PA REV-1500 2014 free printable template

Show details

1505610105

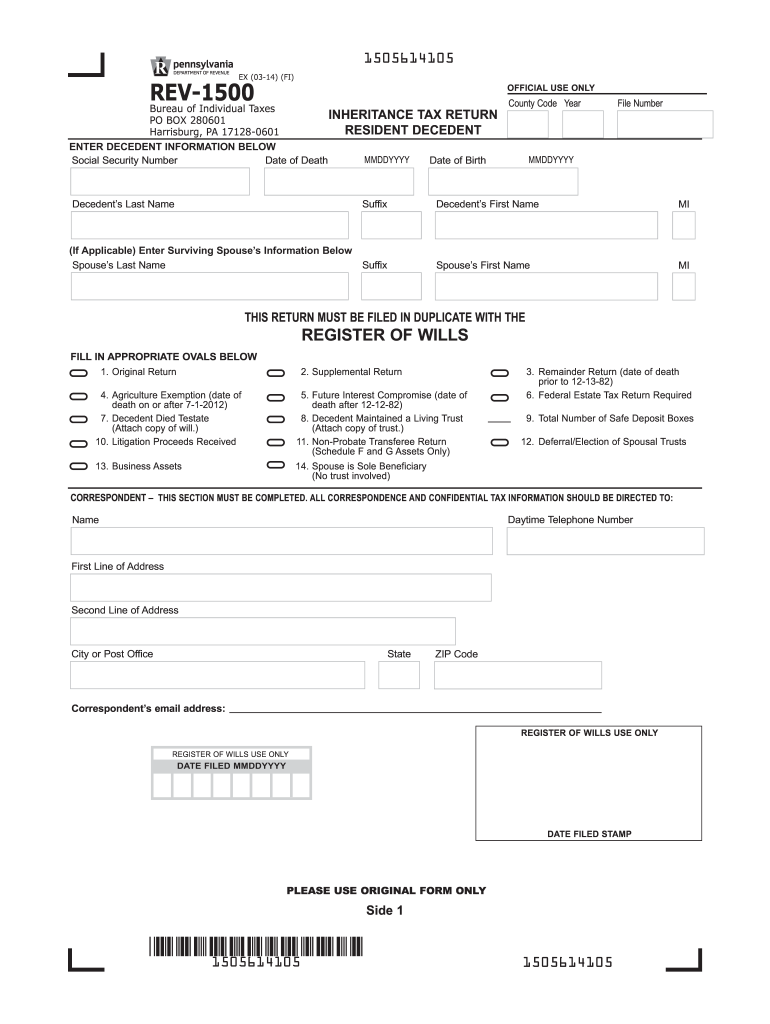

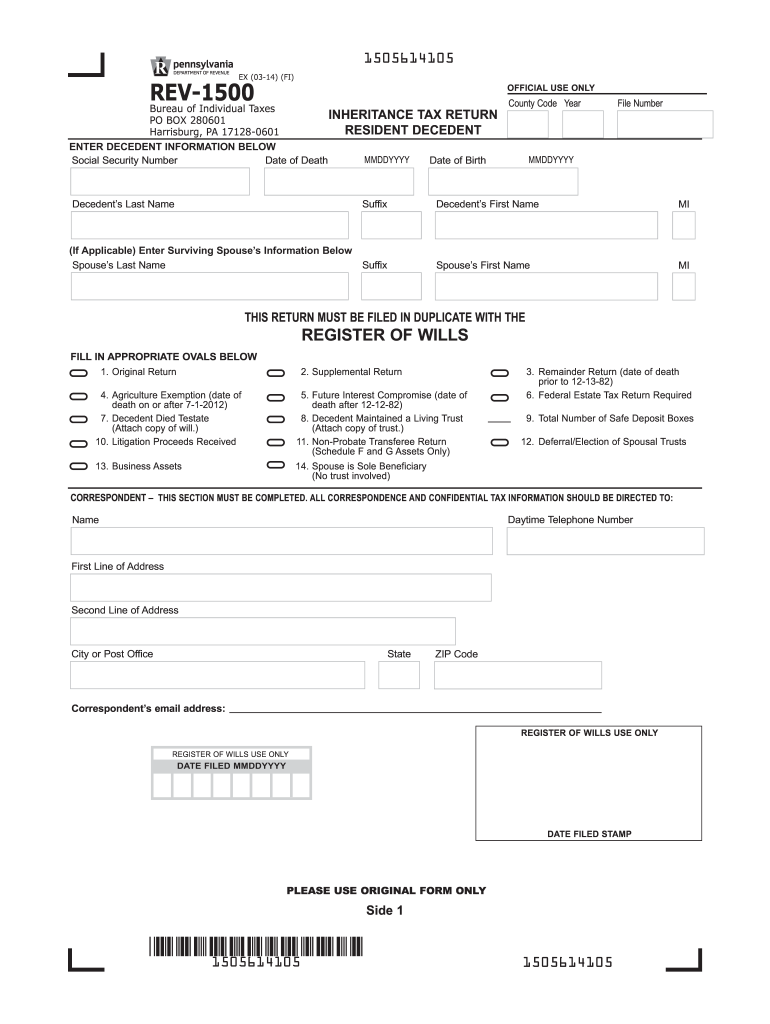

REV-1500

PA Department of Revenue

EX (02-11) (FI)

OFFICIAL USE ONLY

Bureau of Individual Taxes

INHERITANCE TAX RETURN

PO BOX 280601

RESIDENT DECEDENT

Harrisburg, PA 17128-0601

ENTER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-1500

Edit your PA REV-1500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA REV-1500 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA REV-1500. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1500

How to fill out PA REV-1500

01

Start by obtaining the PA REV-1500 form from the Pennsylvania Department of Revenue website or your local tax office.

02

Fill in your personal information, including your name, address, and social security number.

03

Indicate the tax year for which you are filing the form.

04

Provide the details of your income including any sources and amounts.

05

Calculate total income and any deductions applicable to your situation.

06

Clearly indicate any credits you are eligible for and apply them to your total tax amount.

07

Review the completed form for accuracy and sign it.

08

Submit the form by the appropriate deadline either by mailing it to the designated address or filing electronically if available.

Who needs PA REV-1500?

01

Individuals who are applying for a tax refund for overpayment of taxes in Pennsylvania.

02

Taxpayers needing to request an adjustment of their tax liability.

03

Those who have received a notice from the Pennsylvania Department of Revenue requiring them to submit this form.

Fill

form

: Try Risk Free

People Also Ask about

Who files the PA inheritance tax return?

The personal representative (executor or administrator appointed by the Register of Wills) of a decedent's estate is the person responsible for disclosing property of the decedent and filing the inheritance tax return.

What forms are needed for inheritance tax?

Details for deaths on or before 31 December 2021 HMRC use form IHT205. for deaths on or after 1 January 2022 you do not need to fill in a HMRC form however you must give details of the assets you need a Grant of Representation for and extra information for Inheritance Tax on the Estate Summary Form (NIPF7) below.

