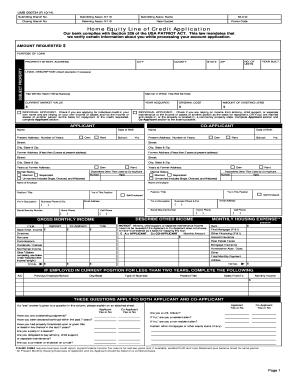

Get the free Home Equity Loan Application - First National Bank of Winnsboro

Show details

FIRST NATIONAL BANK OF WINNSBORO MAIN OFFICE / 903-342-5275 PO BOX 29 / 315 N MAIN WINNSBORO, TX 75494 Universal Credit Application WINONA-OWENTOWN BRANCH / 903-877-3311 PO BOX 388 / 11120 STATE HWY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity loan application

Edit your home equity loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home equity loan application online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home equity loan application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the monthly payment on a $100 000 home equity loan?

Loan payment example: on a $100,000 loan for 180 months at 7.30% interest rate, monthly principal and interest payments would be $915.68 over the full term of the loan. Payment example does not include amounts for taxes and insurance premiums.

Can you get pre approved for a home equity loan?

Getting preapproved or prequalified for a HELOC can help you understand what loan terms you're likely to qualify for. Both can help you gauge what you can borrow and how much you can afford with a home equity line of credit. You can use preapprovals or prequalifications to compare different lenders' rates.

How to get a loan on the equity of my house?

There are three main ways you can borrow against your home's equity: a home equity loan, a home equity line of credit or a cash-out refinance. Using equity is a smart way to borrow money because home equity money comes with lower interest rates.

What is the first step to getting a home equity loan?

There are six basic steps to get a home equity loan: Decide how much cash you need. Check your credit before applying. Get quotes and compare interest rates. Complete your application and turn in financial documents. Wait for approval, including underwriting and appraisal. Close on the loan and receive funds.

Can I get a home equity loan through my bank?

You can get a home equity loan from a credit union, bank, or specialized lender. A good home equity loan should have no or low fees, a low fixed interest rate, no prepayment penalties, and transparent terms.

What disqualifies you from getting a home equity loan?

Insufficient Income One of the most common reasons for denial is a borrower's lack of sufficient income. Even if a homeowner has significant equity in their home, lenders need to be confident that the borrower has the income to repay the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit home equity loan application online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your home equity loan application and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit home equity loan application in Chrome?

home equity loan application can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit home equity loan application straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing home equity loan application right away.

What is home equity loan application?

Home equity loan application is a form that allows individuals to apply for a loan using the equity they have built in their home as collateral.

Who is required to file home equity loan application?

Anyone who wishes to apply for a home equity loan is required to file a home equity loan application.

How to fill out home equity loan application?

To fill out a home equity loan application, you will need to provide information about your income, debts, and home value.

What is the purpose of home equity loan application?

The purpose of a home equity loan application is to assess the potential borrower's eligibility for a home equity loan.

What information must be reported on home equity loan application?

Information such as income, debts, home value, and desired loan amount must be reported on a home equity loan application.

Fill out your home equity loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.