AU SA325 2014 free printable template

Show details

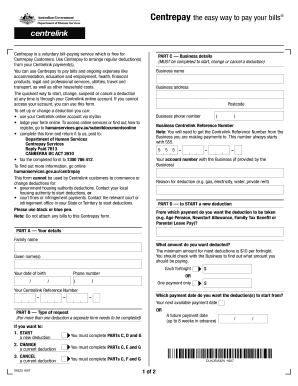

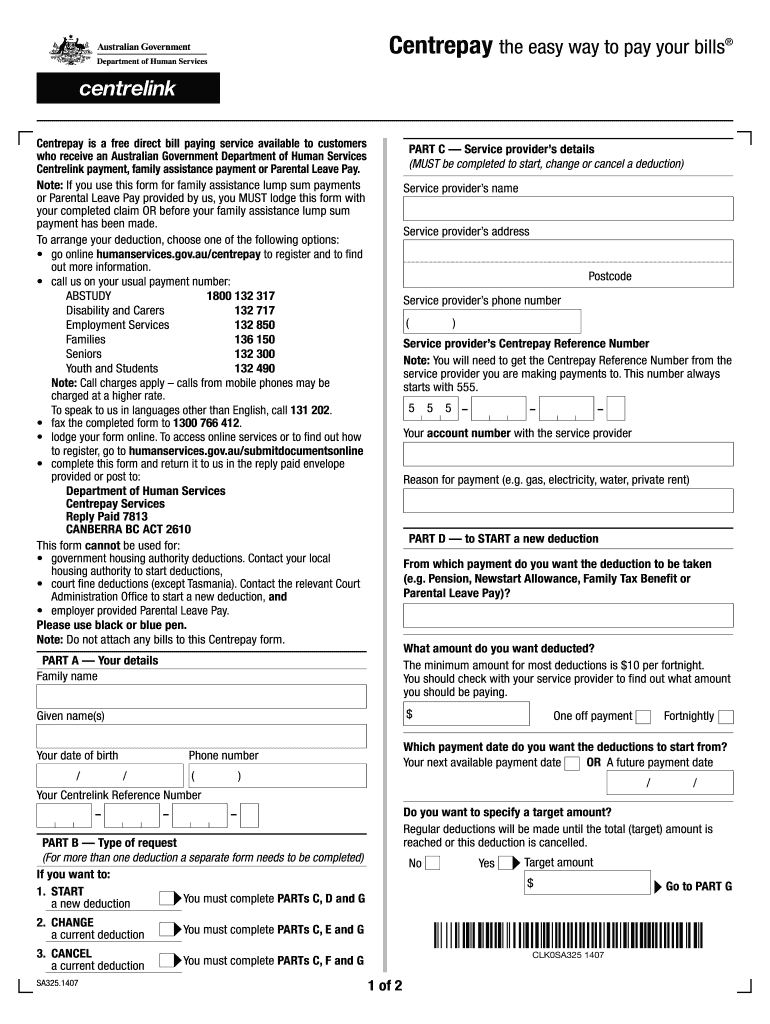

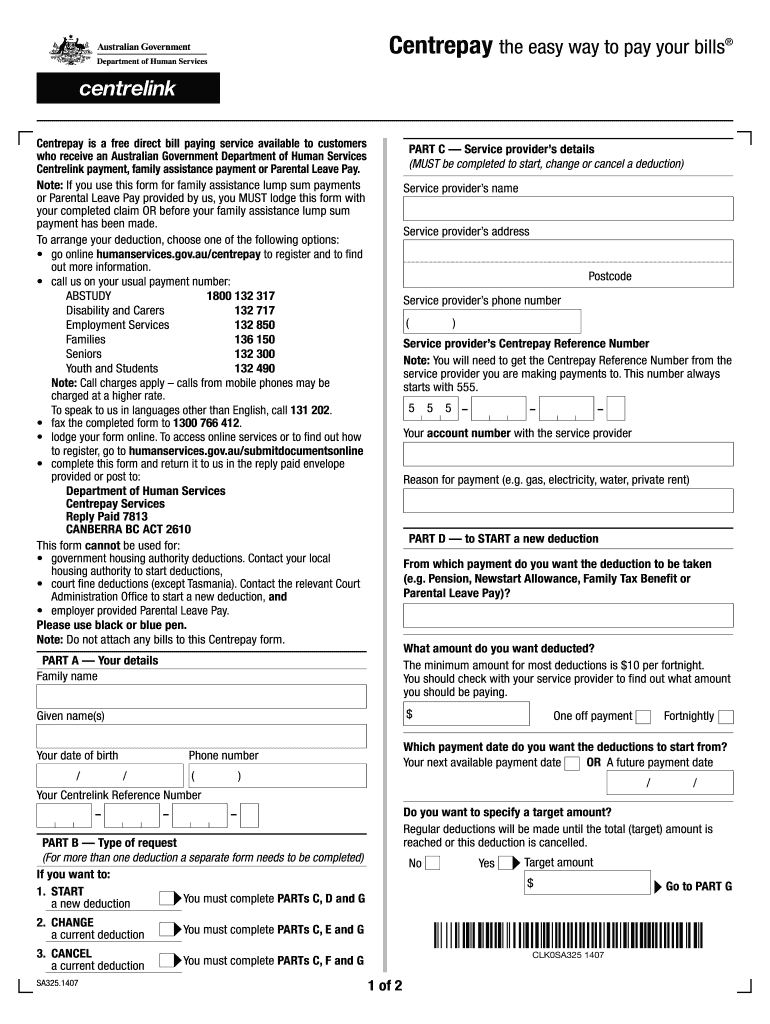

Print Instructions Clear Cent repay the easy way to pay your bills Cent repay is a free direct bill paying service available to customers who receive an Australian Government Department of Human Services

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU SA325

Edit your AU SA325 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SA325 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SA325 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU SA325. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA325 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU SA325

How to fill out AU SA325

01

Locate the AU SA325 form on the official Australian Taxation Office website.

02

Read the instructions provided for the form carefully.

03

Fill in your personal details including your name, address, and tax file number.

04

Specify the type of income you are reporting, if applicable.

05

Enter details of any deductions you are claiming.

06

Provide information about any tax offsets you are eligible for.

07

Review all entries for accuracy and completeness.

08

Sign and date the form, using a pen to ensure your signature is clear.

09

Submit the form electronically via the ATO's online services or print it out and send it via mail.

Who needs AU SA325?

01

Individuals who have received a notice to lodge an income tax return.

02

Taxpayers who have income or deductions that need to be reported.

03

Anyone claiming tax offsets or rebates in Australia.

Fill

form

: Try Risk Free

People Also Ask about

How much does a Yanmar 425 weigh?

SPECIFICATIONS: Operating Weight (as unit equipped): 2,991 lbs, Engine 25 Horsepower, 3-Point Hitch Lift Force at 24” Lift Point lb.

How much does a Yanmar tractor weigh?

OPERATING WEIGHT W/LOADER: 2200 LBS. LIFT CAPACITY AT PINS: 1200 LBS. LOADER WEIGHT W/BUCKET: 430 LBS.

How much does a Yanmar SA324 weigh?

Yanmar 324 Dimensions & TiresWheelbase:63 inches 160 cmWeight:1715 lbs 777 kgFull dimensions and tires Apr 18, 2021

What is the price of a SA324?

