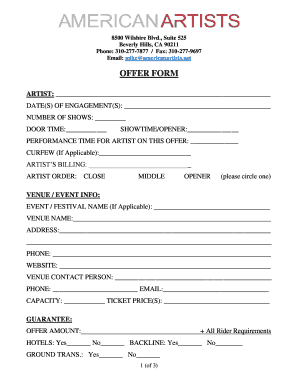

Kaeding & Company Sample Pro Forma Balance Sheet & Income Statement 2013 free printable template

Show details

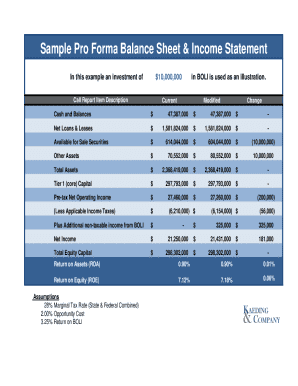

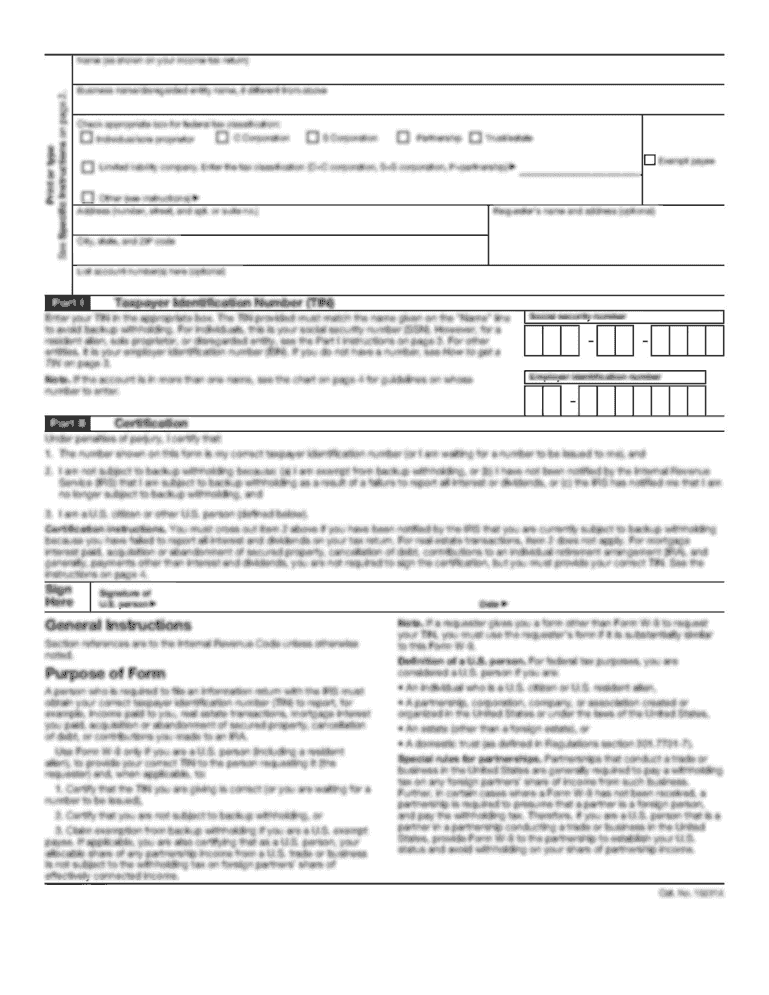

Sample Pro Forma Balance Sheet & Income Statement In this example an investment of $10,000,000 in BOLD is used as an illustration Call Report Item Description Current Modified Change Cash and Balances

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign proforma income statement template

Edit your Kaeding Company Sample Pro Forma Balance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Kaeding Company Sample Pro Forma Balance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Kaeding Company Sample Pro Forma Balance online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Kaeding Company Sample Pro Forma Balance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Kaeding & Company Sample Pro Forma Balance Sheet & Income Statement Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Kaeding Company Sample Pro Forma Balance

How to fill out pro forma income statement:

01

Start by gathering financial data: Collect information on past revenues, expenses, and profits from previous periods. This includes sales revenue, cost of goods sold, operating expenses, and taxes paid.

