HI DoT N-139 2021 free printable template

Show details

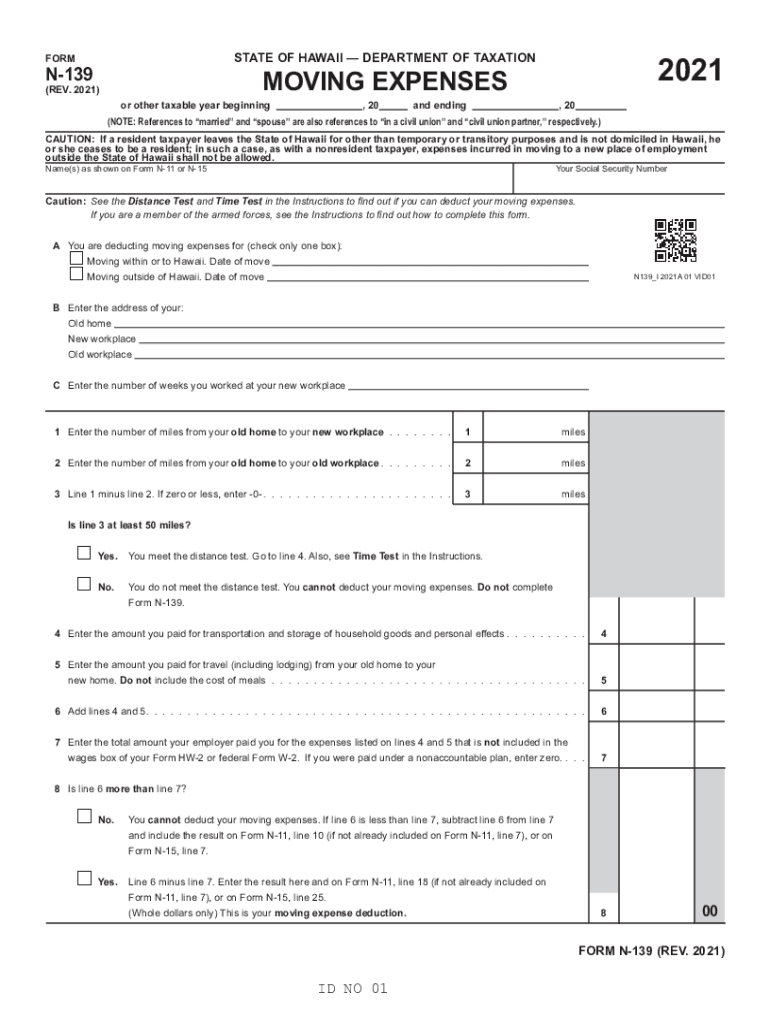

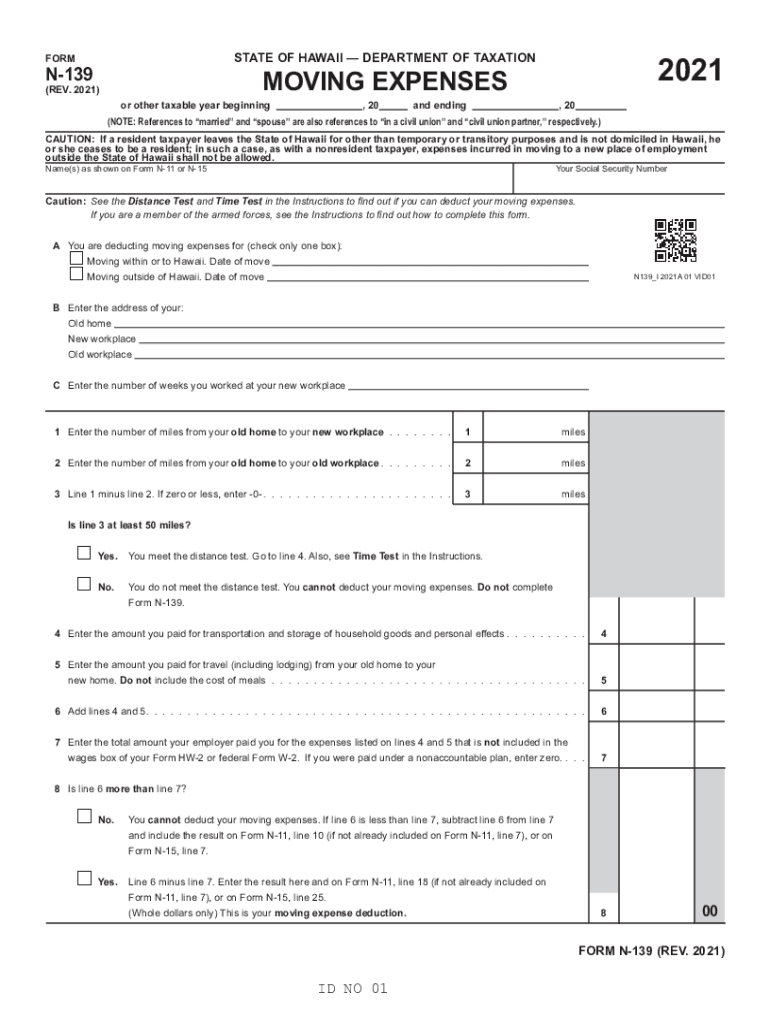

Clear Form2021STATE OF HAWAII DEPARTMENT OF TAXATIONFORMN139MOVING EXPENSES(REV. 2021)or other taxable year beginning, 20and ending, 20(NOTE: References to married and spouse are also references to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii form n 139

Edit your hawaii form n 139 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii form n 139 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hawaii form n 139 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hawaii form n 139. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-139 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hawaii form n 139

How to fill out HI DoT N-139

01

Begin by downloading the HI DoT N-139 form from the official website.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Provide the required information regarding your vehicle, including make, model, and year.

04

Enter any additional details as requested in the form, such as previous ownership or title information.

05

Review your entries for accuracy, ensuring all required fields are completed.

06

Sign and date the form at the bottom.

07

Submit the completed form as directed, either online, by mail, or in person.

Who needs HI DoT N-139?

01

Individuals who are registering a vehicle in Hawaii for the first time.

02

Those who have recently moved to Hawaii and need to update their vehicle registration.

03

Owners of vehicles that have undergone a title change or ownership transfer.

Fill

form

: Try Risk Free

People Also Ask about

Is Southwest the best airline?