2022 Yanmar SA324 • $15,279 SA Series tractors pack the power you'd expect from much larger tractors. That means the SA324 can do serious work with a front-end loader, a hydraulic backhoe, and three-point hitch attachments for mowing, tilling, planting, digging, plowing and so much more.

How much does a Yanmar 324 weigh?

Yanmar 324 Dimensions & TiresWheelbase:63 inches 160 cmWeight:1715 lbs 777 kgFull dimensions and tires Apr 18, 2021

How much does a Yanmar 424 weigh?

Operating Weight (including ballast): 2,591 lbs.

How much is a Yanmar YT235?

2022 Yanmar YT235 • $26,000 The YT235 is equipped with a hydrostatic transmission that gives you an unlimited choice of tractor speeds.

How much is a Yanmar SA324?

2022 Yanmar SA324 • $15,279 That means the SA324 can do serious work with a front-end loader, a hydraulic backhoe, and three-point hitch attachments for mowing, tilling, planting, digging, plowing and so much more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU SA325?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific AU SA325 and other forms. Find the template you need and change it using powerful tools.

How do I complete AU SA325 online?

pdfFiller has made it easy to fill out and sign AU SA325. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the AU SA325 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your AU SA325 in minutes.

What is AU SA325?

AU SA325 is a specific Australian tax form used for reporting certain financial details and obligations related to tax matters.

Who is required to file AU SA325?

Individuals or entities that meet specific criteria set by the Australian Taxation Office (ATO) are required to file AU SA325.

How to fill out AU SA325?

To fill out AU SA325, individuals must gather relevant financial information, complete the form as per the ATO guidelines, and submit it by the required deadline.

What is the purpose of AU SA325?

The purpose of AU SA325 is to provide the ATO with detailed financial information for assessment of tax liabilities and compliance.

What information must be reported on AU SA325?

Information reported on AU SA325 typically includes income details, expenses, deductions, and other financial data relevant to the tax assessment.

Fill out your AU SA325 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU sa325 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.