HI DoT N-139 2013 free printable template

Show details

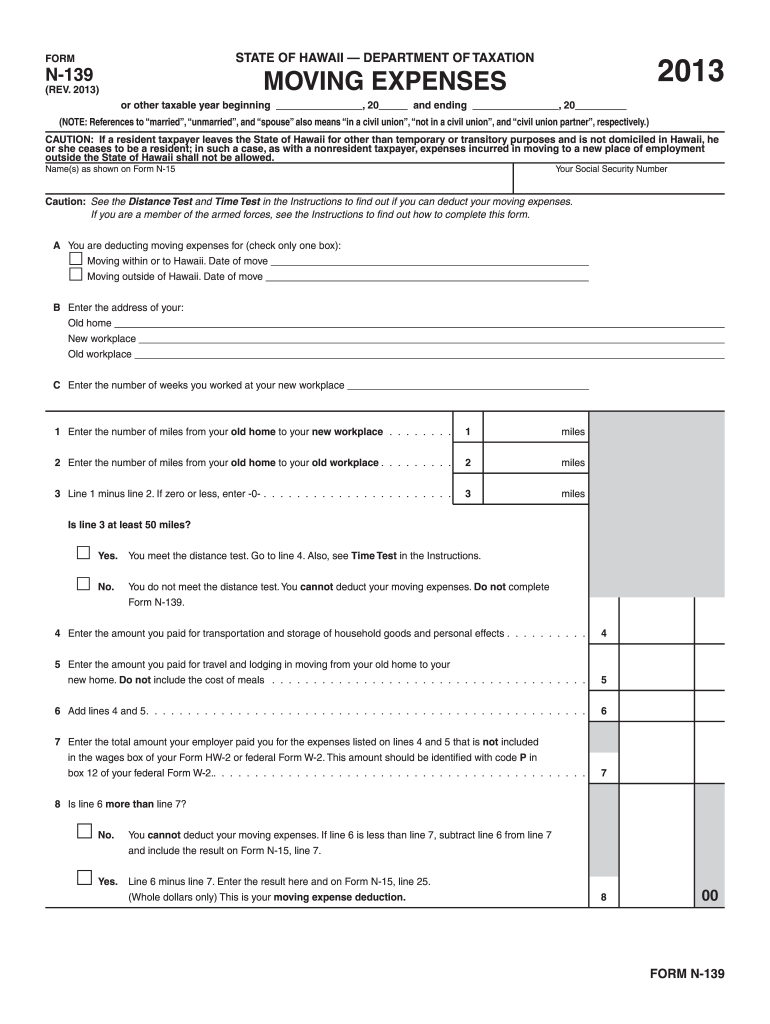

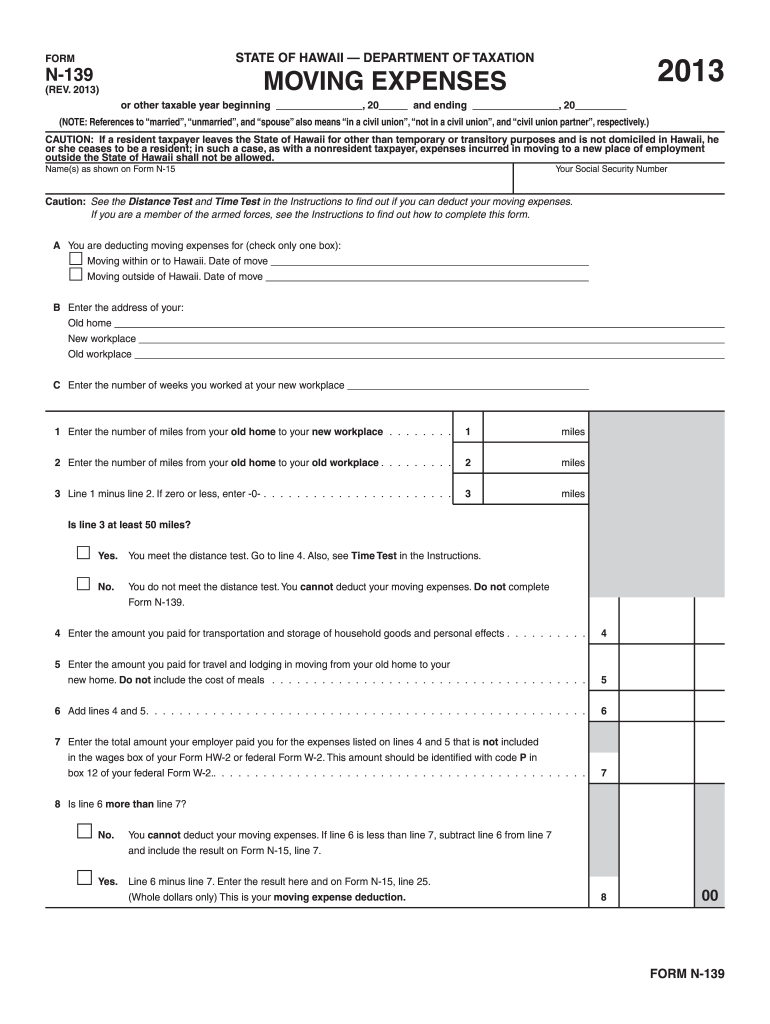

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-139 2013 MOVING EXPENSES (REV. 2013) or other taxable year beginning, 20 and ending, 20 (NOTE: References to married, unmarried, and spouse

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form n-139 rev 2013

Edit your form n-139 rev 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-139 rev 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form n-139 rev 2013 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form n-139 rev 2013. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-139 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form n-139 rev 2013

How to fill out HI DoT N-139

01

Begin by downloading the HI DoT N-139 form from the official website.

02

Provide your personal information, including your full name, address, and contact details in the designated fields.

03

Fill in the information regarding your vehicle, including make, model, and vehicle identification number (VIN).

04

Complete the section on the purpose of the application, specifying the reason for submitting the form.

05

Review the form for any errors or missing information.

06

Sign and date the document to certify that all information provided is accurate.

07

Submit the completed form to the appropriate Department of Transportation office or via the designated submission method.

Who needs HI DoT N-139?

01

Individuals or businesses seeking to register a vehicle in Hawaii.

02

People applying for a title transfer for a vehicle.

03

Anyone updating information regarding their registered vehicle.

Fill

form

: Try Risk Free

People Also Ask about

What do you need to qualify for the moving expense deduction?

Moving expenses tax deduction – current requirements Active-duty military member, and you permanently move to a new base pursuant to a military order. The dependent or spouse of a military member who moves to a new base. The spouse or dependent of a military member that died, was imprisoned or deserted.

Are reimbursed moving expenses considered income?

So, to answer the question, are relocation expenses taxable, the answer is yes. Moving expenses, including lump sum payments, are considered taxable income, which means the employee is responsible for paying both federal and state (if applicable) income tax on the amount.

