Get the free acd 31102

Get, Create, Make and Sign fillable acd 31102 form

Editing acd 31102 form online

Uncompromising security for your PDF editing and eSignature needs

Video instructions and help with filling out and completing acd 31102

Instructions and Help about acd 31102 form

My name is Jennifer Harrison I'm a toxic examiner advanced within the call center Bureau in Albuquerque I started as an office clerk and I moved my way up going to a tax examiner basic and then to a tax examiner operational now a tax examiner advanced I really encourage you to come to our rapid hire it is a great place to work and move your way up through the organization like I am and keep moving forward

People Also Ask about

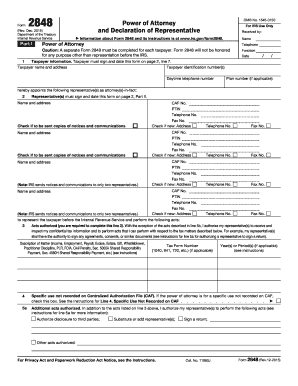

What is a power of attorney for a car in New Mexico?

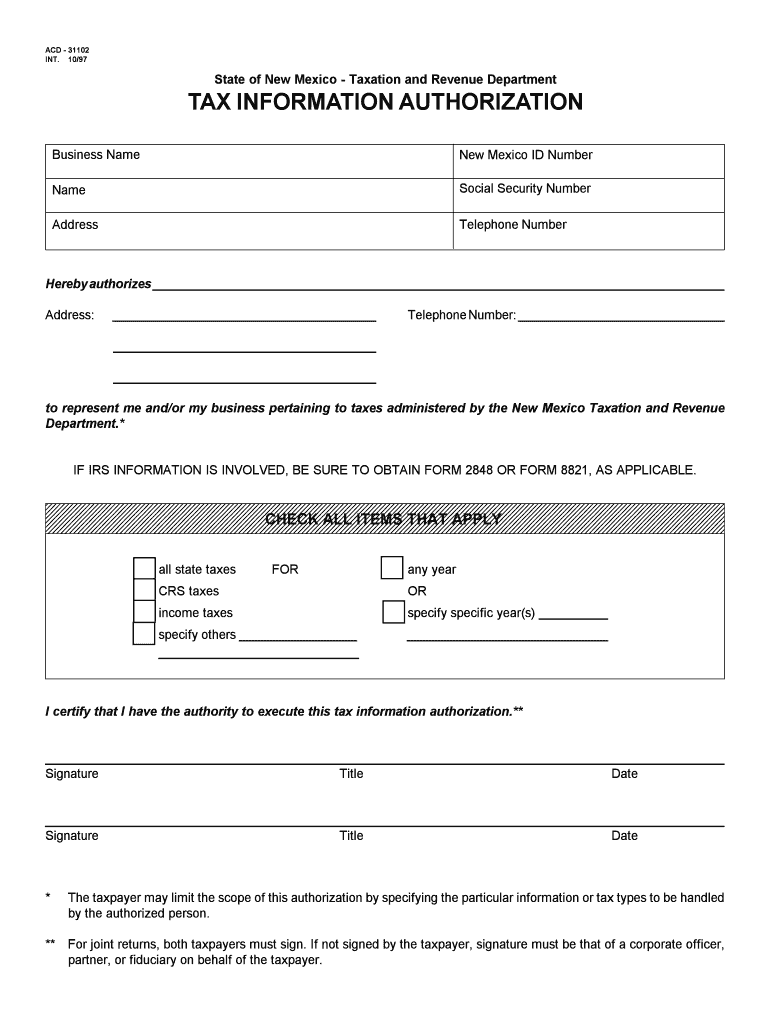

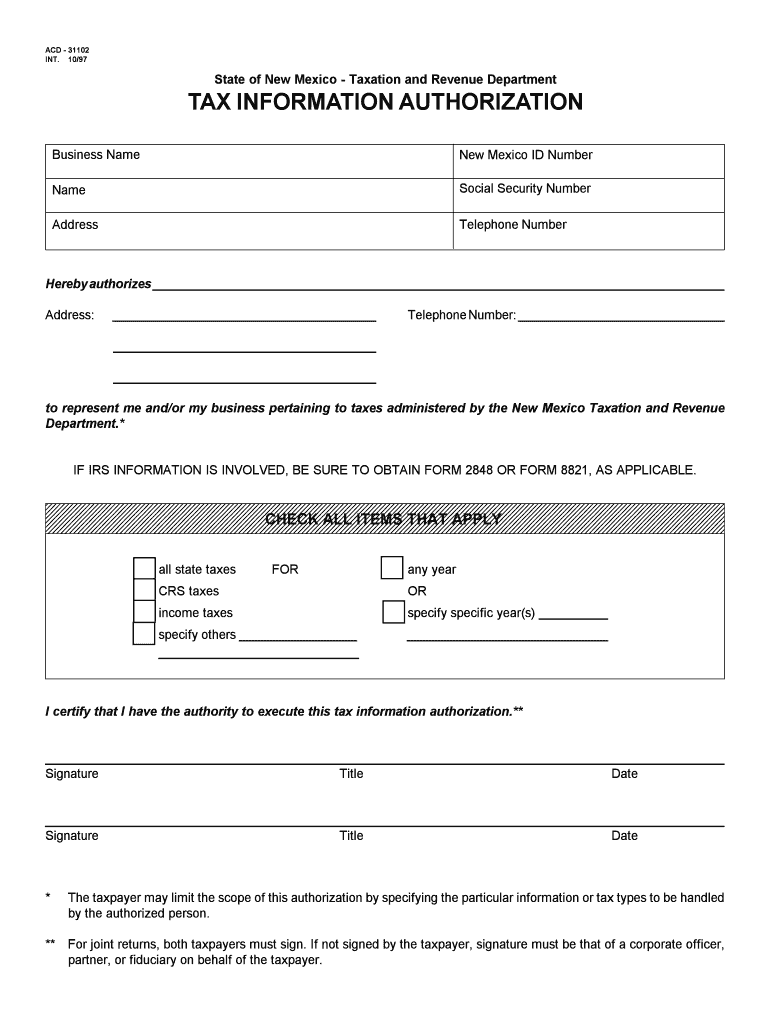

What is the form ACD 31102 in New Mexico?

Is a CRS number the same as a tax ID?

Does a power of attorney need to be filed in New Mexico?

What is the form for tax power of attorney in New Mexico?

How long does it take to get New Mexico state tax refund?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit acd 31102 form in Chrome?

Can I create an electronic signature for signing my acd 31102 form in Gmail?

How do I fill out acd 31102 form on an Android device?

What is acd 31102?

Who is required to file acd 31102?

How to fill out acd 31102?

What is the purpose of acd 31102?

What information must be reported on acd 31102?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.