Who needs a 130U form?

When registering a motor vehicle, you must apply for a Certificate of Title as proof of legal ownership.

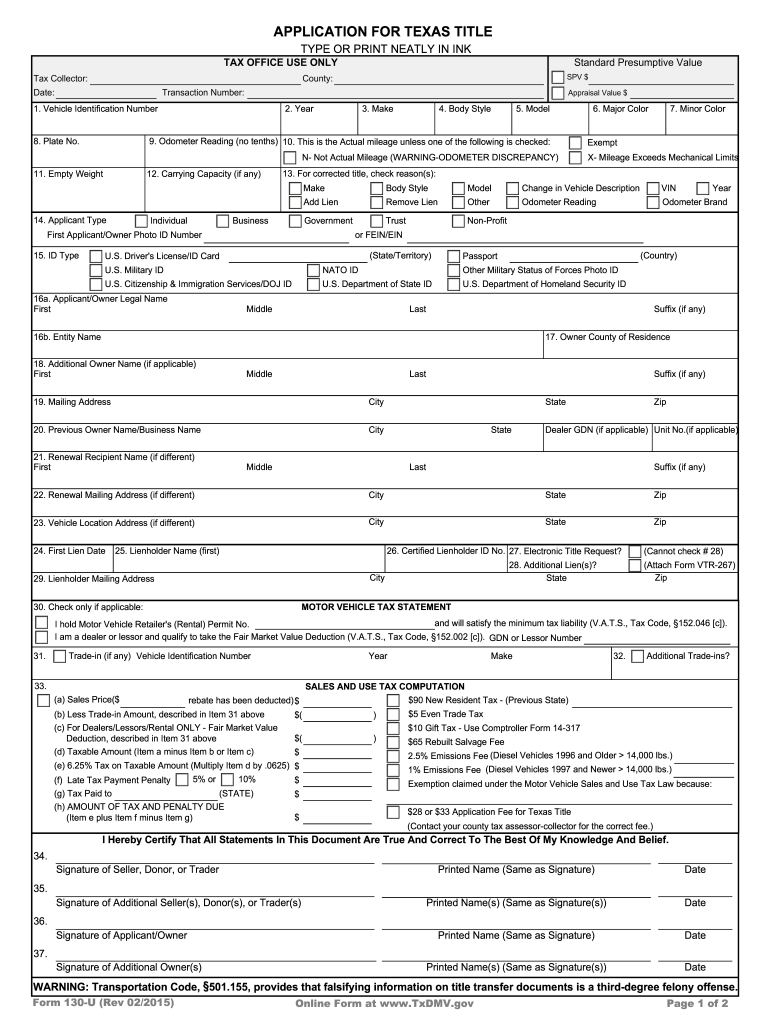

What is the 130U form for?

The 130u Form is an application for the certificate of title for a vehicle. The title is a legal form that establishes the individual or business as the legal owner of a vehicle.

Is the 130U form accompanied by other forms?

The 130U form is submitted to your local Country tax collector-assessor. Additionally, you will need to provide proof of ID, car insurance, vehicle inspection, and ownership. You will also need to pay the $50.75 vehicle registration fee.

When is the 130U form due?

The 130U form is due within 30 days of sale when registering a vehicle. The vehicle cannot be legally operated without a title certificate. Even if not titling your vehicle, 130U form should be submitted if registering.

How do I fill out the 130U form?

The 130U form is self explainable and should be filled in as required. It will ask for information such as:

-

Identifying information about the vehicle, its vehicle identification number, make, color, and year of manufacture.

-

The license plate number.

-

Technical information about the vehicle to define its taxation regime; its gross vehicle weight, motive power, and purchase price when new.

-

The name and address of the purchaser or "registered owner" .

-

If money is owed on the vehicle, the name of the lienholder or "legal owner" to whom this money is owed

-

The signature of the seller of the seller and the buyer

Where do I send the 130U form?

The 130U form should be sent to your Local County Tax Assessor-Collector with the accompanying forms.