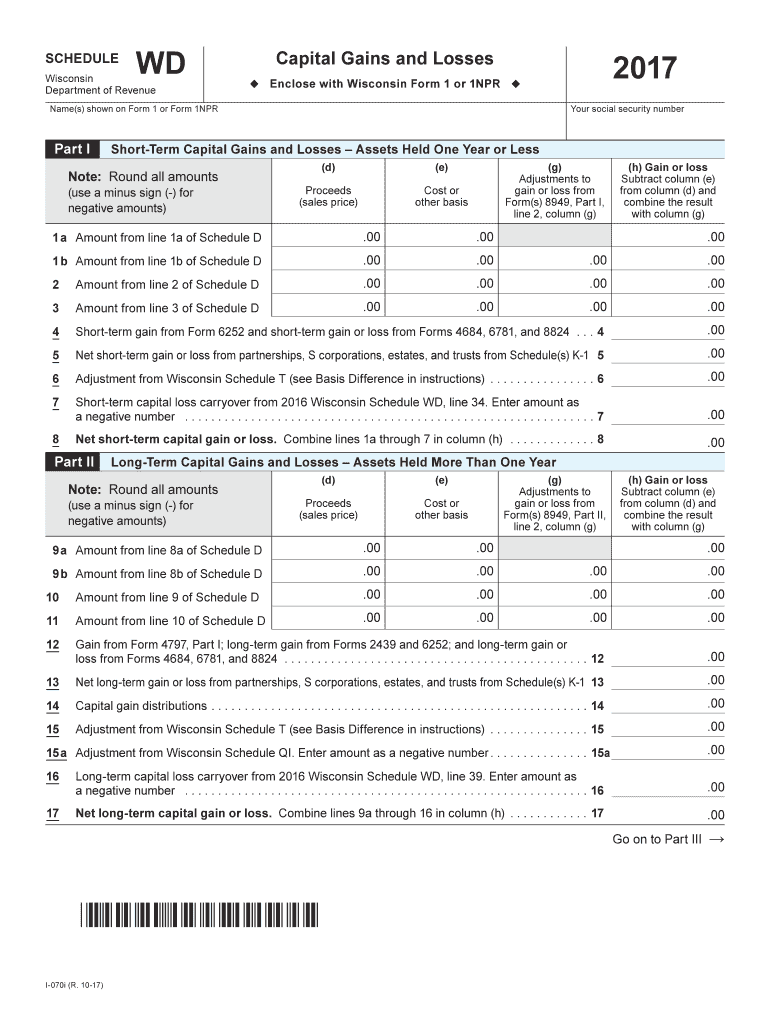

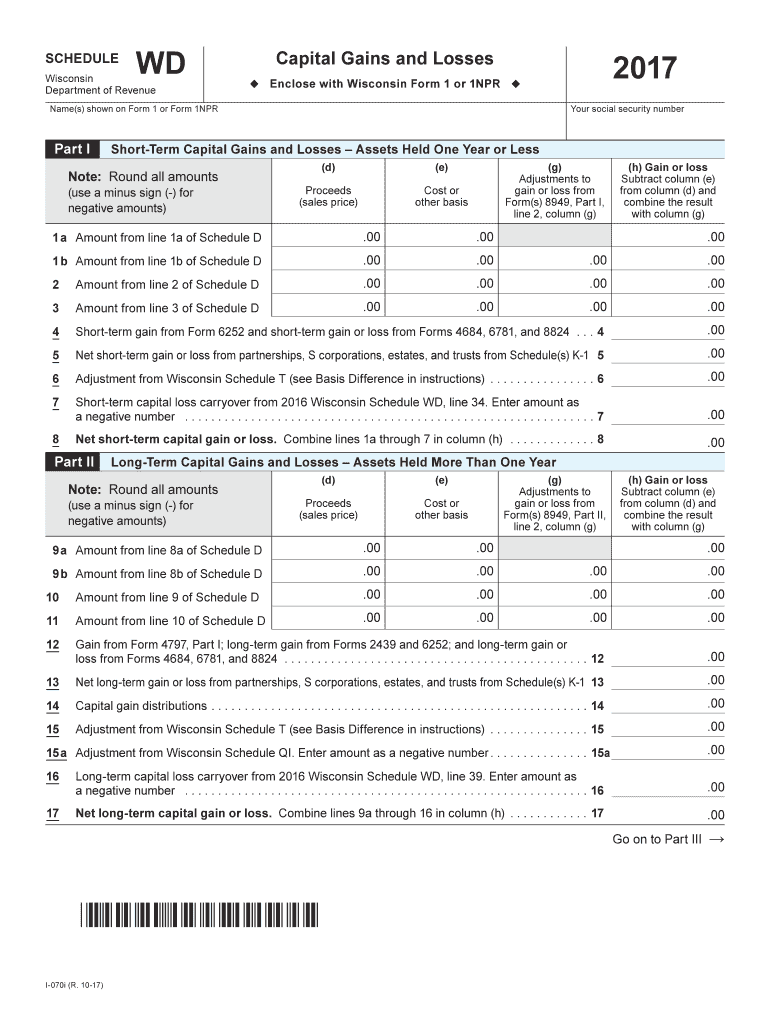

WI DoR Schedule WD 2017 free printable template

Show details

15a 16 Long-term capital loss carryover from 2016 Wisconsin Schedule WD line 39. Enter amount as Go on to Part III I-070i R. 10-17 2017 Schedule WD Name Page 2 of 2 Social Security Number Part III Summary of Parts I and II see instructions - use a minus sign - for negative amounts. 5 6 Adjustment from Wisconsin Schedule T see Basis Difference in instructions. 6 7 Short-term capital loss carryover from 2016 Wisconsin Schedule WD line 34. 20 21 Fill in the amount of long-term capital gain from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR Schedule WD

Edit your WI DoR Schedule WD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR Schedule WD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR Schedule WD online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WI DoR Schedule WD. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR Schedule WD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR Schedule WD

How to fill out WI DoR Schedule WD

01

Gather all relevant financial documents including W-2 forms, 1099 forms, and any other income documentation.

02

Obtain a copy of the WI DoR Schedule WD form from the Wisconsin Department of Revenue website or your tax professional.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your total Wisconsin income on the appropriate line.

05

Include any adjustments to income as required by Wisconsin tax regulations.

06

Complete the sections that pertain to your specific sources of income, such as wages, interest, or business income.

07

If applicable, calculate your total deductions, following the guidance provided on the form.

08

Review all entries for accuracy and ensure you've included all necessary supporting documentation.

09

Sign and date the form before submitting it, along with your Wisconsin tax return.

Who needs WI DoR Schedule WD?

01

Individuals who are filing a tax return in Wisconsin and have income that falls under the requirements specified by the Wisconsin Department of Revenue.

02

Taxpayers who have earned income from Wisconsin sources and need to report it on their state tax return.

03

Individuals claiming deductions or adjustments to income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate capital loss against capital gains?

To calculate your capital gain or capital loss, subtract the total of your property's adjusted cost base (ACB) , and any outlays and expenses you incurred to sell it, from the proceeds of disposition.

Do I have to pay capital gains when I sell my house in Wisconsin?

If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $250,000 gain ($500,000 if married filing a joint return). This exclusion applies if during the 5-year period ending on the date of the sale, you: Owned the home for at least 2 years (the ownership test), and.

What is a Wisconsin capital loss carryover?

