KY 51A158 2014 free printable template

Show details

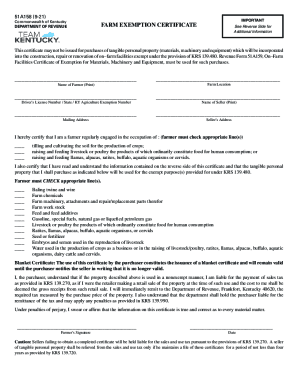

51A158 (614)Commonwealth of Kentucky

DEPARTMENT OF REVENUE FARM EXEMPTION CERTIFICATEIMPORTANT

See Reverse Side for

Additional InformationThis certificate may not be issued for purchases of tangible

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 51A158

Edit your KY 51A158 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 51A158 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY 51A158 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KY 51A158. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A158 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 51A158

How to fill out KY 51A158

01

Obtain a copy of Form KY 51A158 from the Kentucky Department of Revenue website or local tax office.

02

Fill in your personal information, including your full name, address, and Social Security number or Federal Employer Identification Number.

03

Indicate the tax year for which the form is being filled out.

04

Provide details regarding your income and deductions as specified in the form instructions.

05

Review the instructions carefully to ensure that you accurately fill in all necessary sections.

06

Sign and date the form at the designated area to certify that the information provided is correct.

07

Submit the completed form as instructed, either online or by mailing it to the appropriate tax authority.

Who needs KY 51A158?

01

Individuals or businesses in Kentucky who need to report their income, claim deductions, or fulfill tax obligations may require Form KY 51A158.

Fill

form

: Try Risk Free

People Also Ask about

How many acres is considered a farm in ky?

"Agricultural land" means: Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

What is farm exempt items in Kentucky?

Examples of items which qualify for exemption in addition to the more commonly known items of “farm machinery” are: irrigation systems, tobacco curing equipment, farm wagons, portable insecticide sprayers, chain saws, mechanical cleaning equipment, mechanical shop equipment, mechanical posthole diggers, silo unloaders

What qualifies you as a farm in Kentucky?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

How many acres is a farm in Kentucky?

Under the enabling legislation for the amendment, to qualify as farmland the property had to contain a minimum number of acres (10 acres for agricultural land and 5 acres for horticultural land) and had to be used for agricultural or horticultural purposes.

How do I get farm exempt in ky?

You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment (Form 51A159) to each of your vendors using your Agriculture Exemption Number.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KY 51A158 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your KY 51A158 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find KY 51A158?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific KY 51A158 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out KY 51A158 on an Android device?

Use the pdfFiller app for Android to finish your KY 51A158. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

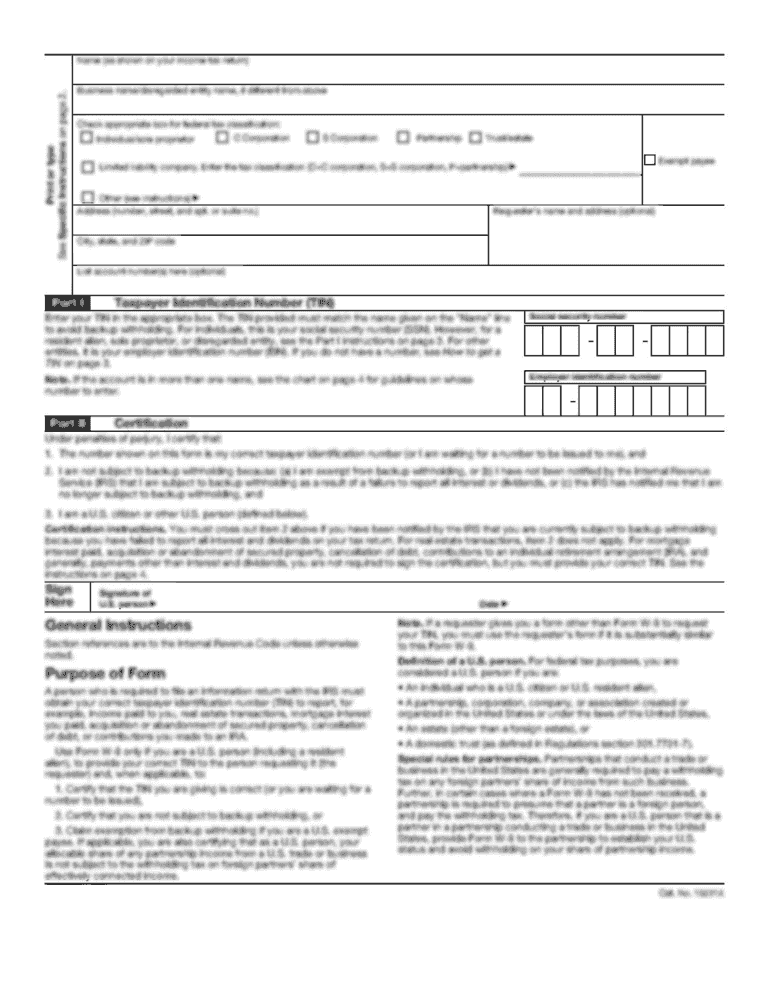

What is KY 51A158?

KY 51A158 is a tax form used in the state of Kentucky for reporting certain income or tax information.

Who is required to file KY 51A158?

Individuals or entities that meet specific criteria for income reporting or tax obligations are required to file KY 51A158.

How to fill out KY 51A158?

To fill out KY 51A158, you need to provide personal information, income details, and any relevant deductions according to the instructions provided with the form.

What is the purpose of KY 51A158?

The purpose of KY 51A158 is to ensure proper reporting of income for taxation purposes and to facilitate the collection of state taxes.

What information must be reported on KY 51A158?

The information that must be reported on KY 51A158 includes personal identification, income sources, deductions, and any applicable credits.

Fill out your KY 51A158 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 51A158 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.