NM ACD-31094 2015 free printable template

Show details

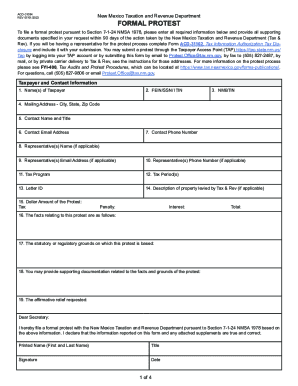

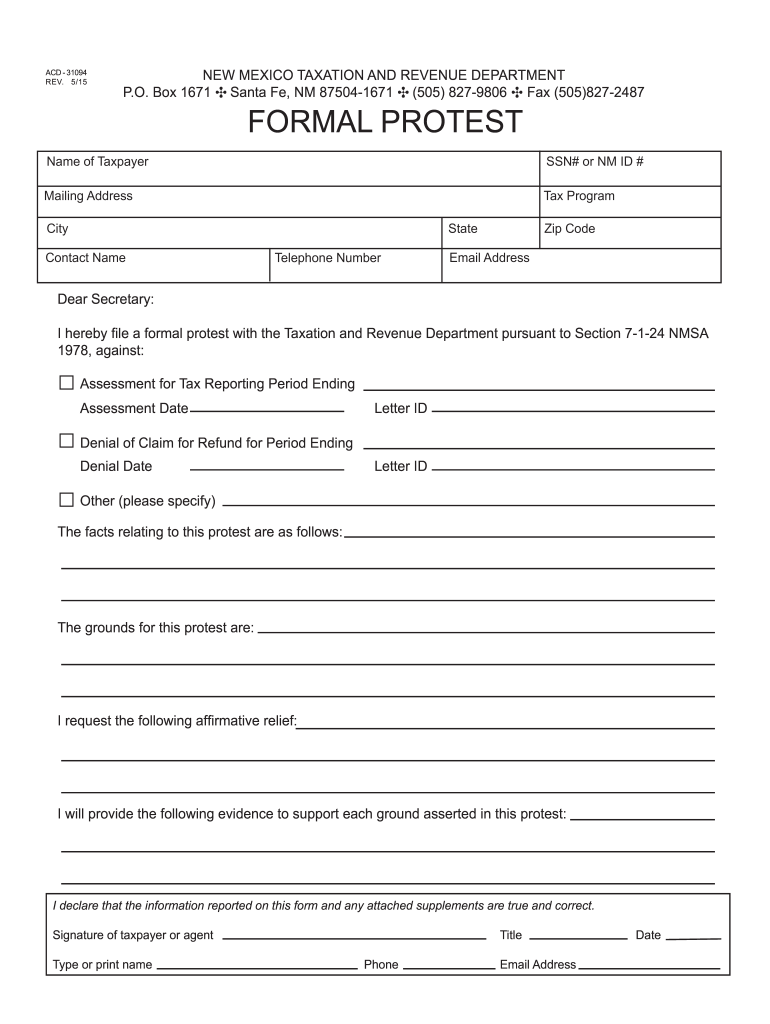

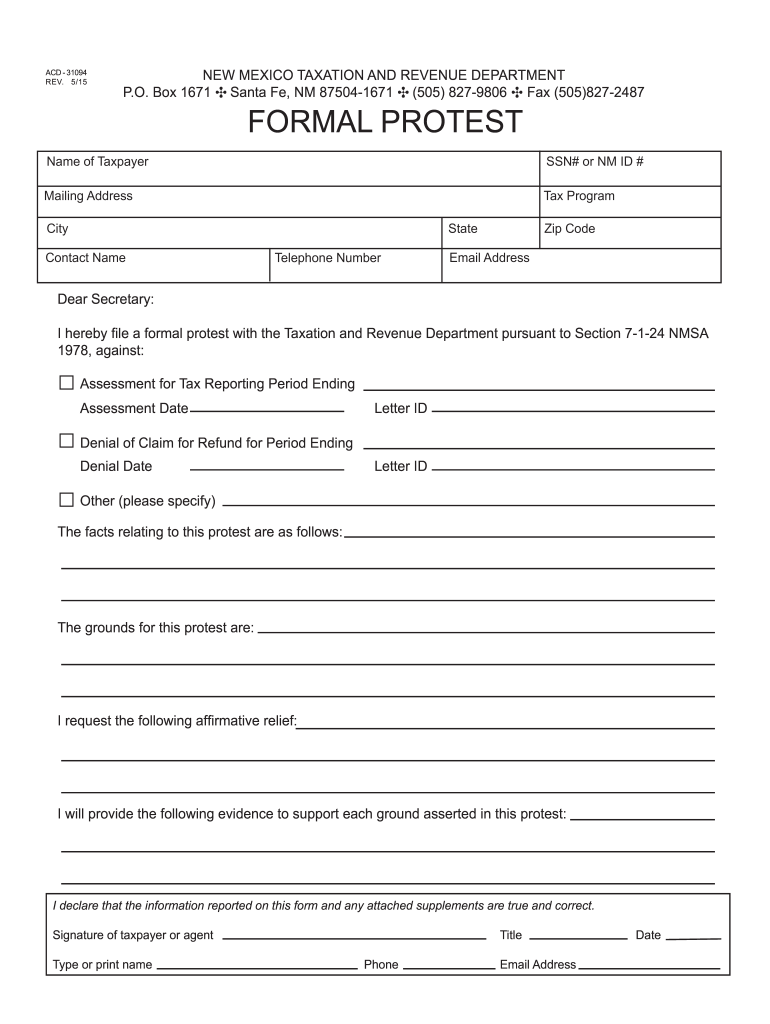

ACD - 31094 REV. 5/15 NEW MEXICO TAXATION AND REVENUE DEPARTMENT P. O. Box 1671 C Santa Fe NM 87504-1671 C 505 827-9806 C Fax 505 827-2487 FORMAL PROTEST Name of Taxpayer SSN or NM ID Mailing Address Tax Program City State Contact Name Telephone Number Zip Code Email Address Dear Secretary I hereby file a formal protest with the Taxation and Revenue Department pursuant to Section 7-1-24 NMSA 1978 against Assessment for Tax Reporting Period Ending Assessment Date Letter ID Denial Date Denial...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM ACD-31094

Edit your NM ACD-31094 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM ACD-31094 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM ACD-31094 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NM ACD-31094. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM ACD-31094 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM ACD-31094

How to fill out NM ACD-31094

01

Start by obtaining the NM ACD-31094 form from the New Mexico Taxation and Revenue Department website or office.

02

Fill in your full name and address at the top of the form.

03

Provide your Social Security Number or Employer Identification Number as required.

04

Indicate the type of tax or license you are applying for in the designated section.

05

Complete the relevant financial information as requested in the form, ensuring accuracy.

06

Review the instructions carefully for any additional details specific to your application.

07

Sign and date the form at the end before submitting it.

Who needs NM ACD-31094?

01

Individuals or businesses in New Mexico who are required to report or remit taxes.

02

Tax professionals assisting clients with tax obligations in New Mexico.

03

Anyone applying for an assessment or license specified on the NM ACD-31094.

Fill

form

: Try Risk Free

People Also Ask about

Why is my NM State refund taking so long?

If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return. Your return was missing information or incomplete.

At what age do seniors stop paying property taxes in New Mexico?

All New Mexico seniors at least 65 years old may claim a special exemption.

How do I dispute property taxes in New Mexico?

A taxpayer must submit a protest in writing, being sure to identify the tax or taxes involved and to state the grounds for the protest and the relief desired. You must include a summary of the evidence that you intend to produce to support your position.

