KY 51A158 2006 free printable template

Show details

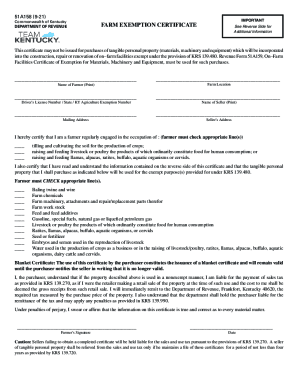

480. Revenue Form 51A159 On-Farm Facilities Certificate of Exemption for Materials Machinery and Equipment must be used for such purchases. 51A158 10-06 Commonwealth of Kentucky DEPARTMENT OF REVENUE IMPORTANT FARM EXEMPTION CERTIFICATE See Reverse Side for Additional Information This certificate may not be issued for purchases of tangible personal property materials machinery and equipment which will be incorporated into the initial construction of on-farm facilities exempt under the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 51A158

Edit your KY 51A158 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 51A158 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY 51A158 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY 51A158. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A158 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 51A158

How to fill out KY 51A158

01

Begin by downloading the KY 51A158 form from the Kentucky Department of Revenue website.

02

Fill out your personal information in the designated fields, including your name, address, and Social Security number.

03

Provide details regarding any applicable exemptions in the specified sections.

04

Calculate any applicable deductions and credits as per the guidelines provided on the form.

05

Ensure all required signatures and dates are filled out accurately.

06

Review the completed form for any errors or omissions.

07

Submit the form by mail or electronically as advised, ensuring to keep a copy for your records.

Who needs KY 51A158?

01

Anyone who is a resident of Kentucky and needs to report their income for tax purposes.

02

Individuals or businesses seeking to claim deductions or credits on their state tax return.

03

Taxpayers who need to establish their eligibility for certain tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How many acres is farm exempt in Kentucky?

Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

What items are exempt from farm tax in Kentucky?

Examples of items which qualify for exemption in addition to the more commonly known items of “farm machinery” are: irrigation systems, tobacco curing equipment, farm wagons, portable insecticide sprayers, chain saws, mechanical cleaning equipment, mechanical shop equipment, mechanical posthole diggers, silo unloaders

What qualifies as a farm in ky?

Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

How do I become farm tax exempt in Kentucky?

You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment (Form 51A159) to each of your vendors using your Agriculture Exemption Number.

How do I get a farm tax exempt in Tennessee?

You'll also be required to submit the following documentation: Tax returns with income information. 1099s. Proof of land qualification under the Agricultural Forest and Open Space Land Act. Copy of your Schedule F. Copy of either Form 4835 or Schedule E. Detailed statement of why you qualify for an exemption.

What is the farm tax deduction in Kentucky?

Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural assets, subject to a $25,000 calendar year cap and a $100,000 lifetime cap.

Who is exempt from Kentucky sales tax?

While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Kentucky. CategoryExemption StatusFood and MealsGeneral Occasional SalesEXEMPTMotor VehiclesEXEMPT *Optional Maintenance Contracts19 more rows

How do I get a Kentucky sales tax ID number?

To register for a Kentucky Sales Tax Permit, you can apply at the Department of Commerce's online Kentucky Business One Stop portal, or with Form 10A100, the Kentucky Tax Registration Application.

How do I become tax exempt in ky?

To qualify for sales and use tax exemption in Kentucky, first, your nonprofit corporation must have been granted 501c3 status by the IRS. The next distinction is that your KY nonprofit corporation must meet to qualify is that it has to be a resident educational, charitable, or religious entity.

What is the tax break for farming in Kentucky?

Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural assets, subject to a $25,000 calendar year cap and a $100,000 lifetime cap.

How do I get farm exemption in ky?

You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment (Form 51A159) to each of your vendors using your Agriculture Exemption Number.

How do I become exempt from farm tax in Kentucky?

A new Kentucky law requires that farmers apply for an Agriculture Exemption Number to make qualified purchases for the farm exempt from sales tax. Farmers may still use Forms 51A158 and 51A159 without an Agriculture Exemption Number through June 30, 2022, by using their driver's license number.

How do you qualify as a farm in ky?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get KY 51A158?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the KY 51A158. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my KY 51A158 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your KY 51A158 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit KY 51A158 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share KY 51A158 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is KY 51A158?

KY 51A158 is a form used in the state of Kentucky for reporting various business taxes.

Who is required to file KY 51A158?

Businesses operating in Kentucky that are subject to certain taxes are required to file KY 51A158.

How to fill out KY 51A158?

Fill out KY 51A158 by providing business information, income details, tax liability, and any relevant deductions or credits as instructed on the form.

What is the purpose of KY 51A158?

The purpose of KY 51A158 is to document and report business tax liabilities to the state of Kentucky for accurate tax assessment.

What information must be reported on KY 51A158?

KY 51A158 must report business name, address, federal identification number, net income, and tax liability details.

Fill out your KY 51A158 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 51A158 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.