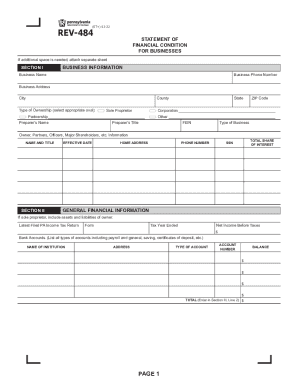

PA DoR REV-484 2013 free printable template

Show details

REV-484 FO 06-13 Start 1. Name and address of business 2. Business phone number 3. Type of ownership. Check appropriate box. DEPARTMENT OF REVENUE Statement of Financial Condition for Businesses If additional space is needed attach separate sheet. Sole proprietor Other specify Corporation Partnership 4. Preparer s name and title 5. Federal employer identification number 6. Type of business 7. Information about owner partners officers major shareholders etc* Name and Title Effective Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR REV-484

Edit your PA DoR REV-484 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR REV-484 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DoR REV-484 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA DoR REV-484. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-484 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR REV-484

How to fill out PA DoR REV-484

01

Obtain the PA DoR REV-484 form from the Department of Revenue's website or local office.

02

Provide your personal information, including your name, address, and Social Security number.

03

Indicate the type of tax or refund you are applying for.

04

Fill out the applicable sections regarding your income and deductions.

05

Provide any necessary documentation to support your claims.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form to the appropriate Pennsylvania Department of Revenue office.

Who needs PA DoR REV-484?

01

Individuals seeking a tax refund from the Pennsylvania Department of Revenue.

02

Taxpayers who need to report changes or corrections to their tax information.

03

Anyone who is required to file a tax return in Pennsylvania.

Fill

form

: Try Risk Free

People Also Ask about

What forms must be attached to PA tax return?

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

What is PA Dept of Revenue real estate tax?

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing.

What is a form PA 40?

2022 Pennsylvania Income Tax Return (PA-40)

How do I file an appeal with the PA Dept of Revenue?

The Board of Appeals can be reached by calling 717-783-3664. Forms can be downloaded from the Board's Online Petition Center at .boardofappeals.state.pa.us, or obtained by calling 1-888-PATAXES (728-2937).

Who must file a PA-40?

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: • You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or • You incurred a loss from any transaction as an individual, sole proprietor, partner in a

How do I get a PA-40 form?

Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get PA DoR REV-484?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the PA DoR REV-484. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in PA DoR REV-484 without leaving Chrome?

PA DoR REV-484 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit PA DoR REV-484 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share PA DoR REV-484 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is PA DoR REV-484?

PA DoR REV-484 is a Pennsylvania Department of Revenue form used to report income tax information and other financial details for individuals and entities.

Who is required to file PA DoR REV-484?

Individuals and businesses operating in Pennsylvania that meet certain income thresholds or have specific tax obligations are required to file PA DoR REV-484.

How to fill out PA DoR REV-484?

To fill out PA DoR REV-484, individuals and businesses should gather all relevant financial information, complete each section of the form accurately, and ensure all calculations are correct before submitting it to the Pennsylvania Department of Revenue.

What is the purpose of PA DoR REV-484?

The purpose of PA DoR REV-484 is to collect essential tax information that allows the Pennsylvania Department of Revenue to assess and ensure compliance with state tax laws.

What information must be reported on PA DoR REV-484?

PA DoR REV-484 requires taxpayers to report personal identification information, income details, deductions, credits, and other relevant financial data as specified in the form instructions.

Fill out your PA DoR REV-484 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR REV-484 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.