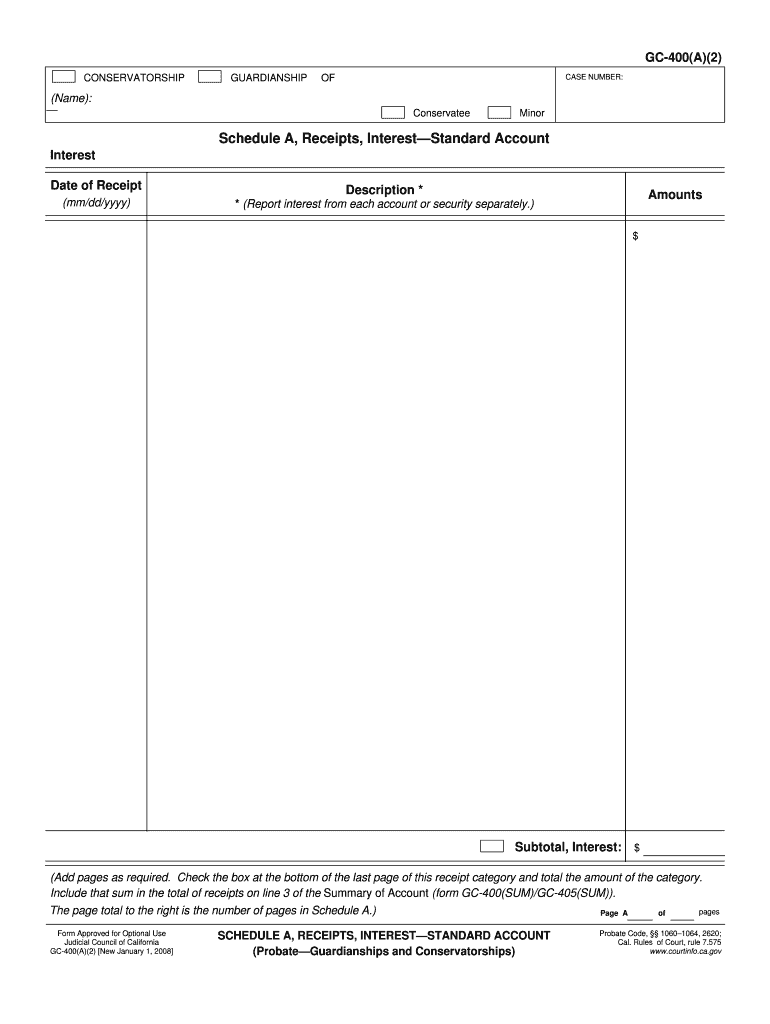

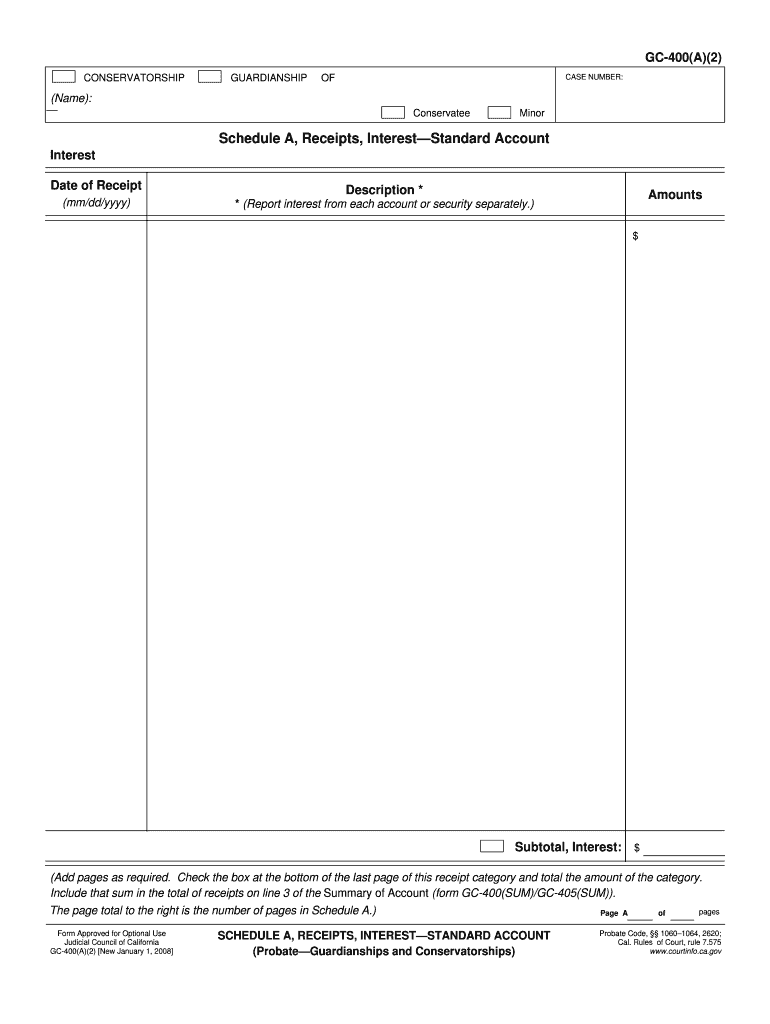

CA GC-400(A)(2) 2008-2025 free printable template

Get, Create, Make and Sign gc400a2 form

How to edit gc 400 a 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gc 400 a 2

How to fill out CA GC-400(A)(2)

Who needs CA GC-400(A)(2)?

Video instructions and help with filling out and completing gc 400 a 2

Instructions and Help about gc 400 a 2

In this series of videos we×39’RGO into to learn to prepare seven different types of budgets the first video we're going to learn how to make scheduled expected cash collections so why don't we do that now as with all of my videos I put problem on we solve the problem and the problem are linked right below this videoing×39’s a Dropbox and kind of takeJohannan external website, but you just click the link I promise there are no viruses×39’s just to download this filtoucansan work on it on your own um so anywhere×39’s the question John budgets ts sales BS for the third quarter of 2013, and they give budgeted sales and dollars sixteen thousand twenty thousand fourteen thousand and so which onyx wondering is when are they going to get the money they're selling 16 20 and fourteen grand, but they're done×39’t get the money right away because you know when businesses sell things they sell thing son account, and they collect a little later so when are they getting the Jonathan×39’s the question of this welgodsonon and gives us a little of information it says from experience the company has learned that 75% of sales are collected in the month of the sell so when they sell 16 grand in Julythey'’re going to get 75% of the moneinjuryly 20,000 and August they get 75% Odin August and so on 25 percent of the sales are collect in the month followings so 25 is going to be receivable to beget it all the next month uncollectible accounts are unusual and may be considered to be 0×, so this