02

Project future revenues: Use market research, sales forecasts, and historical trends to estimate future sales. Consider factors such as industry growth, customer demand, and competitor analysis.

03

Estimate costs and expenses: Determine the costs associated with producing and selling your products or services. This includes costs of raw materials, labor, advertising, rent, utilities, and any other operating expenses.

04

Calculate gross profit: Subtract the cost of goods sold from the projected revenues to obtain the gross profit margin.

05

Analyze operating expenses: Deduct operating expenses such as marketing, administrative costs, and salaries from the gross profit. This provides the operating profit or loss.

06

Account for non-operating income and expenses: Include any other income or expenses that are not directly related to the operations of the business. This may include interest income, investments, or one-time expenses.

07

Calculate net profit or loss: Subtract non-operating income and expenses from the operating profit to obtain the net profit or loss.

08

Include taxes: Consider any tax obligations and deduct them from the net profit to obtain the final profit or loss amount.

09

Review and analyze the pro forma income statement: Ensure all calculations are accurate and review the statement to assess the financial health and performance of the business.

Who needs pro forma income statement:

01

Business owners and entrepreneurs: Pro forma income statements are essential for business planning, budgeting, and financial forecasting. They help in evaluating the feasibility of new ventures, setting realistic financial goals, and making informed business decisions.

02

Investors and lenders: Pro forma income statements provide crucial financial information for potential investors and lenders. These statements help them assess the profitability, stability, and growth potential of a business before making investment or lending decisions.

03

Internal stakeholders: Pro forma income statements are useful for managers and executives to monitor and evaluate the financial performance of a business. They assist in identifying areas for cost reduction, profit maximization, and strategic planning.

04

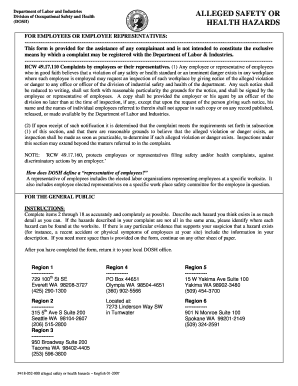

External stakeholders: Pro forma income statements are often required by regulatory bodies, government agencies, and tax authorities to comply with financial reporting standards. They provide a comprehensive overview of a company's financial position and help meet legal obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a pro forma income statement?

A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn't yet occurred. In the online course Financial Accounting, pro forma financial statements are defined as “financial statements forecasted for future periods.

What is the difference between pro forma and P&L?

Individual energy projects are often evaluated using P&L and Cash Flow statements that jointly are known as the "pro forma." Unlike the P&L and Cash Flow statements for a company, which should represent actual historical data, the pro forma represents the analyst's evaluation of the financial worthiness of a potential

What are the 4 steps in developing a pro forma income statement?

How to Create a Pro Forma in 4 Steps Calculate revenue projections for your business. Make sure to use realistic market assumptions to write an accurate pro forma statement. Estimate your total liabilities and costs. Your liabilities are loans and lines of credit. Estimate cash flows. Create the chart of accounts.

How do you create a pro forma income statement?

How to Create a Pro Forma Statement Calculate the estimated revenue projections for your business. Estimate your total liabilities and costs. Use the revenue projections from Step 1 and the total costs found in Step 2 to create the first part of your pro format, This part will project your future net income (NI).

How is proforma written?

To write a pro forma income statement, first list all of your anticipated sources of income. If your company has multiple sources of revenue, such as retail and wholesale sales, use a separate line for each. Base your pro forma projections on past sales figures and trends, such as consistent 20-percent annual growth.

Can I make my own income statement?

