KY DoR 92A200 2003 free printable template

Show details

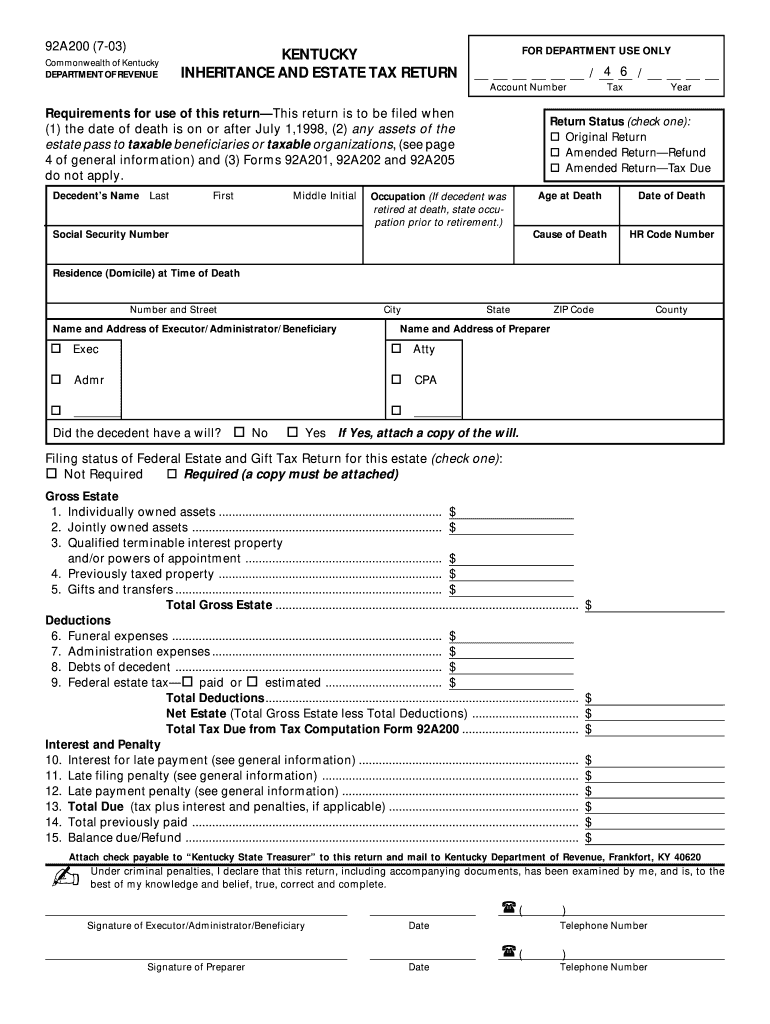

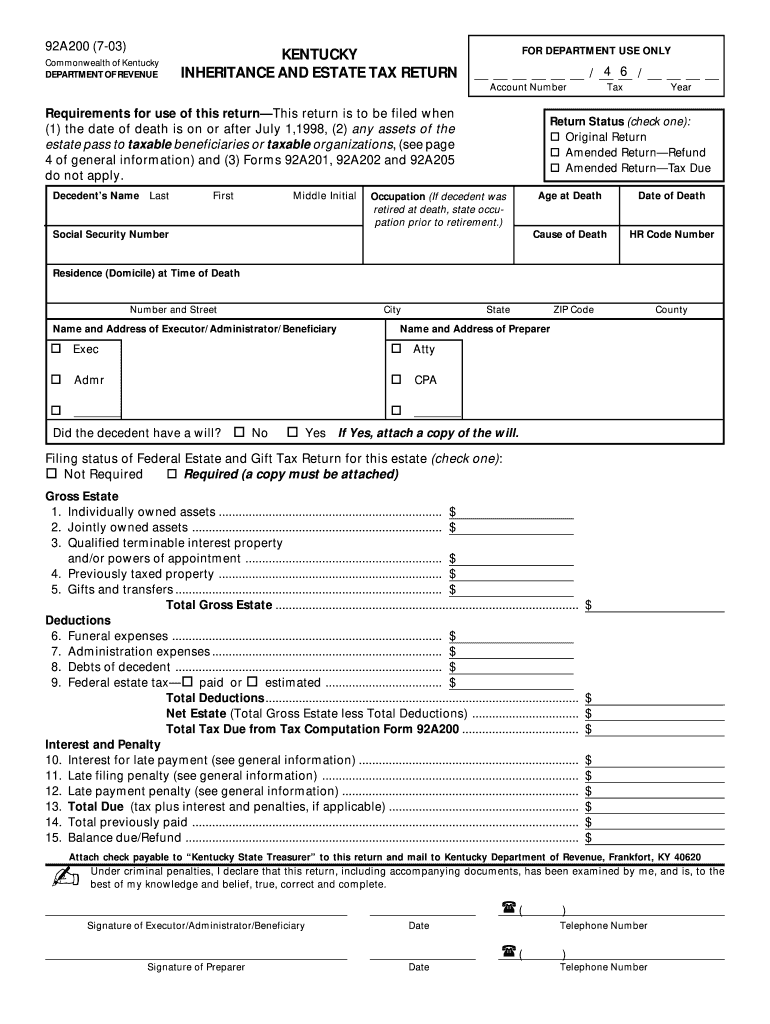

Net Estate Total Gross Estate less Total Deductions. Total Tax Due from Tax Computation Form 92A200. 92A200 7-03 Commonwealth of Kentucky DEPARTMENT OF REVENUE KENTUCKY INHERITANCE AND ESTATE TAX RETURN FOR DEPARTMENT USE ONLY / / Account Number Requirements for use of this return This return is to be filed when 1 the date of death is on or after July 1 1998 2 any assets of the estate pass to taxable beneficiaries or taxable organizations see page 4 of general information and 3 Forms 92A201...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 92A200

Edit your KY DoR 92A200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 92A200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR 92A200 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY DoR 92A200. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 92A200 Form Versions

Version

Form Popularity

Fillable & printabley

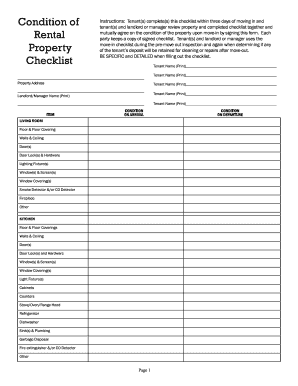

How to fill out KY DoR 92A200

How to fill out KY DoR 92A200

01

Obtain a copy of the KY DoR 92A200 form from the Kentucky Department of Revenue website.

02

Fill in the taxpayer's information, including name, address, and Social Security number.

03

Provide details on the type of income or tax deduction being reported.

04

Include any relevant supporting documentation as instructed in the form.

05

Review the information for accuracy and completeness.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed form by mail or electronically, following the submission guidelines.

Who needs KY DoR 92A200?

01

Individuals or entities in Kentucky who are reporting Kentucky state income tax-related information.

02

Taxpayers seeking to claim specific deductions or credits as outlined by the Kentucky Department of Revenue.

03

Those who have received a notice from the Kentucky Department of Revenue regarding tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who files a Kentucky inheritance tax return?

Inheritance Tax All property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

Do I have to report inheritance to IRS?

Regarding your question, “Is inheritance taxable income?” Generally, no, you usually don't include your inheritance in your taxable income. However, if the inheritance is considered income in respect of a decedent, you'll be subject to some taxes.

