mexico tax regulations.

What information must be reported on NM ACD-31094?

NM ACD-31094 requires reporting of income, deductions, credits, and any other pertinent financial details as specified in the form instructions.

Fill out your NM ACD-31094 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM ACD-31094 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.