To create an income statement for your business, you'll need to print out a standard trial balance report. You can quickly generate the trial balance through your cloud-based accounting software.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

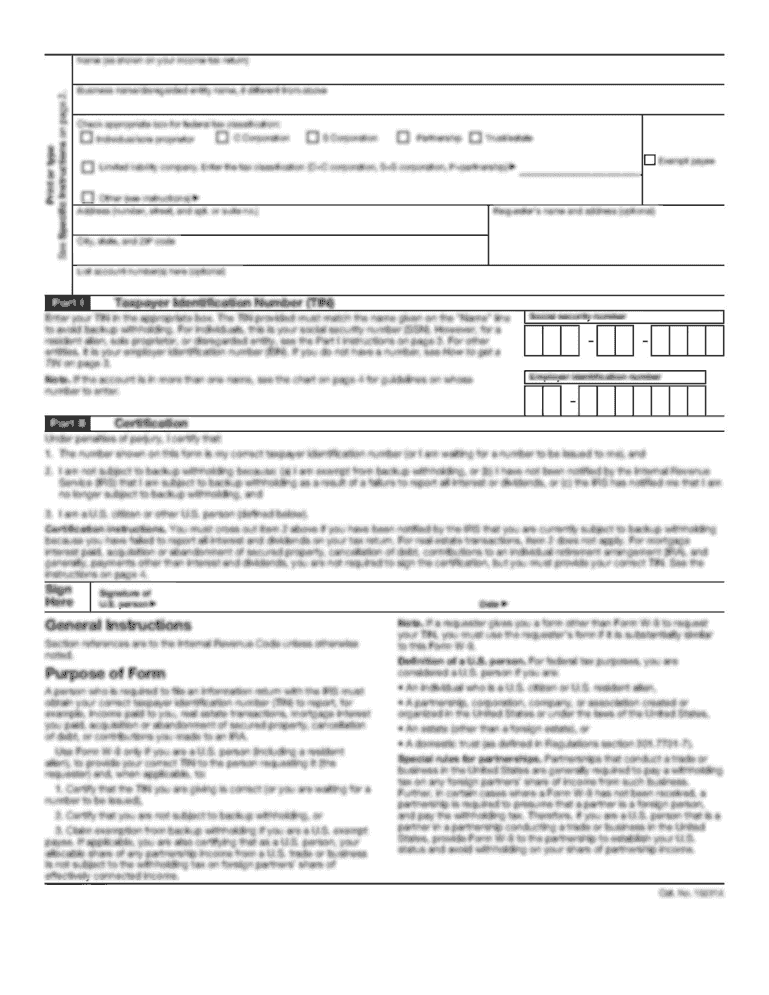

How do I execute Kaeding Company Sample Pro Forma Balance online?

Completing and signing Kaeding Company Sample Pro Forma Balance online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit Kaeding Company Sample Pro Forma Balance online?

The editing procedure is simple with pdfFiller. Open your Kaeding Company Sample Pro Forma Balance in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out Kaeding Company Sample Pro Forma Balance on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your Kaeding Company Sample Pro Forma Balance, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is pro forma income statement?

A pro forma income statement is a financial report that reflects projected revenues and expenses, typically used to estimate future financial performance or assess the potential impact of specific scenarios or events.

Who is required to file pro forma income statement?

Generally, companies involved in mergers, acquisitions, or significant financial changes may be required to file pro forma income statements with regulatory bodies, like the SEC, to provide a clearer picture of expected financial outcomes.

How to fill out pro forma income statement?

To fill out a pro forma income statement, start by estimating future revenues and expenses based on historical data and market analysis. Organize the data into standardized categories such as sales, cost of goods sold, operating expenses, and net income, ensuring to include all relevant assumptions.

What is the purpose of pro forma income statement?

The purpose of a pro forma income statement is to help stakeholders, such as investors and management, understand projected business performance under certain conditions, assist in decision-making, and evaluate the financial impact of potential business decisions.

What information must be reported on pro forma income statement?

A pro forma income statement typically reports estimated revenues, cost of goods sold, gross profit, operating expenses, earnings before interest and taxes (EBIT), interest, taxes, and net income, along with any significant assumptions made during the preparation.

Fill out your Kaeding Company Sample Pro Forma Balance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kaeding Company Sample Pro Forma Balance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.