Get the free dgpayportal

Show details

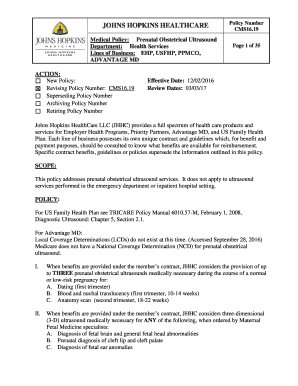

View, Print and Save Your Pay Stubs & W-2 Statement. 24 Hours Per Day/7 ... create a password answer and answer a few security questions. El. You will be ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dg me paystub form

Edit your dgme paystub form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dg paystub form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dollar general pay stub portal online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dg pay stub portal form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dgme employee pay stub form

How to fill out a dg paystub:

01

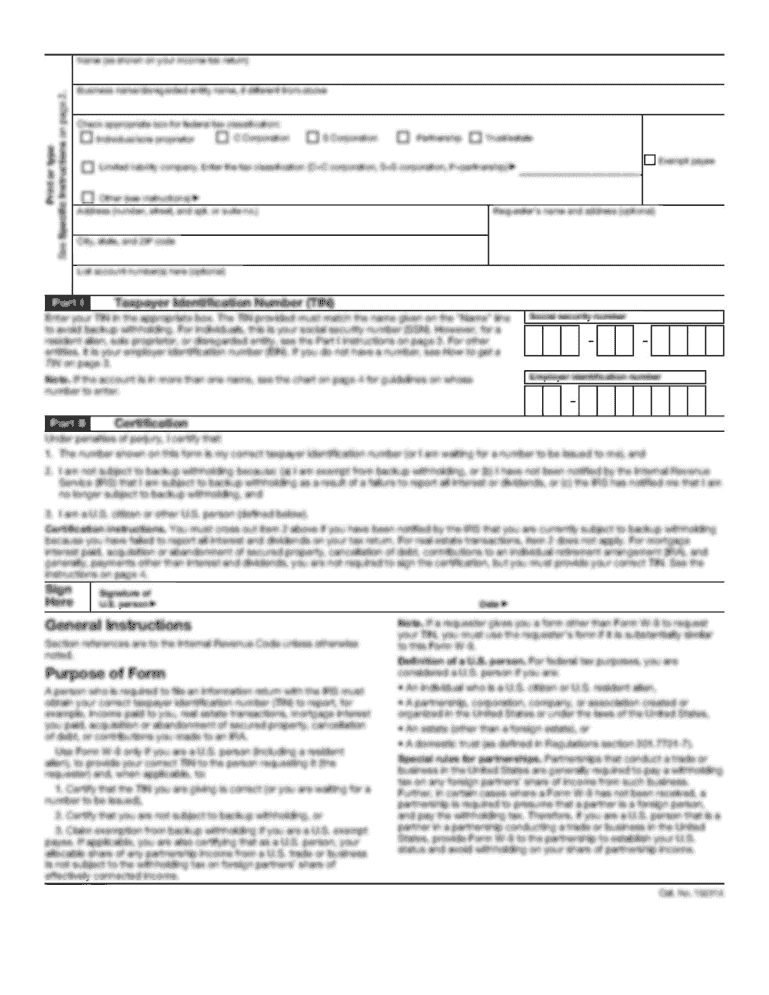

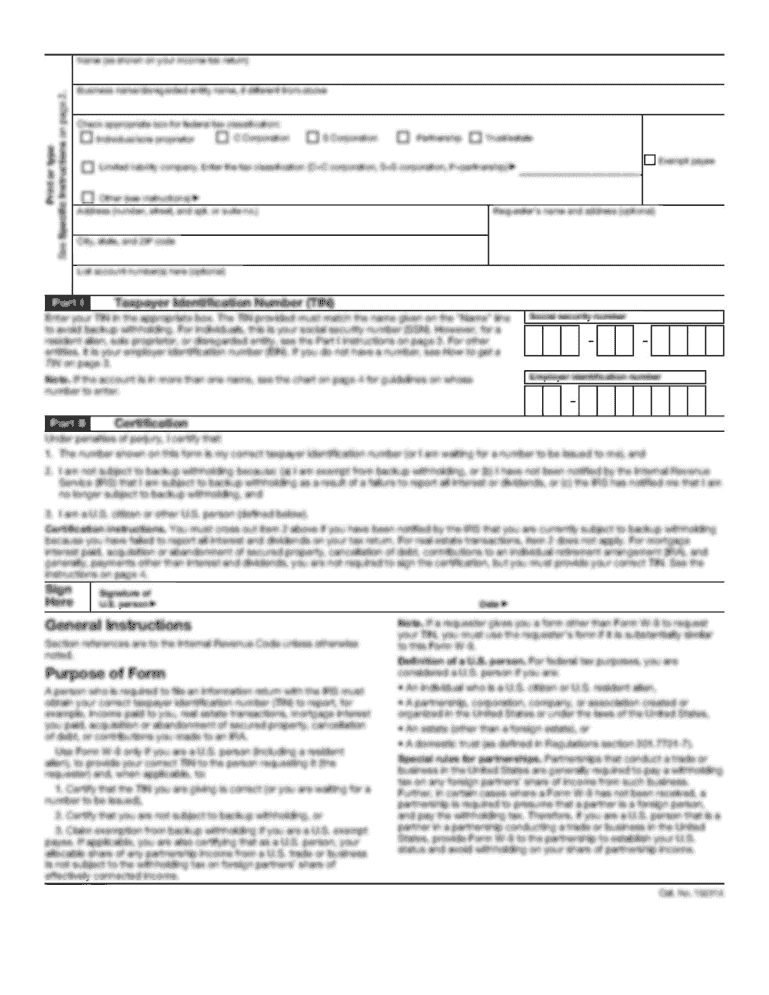

Gather all necessary information, such as employee name, address, and social security number.

02

Enter the pay period dates and the corresponding hours worked or salary earned for each pay period.

03

Calculate any overtime hours and rate if applicable, and input those figures separately.

04

Deduct any taxes, insurance premiums, or other deductions as required by law or company policy.

05

Include any additional earnings like bonuses or commissions if applicable.

06

Total up the gross pay and subtract all deductions to calculate the net pay.

07

Provide any necessary employer information, such as company name, address, and tax identification number.

08

Make sure to include any required legal statements or disclaimers at the bottom of the paystub.

Who needs dg paystub:

01

Employees: It is important for employees to have a copy of their paystub for personal record-keeping and to verify their earnings, deductions, and taxes.

02

Employers: Employers need to provide paystubs to their employees as evidence of payment and for tax and audit purposes.

03

Financial Institutions: Banks and lenders may require paystubs as proof of income when processing loans or financial applications.

04

Government Agencies: Government agencies such as the Internal Revenue Service (IRS) or Social Security Administration may request paystubs for tax or benefit verification purposes.

05

Independent Contractors: Independent contractors may need paystubs to show proof of income when applying for loans or filing taxes as self-employed individuals.

Fill

dg pay stub

: Try Risk Free

People Also Ask about dgpaystub portal

Can you download a paystub?

Yes, you can print paychecks/paystubs to a PDF file.

Can I email my pay stubs?

Email is a convenient and fast way to send any kind of documentation. Once you send paystubs via email, it's up to the recipient to ensure that the files are safe. If they have an easy to guess email password or don't use encrypted email, then it might get stolen.

How do I log into DGme?