They are a favorite among travelers looking for cheap flights without having to compromise on comfort or security. ing to the most recent list of the world's safest airlines, Southwest was ranked in the top 15 airlines in the world in 2021, even beating out Delta, American, and United.

Why did Southwest cancel flights to Hawaii?

HILO (HawaiiNewsNow) - The eruption of Mauna Loa prompted Southwest Airlines to cancel most of its flights in and out of Hilo on Monday but rival Hawaiian Airlines kept flying.

Is Hawaiian Airlines good?

Hawaiian Airlines was named the world's best domestic airline for 2022 by Travel + Leisure. I've flown with them for years, and I've always had positive experiences with the staff. I love that the carrier uses local vendors and provides free snacks on even the shortest flights.

Which spouse can claim moving expenses?

Yes, because at that time you were still in the common-law relationship > you can claim the full amount of moving expenses regardless of who paid it > because if it wasn't for your new job, you and your partner wouldn't have moved.

What is Hawaiian Airlines known for?

Awards & Recognition. Now with over 90 years of continuous service, Hawaiian Airlines is Hawaii's biggest and longest-serving airline. Hawaiian Airlines has led all U.S. carriers in on-time performance for each year since 2004, as reported by the U.S. DOT.

Which is better Hawaiian Airlines or Southwest?

If service onboard is important to you, choose Southwest. If you are flying in the next year and want WiFi, choose Southwest. If you are flying in the next year and want USB charging, choose Hawaiian. If you want premium options like first class or paid, extended legroom in economy, choose Hawaiian.

