KY DoR 92A200 2012 free printable template

Show details

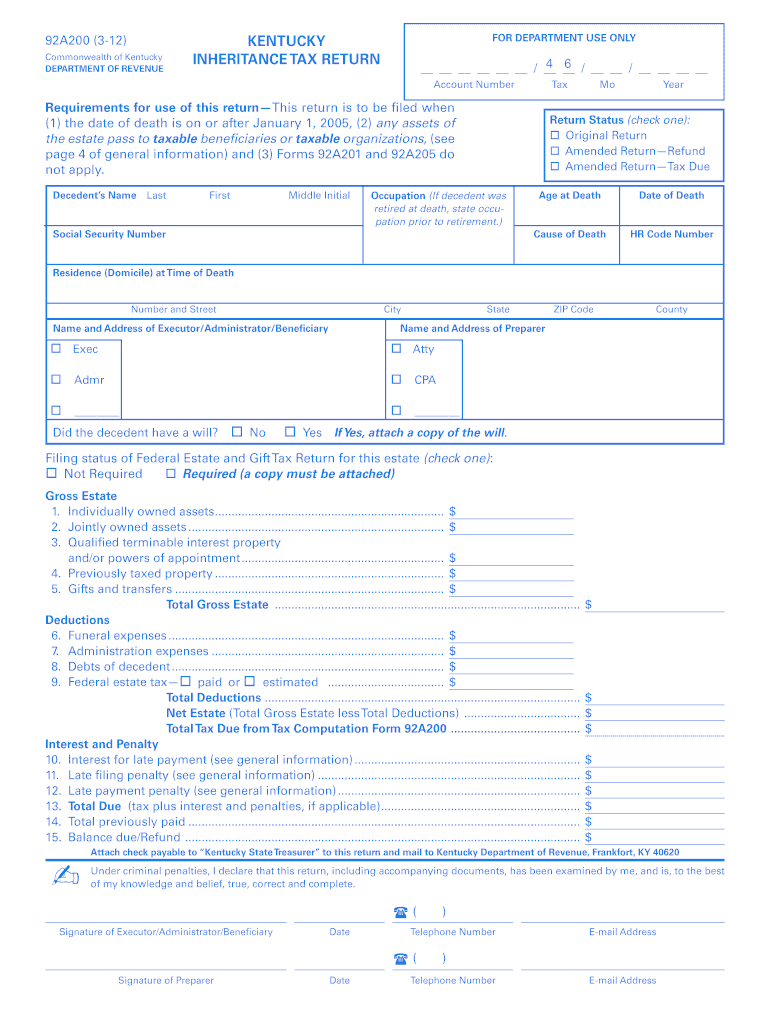

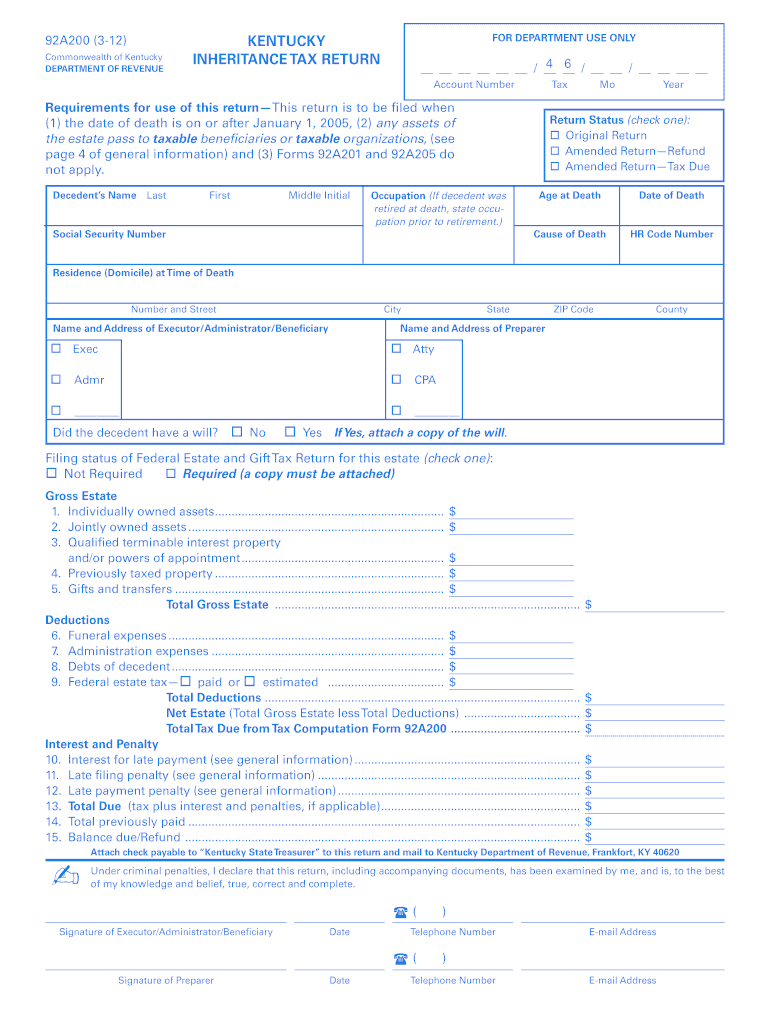

92A200 (3-12)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

FOR DEPARTMENT USE ONLY

KENTUCKY

INHERITANCE TAX RETURN

? __? __? /? __? __? /? __? __? __? __

__? __? __? __? __? __? /? 4? ?6

Account

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 92A200

Edit your KY DoR 92A200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 92A200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 92A200 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY DoR 92A200. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 92A200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 92A200

How to fill out KY DoR 92A200

01

Obtain the KY DoR 92A200 form from the Kentucky Department of Revenue website or office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide information about the income for which you are reporting, including details about the source and amount.

04

Check the appropriate boxes regarding the type of tax relief or credit you are applying for.

05

Review the form for accuracy and completeness.

06

Sign and date the form before submission.

07

Submit the completed form to the Kentucky Department of Revenue by the specified deadline.

Who needs KY DoR 92A200?

01

Individuals or businesses seeking tax credits or relief in Kentucky.

02

Taxpayers who need to report specific income or claim deductions as outlined in the instructions.

03

Those who are required to file this form due to their eligibility for certain tax benefits or programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for inheritance tax in Kentucky?

If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used. The affidavit of exemption is to be filed only with the court. Do not send a copy of the affidavit to the Kentucky Department of Revenue.

Who pays Kentucky inheritance tax?

Inheritance Tax All property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

Who files Kentucky inheritance tax return?

Kentucky assesses an inheritance tax on beneficiaries of Kentucky estates. This tax applies to both real and personal property in Kentucky. It does not apply to property owned by the decedent outside of Kentucky.

