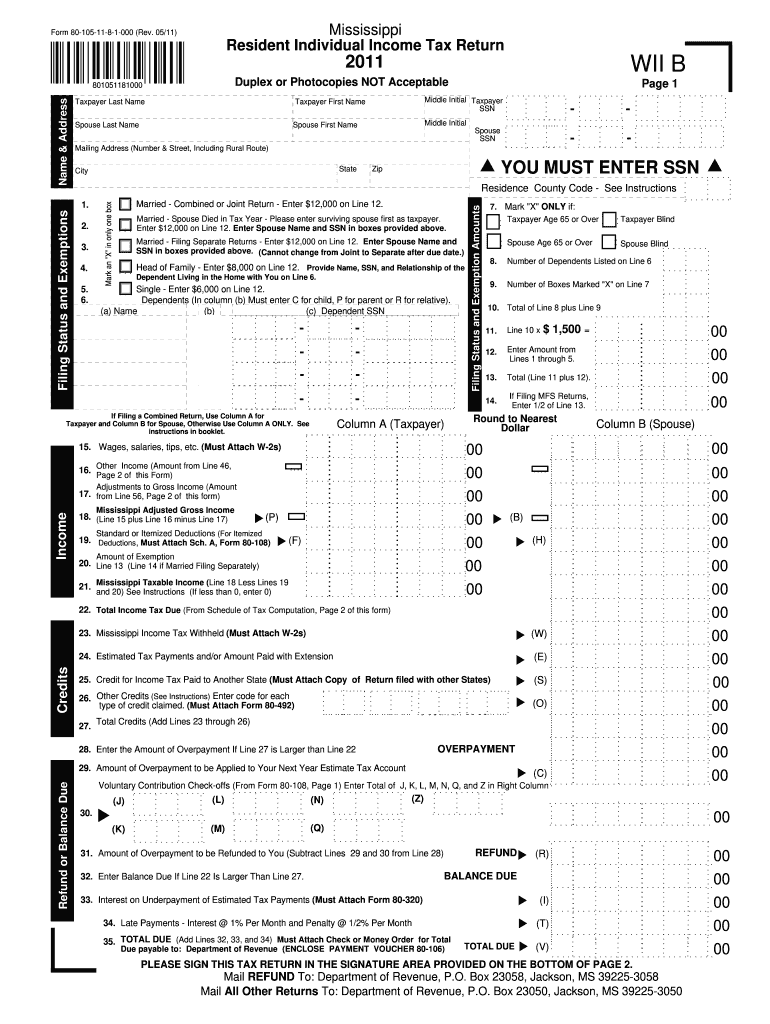

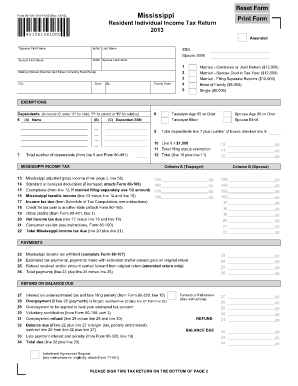

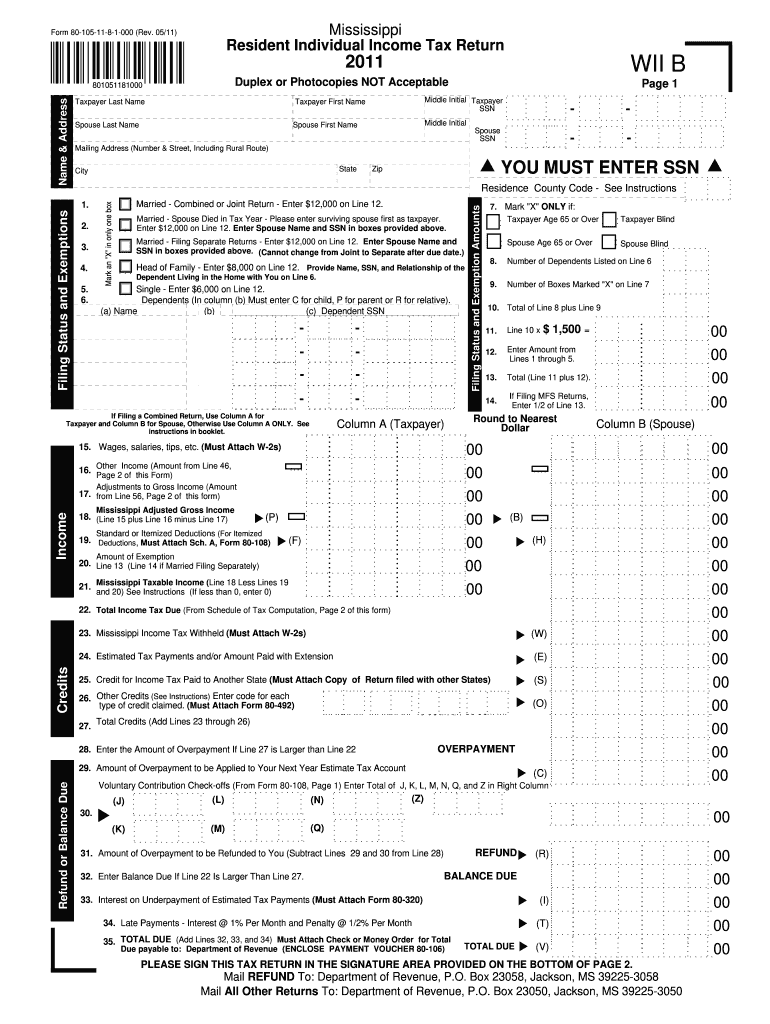

Get the free 80 105

Get, Create, Make and Sign 80 105 form

Editing 80 105 form online

Uncompromising security for your PDF editing and eSignature needs

Video instructions and help with filling out and completing 80 105

Instructions and Help about 80 105 form

If you could only have one lens what lens would it be what is up people Donna here, and today we are talking about MEGO to all-around lens for the Sony a6500 a6300 a6000 or any son ye-mount camera you guys seem to ask me this all the time if I could only have one lens for my camera what lens would it be, and I'm going to big believer of building out your kit that you should have tools for different purposes, but it definitely got me thinking if I was headed somewhere if Was let's say going traveling and all I could bring was one camera and one lens what lens would I bring and that lens is the Sony 18-105 f4 g OSS lens I've had this lens for just over a year now, and it probably stays on my camera more than any other lens that I own, so I figure it's got to be worth talking about now like all my reviews here's what we're going to go through today some good things about this lens some not-so-good things and what toucan do about them some uses for this lens I'm going to answer a bunch of your questions that you asked me over on Instagram and of course because it's never enough to just talk about it, I'm going to show you photos and videos so that you can see just how this thing performs, but before we read out and take a look at what this thing is capable of I'd like to give a huge shout out to the sponsor for this video Vital House this is the VitalHouseathlete's shake it's a four hundred calorie meal replacement shakes that has32 grams of protein in it, I've been drinking these for about a month one a Dayan in my busy life it's amazing to have something that I can just grab fill up with water shake it up and have a full meal it's extremely convenient and really healthy too it's filled with natural ingredients it's got tons officer a bunch of superfoods it's gluten-free vegan GMO free it's just a really awesome thing that you can have especially if you're a person who's on the go it comes in