What IRS form do I use for inheritance?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

How can I avoid inheritance tax?

Set up a trust to avoid inheritance tax If you put assets into a trust, provided certain conditions are met, they no longer belong to you. This means that, when you die, their value normally won't be included when the value of your estate is calculated. Instead, the cash, investments or property belong to the trust.

What's the difference between estate tax and inheritance tax?

Estate and inheritance taxes are taxes levied on the transfer of property at death. An estate tax is levied on the estate of the deceased while an inheritance tax is levied on the heirs of the deceased.

Do all estates have to file a 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KY DoR 92A200 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing KY DoR 92A200, you need to install and log in to the app.

How do I edit KY DoR 92A200 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign KY DoR 92A200 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit KY DoR 92A200 on an Android device?

You can edit, sign, and distribute KY DoR 92A200 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is KY DoR 92A200?

KY DoR 92A200 is a form used by the Kentucky Department of Revenue for reporting certain tax information related to coal severance and processing tax.

Who is required to file KY DoR 92A200?

Coal companies or individuals engaged in the severance or processing of coal in Kentucky are required to file KY DoR 92A200.

How to fill out KY DoR 92A200?

To fill out KY DoR 92A200, follow the form instructions by providing the necessary financial details related to coal sales, production, and any applicable deductions or exemptions.

What is the purpose of KY DoR 92A200?

The purpose of KY DoR 92A200 is to report coal severance and processing activities and to calculate the corresponding taxes owed to the state of Kentucky.

What information must be reported on KY DoR 92A200?

KY DoR 92A200 requires reporting of information such as the amount of coal severed, production figures, sales data, exemptions claimed, and total tax calculation.

Fill out your KY DoR 92A200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 92A200 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.