AU MOD(JY) 2020 free printable template

Show details

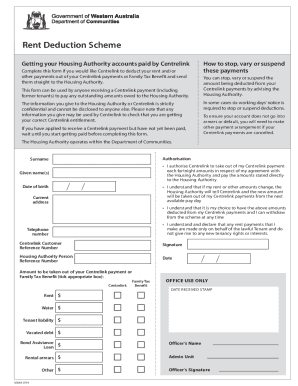

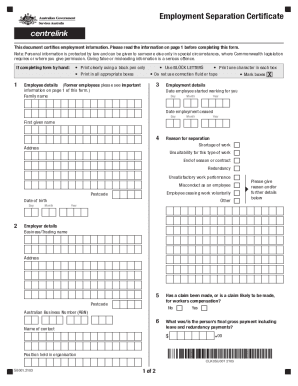

For more information go to servicesaustralia.gov.au/moc www. Keep these Notes pages 1 to 4 for your information. Mod JY. Instructions Parent s /Guardian s details for the BASE tax year and CURRENT tax year for dependent Youth Allowance or ABSTUDY customers People who are under 22 years of age are considered dependent for Youth Allowance and ABSTUDY purposes unless they meet one of the independence criteria. When to use this form Use this form to provide income details of parent s /guardian s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU MODJY

Edit your AU MODJY form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU MODJY form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU MODJY online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU MODJY. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU MOD(JY) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU MODJY

How to fill out AU MOD(JY)

01

Begin by obtaining the AU MOD(JY) form from the relevant authority or website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Specify the purpose of the form in the designated section, providing any necessary details.

04

Complete any relevant sections that pertain to your specific situation or request.

05

Review the completed form for accuracy and ensure all required fields are filled.

06

Sign and date the form at the bottom where indicated.

07

Submit the form according to the instructions provided, either online or via mail.

Who needs AU MOD(JY)?

01

Individuals or organizations needing to provide information for regulatory purposes or data collection.

02

People applying for permits or licenses requiring AU MOD(JY) clearance.

03

Entities engaged in activities regulated under the relevant legislation where AU MOD(JY) applies.

Fill

form

: Try Risk Free

People Also Ask about

What is the base tax year?

The BASE tax year is the financial year ending before 1 January of the year of study. A CURRENT tax year assessment If you are completing this form between September and December, you will need to provide information for both the BASE tax year and the CURRENT tax year.

What does a tax year mean?

A "tax year" is an annual accounting period for keeping records and reporting income and expenses. An annual accounting period does not include a short tax year. The tax years you can use are: Calendar year - 12 consecutive months beginning January 1 and ending December 31.

What is a mod jy form?

Parent or Guardian details - for the BASE tax year and CURRENT tax year for dependent Youth Allowance or ABSTUDY customers form (MOD JY) Use this form to provide income details of a parent or guardian if you are a dependent claiming or receiving Youth Allowance or ABSTUDY.

How do I find my base tax year?

The BASE tax year is the financial year ending before 1 January of the year of study.

What is the most recent tax year?

Most recent tax year means the income tax return submitted for the prior income year. Most recent tax year means the prior-prior federal or State tax year. For example, the “most recent tax year” for the 2019-2020 academic year would be 2017.

What is the base tax year for Youth Allowance?

For the purposes of parental means tested YA, the base year is the financial year ending on 30 June of the year before the calendar year in which payment is made. For the purposes of YA, the term BASE TAX YEAR is used. This term is used in the YA parental income test (1.1. P.

What does mod jy mean?

Parent or Guardian details - for the BASE tax year and CURRENT tax year for dependent Youth Allowance or ABSTUDY customers form (MOD JY) Use this form to provide income details of a parent or guardian if you are a dependent claiming or receiving Youth Allowance or ABSTUDY.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AU MODJY online?

pdfFiller makes it easy to finish and sign AU MODJY online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in AU MODJY without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your AU MODJY, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out AU MODJY on an Android device?

On Android, use the pdfFiller mobile app to finish your AU MODJY. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is AU MOD(JY)?

AU MOD(JY) is a specific form utilized in the Australian taxation system for reporting and disclosing information by certain entities.

Who is required to file AU MOD(JY)?

Entities that are required to file AU MOD(JY) typically include Australian businesses and organizations that meet specific criteria set by the Australian Taxation Office (ATO).

How to fill out AU MOD(JY)?

To fill out AU MOD(JY), individuals or businesses must follow the instructions provided by the ATO, ensuring that all required sections are completed accurately with up-to-date information.

What is the purpose of AU MOD(JY)?

The purpose of AU MOD(JY) is to facilitate compliance with tax regulations and to ensure transparency in reporting financial activities and transactions to the ATO.

What information must be reported on AU MOD(JY)?

Information that must be reported on AU MOD(JY) generally includes financial data, identification details of the reporting entity, and any relevant transactions or activities that fall under ATO guidelines.

Fill out your AU MODJY online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU MODJY is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.