Can a CPA prepare a PA inheritance tax return?

Preparing the Pennsylvania Inheritance Tax Return The Probate Attorney typically prepares the Inheritance Tax Return. An accountant can prepare the return, but many accountants are unfamiliar with the return.

How do I file inheritance tax in PA?

How to file a return Complete the inheritance tax return. Download Form REV-1500—Pennsylvania Inheritance Tax Return Resident Decedent. Prepare your payment. Calculate the tax using the return. Deliver your return and payment to the Inheritance Tax Department. You can either file your return in person or by mail.

Who can prepare a PA inheritance tax return?

The personal representative (executor or administrator appointed by the Register of Wills) of a decedent's estate is the person responsible for disclosing property of the decedent and filing the inheritance tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA REV-1500 for eSignature?

Once you are ready to share your PA REV-1500, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in PA REV-1500?

The editing procedure is simple with pdfFiller. Open your PA REV-1500 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my PA REV-1500 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your PA REV-1500 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is PA REV-1500?

PA REV-1500 is a form used in Pennsylvania for reporting and claiming sales and use tax exemptions.

Who is required to file PA REV-1500?

Entities or individuals seeking to claim exemptions from Pennsylvania sales and use tax must file PA REV-1500.

How to fill out PA REV-1500?

To fill out PA REV-1500, enter the required information accurately, including the basis for the exemption and details about the purchase.

What is the purpose of PA REV-1500?

The purpose of PA REV-1500 is to provide a standardized method for claiming sales tax exemptions on qualifying purchases.

What information must be reported on PA REV-1500?

PA REV-1500 requires reporting information such as the purchaser's name, address, type of exemption, and the specific items being purchased.

Fill out your PA REV-1500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.