WI DoR Schedule WD 2013 free printable template

Show details

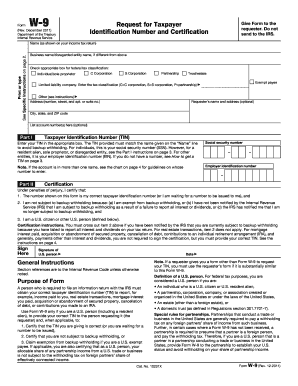

14 6 Long-term capital loss carryover from 2012 Wisconsin Schedule WD line 39. 16 on the back. 17 Go to Page 2 I-070 2013 Schedule WD Page 2 of 2 Part III Summary of Parts I and II see instructions 18 Combine lines 8 and 17 and fill in the net gain or loss here if line 18 is a loss go to line 28. Save TAB through to navigate. Use mouse to check applicable boxes press spacebar or press Enter. CAPITAL GAINS AND LOSSES Part I SCHEDULE u Enclose with your Wisconsin income tax return u Name s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR Schedule WD

Edit your WI DoR Schedule WD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR Schedule WD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR Schedule WD online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WI DoR Schedule WD. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR Schedule WD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR Schedule WD

How to fill out WI DoR Schedule WD

01

Obtain the WI DoR Schedule WD form from the Wisconsin Department of Revenue website or your tax preparation software.

02

Enter your personal information at the top of the form, including your name, address, and Social Security number.

03

Fill in your employer's name and Employer Identification Number (EIN) in the designated fields.

04

Report your total wages, salaries, tips, and other compensation in the appropriate section.

05

Indicate any tax withheld by your employer in the corresponding box.

06

Calculate the total Wisconsin income tax due, if applicable.

07

Review all entries for accuracy before submitting the form.

Who needs WI DoR Schedule WD?

01

Individuals who are Wisconsin residents or part-year residents reporting income earned in Wisconsin.

02

Employees and workers who have taxes withheld by employers in Wisconsin.

03

Self-employed individuals who need to report income earned in Wisconsin.

Instructions and Help about WI DoR Schedule WD

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate capital loss against capital gains?

To calculate your capital gain or capital loss, subtract the total of your property's adjusted cost base (ACB) , and any outlays and expenses you incurred to sell it, from the proceeds of disposition.

Do I have to pay capital gains when I sell my house in Wisconsin?

If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $250,000 gain ($500,000 if married filing a joint return). This exclusion applies if during the 5-year period ending on the date of the sale, you: Owned the home for at least 2 years (the ownership test), and.

What is a Wisconsin capital loss carryover?

The entire amount of capital loss determined for a taxable year may not always be fully deductible in such year. The amount of loss exceeding the annual limitation is treated as a "carryover" loss which may be deducted in subsequent years. Losses may be carried forward for an unlimited time, until completely used.

How are long-term capital gains taxed in Wisconsin?

Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

How do you set off capital loss against capital gains?

Long-term capital loss can be set off against long-term capital gain only. That is set-off of the long-term capital loss is not possible against other incomes. If capital loss still exists then it can be carried forward to the next financial year. Capital Loss can be carried forward to the next 8 financial years.

How do you offset capital gains tax with capital losses?

A capital loss can only offset a capital gain. However a tax loss is applied against your taxable income, this may reduce the amount of tax you have to pay to zero with a remainder loss carried forward amount. This in essence may reduce what you owe on your capital gain tax (CGT) amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WI DoR Schedule WD without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your WI DoR Schedule WD into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send WI DoR Schedule WD to be eSigned by others?

When you're ready to share your WI DoR Schedule WD, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find WI DoR Schedule WD?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the WI DoR Schedule WD in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is WI DoR Schedule WD?

WI DoR Schedule WD is a form used by the Wisconsin Department of Revenue to report withholding taxes, specifically for employers to disclose any wages paid that are subject to Wisconsin withholding tax.

Who is required to file WI DoR Schedule WD?

Employers who have withheld Wisconsin income tax from employee paychecks are required to file WI DoR Schedule WD.

How to fill out WI DoR Schedule WD?

To fill out WI DoR Schedule WD, employers should provide their business information, total wages paid, total Wisconsin income tax withheld, and any other required details as instructed on the form.

What is the purpose of WI DoR Schedule WD?

The purpose of WI DoR Schedule WD is to ensure that employers report accurate withholding amounts to the state and comply with Wisconsin tax laws.

What information must be reported on WI DoR Schedule WD?

Information that must be reported on WI DoR Schedule WD includes total wages paid, the total amount of Wisconsin income tax withheld, and the identification details of the employer.

Fill out your WI DoR Schedule WD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR Schedule WD is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.