MS DoR 80-105 2013 free printable template

Show details

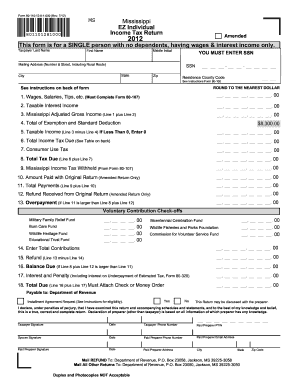

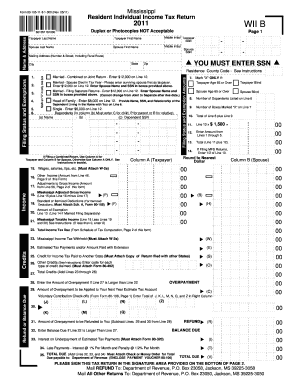

Reset Form Mississippi Form 80-105-13-8-1-000 (Rev. 12/13) Print Form Resident Individual Income Tax Return 2013 801051381000 Amended Taxpayer First Name Initial Last Name Spouse First Name Initial

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 80 105

Edit your form 80 105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 80 105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 80 105 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 80 105. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 80-105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 80 105

How to fill out MS DoR 80-105

01

Obtain the MS DoR 80-105 form from the official website or relevant office.

02

Read the instructions carefully to understand the requirements.

03

Fill out the personal information section with your full name, address, and contact details.

04

Provide accurate details in the employment or education section as applicable.

05

Complete the fields related to your financial status, including income and expenses.

06

Include any necessary documentation or supporting materials as specified in the instructions.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated areas.

09

Submit the form as directed, either online or via postal mail.

Who needs MS DoR 80-105?

01

Individuals applying for assistance or specific benefits related to the MS program.

02

Residents of the state seeking to report their financial circumstances.

03

Students applying for financial aid or scholarship needs.

04

Anyone needing to update their information in relation to the MS program.

Fill

form

: Try Risk Free

People Also Ask about

What form is used to withhold MS state tax?

Form 89-350 - Withholding Exemption Certificate Completed by employee; retained by employer.

What is MS 89 105 form?

Forms required to be filed for Mississippi payroll are: Income Withholdings: Form 89-105, Employer's Withholding Tax Return (due monthly, quarterly, seasonal or annual).

What are the requirements for filing taxes in Mississippi?

FILING REQUIREMENTS Single resident taxpayers – you have gross income in excess of $8,300 plus $1,500 for each dependent. Married resident taxpayers – you and your spouse have gross income in excess of $16,600 plus $1,500 for each dependent.

What is a form 80 105?

More about the Mississippi Form 80-105 Individual Income Tax TY 2022. Form 80-105 is the general individual income tax form for Mississippi residents. You must file, online or through the mail, yearly by April 17. Form 80-105 requires you to list multiple forms of income, such as wages, interest, or alimony .

What is the Mississippi employee Withholding exemption Certificate?

The 89-350 Mississippi Employee's Withholding Exemption Certificate must be completed by employees so employers know how much state income tax to withhold from wages. This form should be maintained in conjunction with the federal Form W-4.

What is a form 80 108?

Itemized Deductions. Individual taxpayers may elect to either itemize their individual nonbusiness deductions or claim a standard deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 80 105 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 80 105 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in form 80 105?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 80 105 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete form 80 105 on an Android device?

Complete your form 80 105 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MS DoR 80-105?

MS DoR 80-105 is a specific form used by certain organizations to report detailed financial information related to their operations.

Who is required to file MS DoR 80-105?

Organizations that meet specific regulatory requirements or thresholds set forth by governing bodies are required to file MS DoR 80-105.

How to fill out MS DoR 80-105?

To fill out MS DoR 80-105, organizations must provide accurate financial data, signatures from authorized representatives, and follow the guidelines outlined in the accompanying instructions.

What is the purpose of MS DoR 80-105?

The purpose of MS DoR 80-105 is to ensure transparency and accountability in financial reporting, enabling regulators and stakeholders to understand the organization’s financial status.

What information must be reported on MS DoR 80-105?

MS DoR 80-105 requires reporting of financial statements, revenue sources, expenditures, and other relevant financial data as specified in the form guidelines.

Fill out your form 80 105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 80 105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.