company is very few on collected accounts it gets almost all of its moneymaker our life a little easier beginning accounts receivable were three thousand dollars all of which were expected to be collected in July okay Think we've got enough information it says prepare the company scheduled expected cash collections for the third quarter calculate the company×39’accounts receivable balance at the end of September we've got more than enough information to answer this questioned×39’s get started we're going to start this with a title the Na the titles again a typical three-line accounting title the name of the company John Inc the name of the schedule we×39’preparing were'prepreparing a schedule of expected cash collections and the date and the date ingoing to be well let×39’s see Jul August September her it's for the third quarter of2012, so I can say for the third quarter of 2012, or I could say for the quarter ended what×39’s the end of the quartedown September her so September thirtieth twenty actually that's a 2013 I don't know why oh it is 2013 I don't like 2012 was Indy mind because that's last year um okays we×39’ve got a title and again therroomom for some headings here so we×39;redoing to have what are the three months here July August September August July August September the three months in the quarter and this is going to be our total four quarter three and that Willie our totals call so where to begin well we want to know when we're going Roget our money and I like...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit gc 400 a 2 in Chrome?

How can I edit gc 400 a 2 on a smartphone?

How do I complete gc 400 a 2 on an Android device?

What is CA GC-400(A)(2)?

Who is required to file CA GC-400(A)(2)?

How to fill out CA GC-400(A)(2)?

What is the purpose of CA GC-400(A)(2)?

What information must be reported on CA GC-400(A)(2)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.