Which of the expenses do not qualify as an allowable moving expense?

money spent fixing up your old home before putting it up for sale. any losses from the sale of your home. the cost of default mortgage insurance. costs incurred in the sale of your old home if you delayed selling for investment purposes or until the real estate market improved.

Which airline is best to Hawaii?

The 6 Best Airlines That Fly to Hawaii Hawaiian Airlines. Fittingly, Hawaiian Airlines offers some of the best flights to Hawaii, providing daily service to Hawaii from more North American cities than any other airline. Alaska Airlines. American Airlines. United Airlines. Allegiant. WestJet.

Are moving expenses tax deductible 2022?

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

What is best airline to Hawaii?

The 6 Best Airlines That Fly to Hawaii Hawaiian Airlines. Fittingly, Hawaiian Airlines offers some of the best flights to Hawaii, providing daily service to Hawaii from more North American cities than any other airline. Alaska Airlines. American Airlines. United Airlines. Allegiant. WestJet.

What can be claimed as moving expenses?

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

Does Hawaii allow you to deduct moving expenses?

You can deduct the reasonable expenses of moving your household goods and personal effects and of traveling from your old home to your new home. Reasonable expenses can include the cost of lodging (but not meals) while traveling to your new home.

Why are moving expenses no longer deductible?

Since the Tax Cuts and Jobs Act (TCJA) was passed in 2017 by President Trump, many people are no longer able to deduct moving expenses on their federal taxes. TCJA makes it simple – If you moved after 2018 and are not an active member of the Military or Armed Forces, you cannot deduct moving expenses.

Can you claim any moving expenses on taxes?

General rule for moving-related expenses. The general rule is that a taxpayer can claim reasonable amounts that were paid for moving himself or herself, family members, and household effects. In all cases, the moving expenses must be deducted from employment or self-employment income earned at the new location.

Is Hawaiian Airlines a good airline?

Hawaiian Airlines has been named the world's best domestic airline.

What are qualified moving expenses?

Deductible Moving Expenses - You can deduct expenses that are reasonable for the circumstances of your move. Your eligible moving expenses include household goods, personal effects, storage and traveling expenses (including lodging) to your new home.

Which states still allow moving expense deduction?

States That Allow Moving Expense Deduction Alabama. Alaska. Arizona. Arkansas. California. Colorado. Connecticut. Delaware.

Can moving costs be tax deductible?

What Can I Claim? Moving home for a job raises the question “are my moving costs tax-deductible” the short answer is No; you cannot claim them personally. However, when you are moving due to employment the employee is able to claim tax back through an employer.

What is better Delta or Hawaiian Airlines?

#1: Hawaiian Airlines. Wallethub: Hawaiian ranked near the top in reliability and safety, and just behind Delta overall. They scored lower in comfort, canceled flights, and the number of consumer complaints. Also, they noted that Hawaiian doesn't offer now industry standard Wi-Fi.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in hawaii form n 139?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your hawaii form n 139 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the hawaii form n 139 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your hawaii form n 139 in seconds.

How do I edit hawaii form n 139 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing hawaii form n 139 right away.

What is HI DoT N-139?

HI DoT N-139 is a reporting form required by the Hawaii Department of Transportation for certain transportation-related activities.

Who is required to file HI DoT N-139?

Entities involved in specific transportation activities that meet the criteria set by the Hawaii Department of Transportation are required to file HI DoT N-139.

How to fill out HI DoT N-139?

To fill out HI DoT N-139, provide the required information clearly and accurately, following the instructions provided with the form.

What is the purpose of HI DoT N-139?

The purpose of HI DoT N-139 is to collect data and ensure compliance with state regulations regarding transportation activities.

What information must be reported on HI DoT N-139?

The information required includes details about the entity, the nature of the transportation activities, and any relevant financial or operational data as specified by the form.

Fill out your hawaii form n 139 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii Form N 139 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.