The entire amount of capital loss determined for a taxable year may not always be fully deductible in such year. The amount of loss exceeding the annual limitation is treated as a "carryover" loss which may be deducted in subsequent years. Losses may be carried forward for an unlimited time, until completely used.

How are long-term capital gains taxed in Wisconsin?

Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

How do you set off capital loss against capital gains?

Long-term capital loss can be set off against long-term capital gain only. That is set-off of the long-term capital loss is not possible against other incomes. If capital loss still exists then it can be carried forward to the next financial year. Capital Loss can be carried forward to the next 8 financial years.

How do you offset capital gains tax with capital losses?

A capital loss can only offset a capital gain. However a tax loss is applied against your taxable income, this may reduce the amount of tax you have to pay to zero with a remainder loss carried forward amount. This in essence may reduce what you owe on your capital gain tax (CGT) amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my WI DoR Schedule WD directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your WI DoR Schedule WD and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I fill out the WI DoR Schedule WD form on my smartphone?

Use the pdfFiller mobile app to fill out and sign WI DoR Schedule WD on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit WI DoR Schedule WD on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign WI DoR Schedule WD on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is WI DoR Schedule WD?

WI DoR Schedule WD is a form used in Wisconsin to report a taxpayer's withdrawal from an entity, such as a partnership or corporation, along with other relevant ownership changes.

Who is required to file WI DoR Schedule WD?

Taxpayers who have withdrawn from a partnership, limited liability company (LLC), or corporation in Wisconsin and those who have made changes to ownership must file WI DoR Schedule WD.

How to fill out WI DoR Schedule WD?

To fill out WI DoR Schedule WD, you need to provide information regarding your identification, entity details, type of withdrawal, and any changes in ownership percentages or contributions.

What is the purpose of WI DoR Schedule WD?

The purpose of WI DoR Schedule WD is to ensure proper reporting of ownership changes and withdrawals from business entities for accurate tax assessments in the state of Wisconsin.

What information must be reported on WI DoR Schedule WD?

Information required on WI DoR Schedule WD includes the taxpayer's name and identification number, details about the business entity, the nature of the withdrawal, and any changes in ownership percentages or capital contributions.

Fill out your WI DoR Schedule WD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR Schedule WD is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.