What tax form do I need for inheritance income?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Where do I mail my Kentucky inheritance tax return?

Where to File Form NumberWhere to File after July 1, 2019706-GS(D) (supplemental or amended)Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence, KY 41042-2915706 GS(D-1)Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence, KY 41042-291528 more rows

Do I have to pay taxes on a $10 000 inheritance?

In California, there is no state-level estate or inheritance tax. If you are a California resident, you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. As of 2023, only six states require an inheritance tax on people who inherit money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute KY DoR 92A200 online?

pdfFiller has made it simple to fill out and eSign KY DoR 92A200. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit KY DoR 92A200 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing KY DoR 92A200.

How do I fill out KY DoR 92A200 on an Android device?

On Android, use the pdfFiller mobile app to finish your KY DoR 92A200. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is KY DoR 92A200?

KY DoR 92A200 is a form used in the state of Kentucky to report various tax information to the Department of Revenue.

Who is required to file KY DoR 92A200?

Businesses and individuals who have tax liabilities or who engage in certain transactions that require reporting to the Kentucky Department of Revenue are required to file KY DoR 92A200.

How to fill out KY DoR 92A200?

To fill out KY DoR 92A200, you need to provide accurate information regarding your tax situation, including details such as taxpayer identification, the nature of the income or tax liability, and any relevant financial figures.

What is the purpose of KY DoR 92A200?

The purpose of KY DoR 92A200 is to ensure that the Kentucky Department of Revenue collects accurate tax information for assessment and compliance purposes.

What information must be reported on KY DoR 92A200?

The information that must be reported on KY DoR 92A200 includes taxpayer identification details, income or transaction amounts, applicable tax rates, and any deductions or credits being claimed.

Fill out your KY DoR 92A200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 92A200 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.