these bottles that have powder in them, so you can fill them with water they're great if you have to go on planes and kind of thing, so you don't get hit with taking liquids on the plane and like Said I've been drinking these for about a month now, and it's such an awesome product really great people there's going to be a link in the description if you want to go check it out if you've ever been interested in having a meal replacement I definitely suggest this and a huge thank you to Vital House for sponsoring this video I guess we better get back to the lens hey let's go see what this thing's capable of Sony 18-105 F4 Review so first thing we need to talk about is the focal length of this lens the 18 to 105 focal length gives you quite a broad range and makes this a very versatile lens the full-frame equivalent to that is 27 to about 152, so it's got a pretty standard kind of wide end as well as a decent telephoto in not super long, but you know long enough for most cases at Jawaheralhousani I'm totally sorry if I'm saying that terrible over on Instagram...

People Also Ask about

Does Mississippi tax retirement income?

Do I have to file a Mississippi state tax return non resident?

Do you have to file a state tax return in Mississippi?

Do you use the same form for state and federal taxes?

Do I have to file state taxes if I don't live in the US?

Who must file a Mississippi state tax return?

Does Mississippi have a state income tax form?

Which people are legally required to file a tax return?

Does Mississippi have state withholding tax?

How much money do you have to make to file taxes in Mississippi?

Who is required to file a Mississippi tax return?

What happens if you don't pay Mississippi state taxes?

Who does not have to file a US tax return?

Do non residents need to file a tax return?

Does a non resident alien need to file a tax return?

Does Mississippi have a state tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 80 105 form?

How do I make changes in 80 105 form?

Can I edit 80 105 form on an Android device?

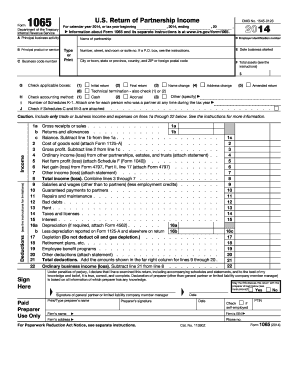

What is 80 105?

Who is required to file 80 105?

How to fill out 80 105?

What is the purpose of 80 105?

What information must be reported on 80 105?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.