0:16 1:46 How to Login DG me Account? Dgme Employee Access Login - YouTube YouTube Start of suggested clip End of suggested clip And after you have opened your browser on the source bar click there and type in d g capital. And meMoreAnd after you have opened your browser on the source bar click there and type in d g capital. And me small log in and hit enter.

How do I get my pay stubs online?

Through your employee website Find out where you can search for your pay stubs online. Ask your manager or the human resources department where you can locate them electronically. Typically, companies who house them electronically have them on a payroll service website which requires an employee login and password.

Can you get a copy of your pay stub?

If you no longer have your paycheck stubs, contact your payroll department or human resources department to request copies. If you're getting paid by direct deposit, your paystubs are most likely emailed to you, so there's a good chance they're in your email inbox already.

How do I get my Dollar General pay stub?

How do I check my Dollar General pay stub? If you are a current employee of DG, it's easy to log in and view your paystub. Visit the log in page at DGme, enter your Employee ID or EID, initials, and the password. If you are a new hire, you must register at DGme to view the paystub.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

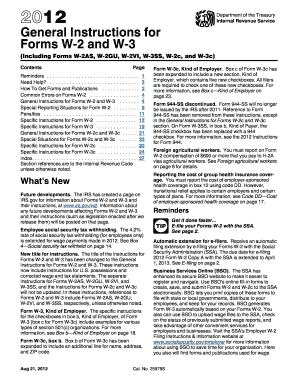

How can I edit dg w2 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your dg check stub into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit pay stub portal dg online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your dollar general pay stubs to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the dg me paystubs in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your paystub portal dg and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is dgpayportal?

Dgpayportal is an online platform designed to facilitate the management and processing of payment-related transactions for various services.

Who is required to file dgpayportal?

Businesses and individuals who engage in transactions that require reporting for tax or regulatory purposes are required to file dgpayportal.

How to fill out dgpayportal?

To fill out dgpayportal, users must log in to the portal, provide the necessary details about the transactions, and submit the required documentation as prompted.

What is the purpose of dgpayportal?

The purpose of dgpayportal is to streamline payment reporting processes, enhance compliance with regulatory requirements, and improve efficiency in transaction management.

What information must be reported on dgpayportal?

Information that must be reported on dgpayportal includes transaction amounts, dates, participant details, and any relevant documentation required by regulatory authorities.

Fill out your dgpayportal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dg Pay Stubs is not the form you're looking for?Search for another form here.

Keywords relevant to dg paycheck stub

Related to dg paystubs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.