How do I report moving expense reimbursement?

Form 3903 can be completed for the amount of moving expenses paid by the taxpayer. If a moving expense deduction is computed, it will be reported on Schedule 1 (Form 1040) Additional Income and Adjustments to Income, on Line 14.

How do I report reimbursed moving expenses?

Shipping and storage costs for packing and moving your household goods and personal effects go on line 1 of Form 3903. Travel, lodging, and gas costs go on line 2. Reimbursements from your employer for any moving expenses are reported on line 4.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

What is a form N 139?

Use Form N-139 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form n-139 rev 2013 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form n-139 rev 2013 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my form n-139 rev 2013 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form n-139 rev 2013 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete form n-139 rev 2013 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your form n-139 rev 2013. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is HI DoT N-139?

HI DoT N-139 is a form used by the Hawaii Department of Transportation for reporting certain transportation-related information.

Who is required to file HI DoT N-139?

Individuals or entities involved in specific transportation activities or operations that require reporting to the Hawaii Department of Transportation must file HI DoT N-139.

How to fill out HI DoT N-139?

To fill out HI DoT N-139, provide accurate information as required on the form, including details about the transportation operations and other relevant data, and submit it to the appropriate department.

What is the purpose of HI DoT N-139?

The purpose of HI DoT N-139 is to collect data and information necessary for the regulation and oversight of transportation activities in Hawaii.

What information must be reported on HI DoT N-139?

Information that must be reported on HI DoT N-139 typically includes details about the type of transportation activities, vehicle information, dates of operation, and any other specific data required by the form.

Fill out your form n-139 rev 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-139 Rev 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.