When can I expect my NM state tax refund?

Electronically filed returns claiming a refund are processed within 6 to 8 weeks. For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

How long are NM state tax refunds taking?

Electronically filed returns claiming a refund are processed within 6 to 8 weeks. For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

Why are NM tax refunds taking so long?

A number of things could cause a refund delay, including the following: If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return.

How long does it take to get New Mexico state tax refund?

The Department generally processes electronically filed returns claiming a refund within 6 to 8 weeks. A paper return received by the Department takes 8 to 12 weeks to process.

What is New Mexico tax power of attorney form ACD 31102?

New Mexico Tax Power of Attorney (Form ACD-31102), otherwise known as the “Taxation and Revenue Department Tax Information Authorization,” is a form used to appoint someone, usually a tax attorney or accountant, to represent your tax-related affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NM ACD-31094 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your NM ACD-31094 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get NM ACD-31094?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NM ACD-31094 and other forms. Find the template you need and change it using powerful tools.

Can I edit NM ACD-31094 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NM ACD-31094 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NM ACD-31094?

NM ACD-31094 is a form used in New Mexico for reporting and remitting sales and use taxes.

Who is required to file NM ACD-31094?

Businesses and individuals in New Mexico who collect sales or use tax on taxable transactions are required to file NM ACD-31094.

How to fill out NM ACD-31094?

To fill out NM ACD-31094, you must provide your taxpayer identification details, report total sales, calculate the amount of tax due, and include any deductions or exemptions.

What is the purpose of NM ACD-31094?

The purpose of NM ACD-31094 is to ensure accurate reporting and payment of sales and use taxes to the New Mexico Department of Taxation and Revenue.

What information must be reported on NM ACD-31094?

Information that must be reported on NM ACD-31094 includes gross receipts, taxable sales, exemptions claimed, and total tax due.

Fill out your NM ACD-31094 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM ACD-31094 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.