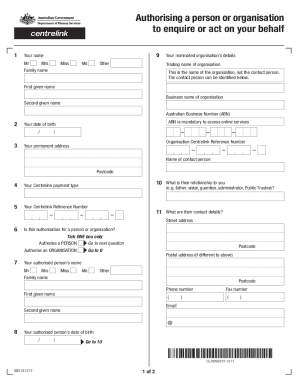

AU MOD(JY) 2012 free printable template

Show details

Parent(s)/Guardian(s) details MOD for the BASE Tax Year and CURRENT Tax Year for Dependent Youth Allowance or STUDY Customers BY Purpose of this form The appropriate rate of payment for a dependent

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU MODJY

Edit your AU MODJY form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU MODJY form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU MODJY online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU MODJY. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU MOD(JY) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU MODJY

How to fill out AU MOD(JY)

01

Obtain the AU MOD(JY) form from the official website or authorized office.

02

Read the instructions carefully to understand the requirements for each section.

03

Fill out your personal information, including name, address, and contact details in the designated fields.

04

Provide any necessary identification information, such as a driver's license or social security number.

05

Complete the specific sections related to your application category, making sure to adhere to any specific guidelines.

06

Review the filled form for accuracy and completeness, correcting any errors or omissions.

07

Sign and date the form in the appropriate section.

08

Submit the form as per the instructions, either online, by mail, or in person, depending on the submission guidelines.

Who needs AU MOD(JY)?

01

Individuals applying for permits, licenses, or approvals that require the AU MOD(JY).

02

Professionals seeking regulatory compliance in specific fields that mandate the submission of this form.

03

Organizations or businesses that need to fulfill legal or operational requirements associated with AU MOD(JY).

Fill

form

: Try Risk Free

People Also Ask about

What is a current tax year?

A tax year is the 12-month calendar year covered by a tax return. In the U.S., the tax year for individuals runs from Jan. 1 to Dec. 31 and includes taxes owed on earnings during that period.

What is the parents form for Centrelink?

Parents(s)/Guardian(s) additional details for Youth Allowance, Special Benefit or ABSTUDY customers form (A2115) Use this form to provide parental income if you're the parent or guardian of someone claiming Youth Allowance or ABSTUDY.

What are details for base tax year?

Definition. For the purposes of parental means tested YA, the base year is the financial year ending on 30 June of the year before the calendar year in which payment is made. For the purposes of YA, the term BASE TAX YEAR is used.

How do you advise parental income?

If you don't have a Centrelink online account linked to myGov, you'll need to use the Advise Parental Income online service.You'll need all of the following: the One Time Access Code in the letter. your child's CRN. your child's name and date of birth.

What is considered current tax year?

Calendar Tax Year: This is a period of 12 consecutive months beginning January 1 and ending December 31; or. Fiscal Tax Year: This is a period of 12 consecutive months ending on the last day of any month except December.

What is the meaning of Mod jy?

Parent or Guardian details - for the BASE tax year and CURRENT tax year for dependent Youth Allowance or ABSTUDY customers form (MOD JY) Use this form to provide income details of a parent or guardian if you are a dependent claiming or receiving Youth Allowance or ABSTUDY.

What is the parental income?

This is the total amount of any salary or wages (taxable or non-taxable). This includes: paid parental leave. weekly accident insurance payments.

Can I restart my Youth Allowance?

If your payment has been reduced to zero because your parents didn't tell us their income, they can still update their income details online. After they do this, we'll restart your payment if you're still eligible.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AU MODJY from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including AU MODJY. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send AU MODJY for eSignature?

When you're ready to share your AU MODJY, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit AU MODJY in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your AU MODJY, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is AU MOD(JY)?

AU MOD(JY) is a form used in Australia for reporting certain financial information and obligations to regulatory authorities.

Who is required to file AU MOD(JY)?

Entities or individuals engaged in specific activities or transactions that are subject to reporting requirements set by Australian regulations are required to file AU MOD(JY).

How to fill out AU MOD(JY)?

To fill out AU MOD(JY), individuals or businesses must provide accurate information as per the guidelines outlined by the regulatory authority, ensuring all required fields are completed correctly.

What is the purpose of AU MOD(JY)?

The purpose of AU MOD(JY) is to ensure compliance with financial regulations and to provide transparency regarding financial activities to relevant authorities.

What information must be reported on AU MOD(JY)?

The information that must be reported includes details of transactions, parties involved, monetary amounts, and any other relevant financial data stipulated by the reporting guidelines.

Fill out your AU MODJY online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU MODJY is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.