AU SA325 2012 free printable template

Show details

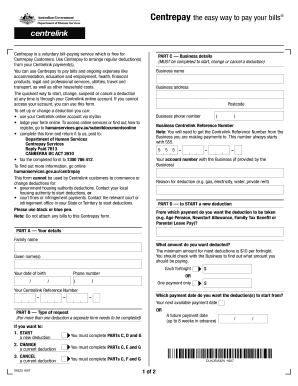

Instructions Cent repay the easy way to pay your bills Cent repay is a free direct bill paying service available to customers who receive a Centrelink payment. PART C Service providers details (MUST

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU SA325

Edit your AU SA325 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU SA325 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU SA325 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU SA325. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SA325 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU SA325

How to fill out AU SA325

01

Obtain the AU SA325 form from the official website or your local tax office.

02

Fill in your personal details, including your name, address, and tax file number.

03

Provide information about your income sources and amounts for the relevant period.

04

Complete any sections related to deductions you wish to claim.

05

Review all the information provided to ensure accuracy.

06

Sign and date the form at the designated area.

07

Submit the form either electronically or via mail, as instructed.

Who needs AU SA325?

01

Individuals or businesses that need to report income and claim deductions for tax purposes.

02

Taxpayers who are required to declare foreign income or particular Australian tax offsets.

03

Anyone who has received a notice from the tax authority requesting the AU SA325 form.

Fill

form

: Try Risk Free

People Also Ask about

How much does a Yanmar 425 weigh?

SPECIFICATIONS: Operating Weight (as unit equipped): 2,991 lbs, Engine 25 Horsepower, 3-Point Hitch Lift Force at 24” Lift Point lb.

How much does a Yanmar tractor weigh?

OPERATING WEIGHT W/LOADER: 2200 LBS. LIFT CAPACITY AT PINS: 1200 LBS. LOADER WEIGHT W/BUCKET: 430 LBS.

How much does a Yanmar SA324 weigh?

Yanmar 324 Dimensions & TiresWheelbase:63 inches 160 cmWeight:1715 lbs 777 kgFull dimensions and tires Apr 18, 2021

What is the price of a SA324?

2022 Yanmar SA324 • $15,279 SA Series tractors pack the power you'd expect from much larger tractors. That means the SA324 can do serious work with a front-end loader, a hydraulic backhoe, and three-point hitch attachments for mowing, tilling, planting, digging, plowing and so much more.

How much does a Yanmar 324 weigh?

Yanmar 324 Dimensions & TiresWheelbase:63 inches 160 cmWeight:1715 lbs 777 kgFull dimensions and tires Apr 18, 2021

How much does a Yanmar 424 weigh?

Operating Weight (including ballast): 2,591 lbs.

How much is a Yanmar YT235?

2022 Yanmar YT235 • $26,000 The YT235 is equipped with a hydrostatic transmission that gives you an unlimited choice of tractor speeds.

How much is a Yanmar SA324?

2022 Yanmar SA324 • $15,279 That means the SA324 can do serious work with a front-end loader, a hydraulic backhoe, and three-point hitch attachments for mowing, tilling, planting, digging, plowing and so much more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AU SA325 in Gmail?

AU SA325 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out AU SA325 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign AU SA325 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out AU SA325 on an Android device?

Use the pdfFiller mobile app to complete your AU SA325 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is AU SA325?

AU SA325 is a specific form used for reporting certain information related to Australian taxation and financial contributions.

Who is required to file AU SA325?

Entities or individuals that meet specific criteria for financial reporting as per Australian tax regulations are required to file AU SA325.

How to fill out AU SA325?

To fill out AU SA325, follow the instructions provided by the Australian Taxation Office, ensuring all required fields are completed accurately with the necessary financial data.

What is the purpose of AU SA325?

The purpose of AU SA325 is to collect detailed financial information to ensure compliance with tax obligations and to facilitate assessment by the Australian Taxation Office.

What information must be reported on AU SA325?

Information that must be reported on AU SA325 includes income, expenses, tax offsets, and other relevant financial details as stipulated by the guidelines.

Fill out your AU SA325 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU sa325 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.