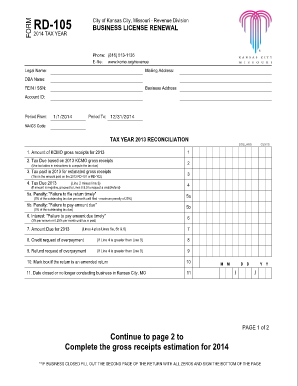

MO RD-105 - City of Kansas City 2014 free printable template

Show details

Amount Due for 2015 (Lines 15 plus Line 16a, 16b & 17). . $. $. 19. 16a. ... All required clearances must be attached to Form RD-105. For information on ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rd 105 kansas city

Edit your rd 105 kansas city form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rd 105 kansas city form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rd 105 kansas city online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rd 105 kansas city. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO RD-105 - City of Kansas City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rd 105 kansas city

How to fill out MO RD-105 - City of Kansas City

01

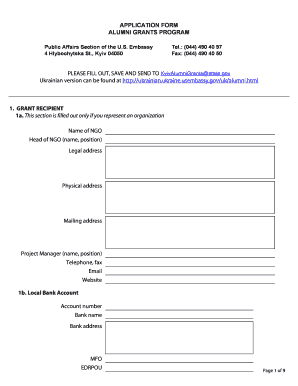

Obtain the MO RD-105 form from the official Kansas City website or local government office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact details.

04

Provide the necessary information about the property related to your request, including the property address and owner details.

05

Fill in any additional required sections as per the guidelines, making sure to provide accurate information.

06

Review the completed form for any errors or omissions before submission.

07

Submit the form according to the instructions, either online, by mail, or in person at the appropriate office.

Who needs MO RD-105 - City of Kansas City?

01

Property owners in Kansas City who are seeking specific approvals or permits.

02

Individuals or businesses looking to report changes related to property assessment or taxation.

03

Anyone needing to file a request that is related to zoning, land use, or property registration in Kansas City.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Kansas City earnings tax?

Who Does Not Pay Earnings Tax? Retirees whose income is from Social Security, pensions, retirement accounts and other non-earned income sources do not pay the e-tax. Others who are exempt include active military in combat zones and non-profits.

What is the Kansas City local tax withholding?

All Kansas City, Missouri residents, regardless of where they are employed, and all non- residents who work within the city limits, are subject to a 1 percent tax on their gross earnings.

What is 1% earnings tax Kansas City?

KANSAS CITY, Mo. — Kansas City, Missouri, charges everyone who lives or works within the city limits a 1% income tax, also known as the city's earnings tax, but some taxpayers are eligible to have all or part of that money refunded.

Are employers required to withhold Kansas City earnings tax?

How do I know if I owe? Your employer should withhold the earnings tax if you work in Kansas City, Missouri. Your W-2 (or your paystubs) will reflect tax paid through payroll deductions.

What is the 1% tax refund in Kansas City?

Kansas City imposes a 1% tax on the earnings of all resident individuals of the city and the earnings of nonresident individuals for services performed or rendered in the city. For tax years prior to 2022, taxpayers were entitled to a refund as long as the taxpayer filed a proper claim for the overpayment.

What is Kansas City withholding tax rate?

Yes, the monies earned by residents are subject to the City's one percent earnings tax regardless of where they are earned unless exempted by state statute or municipal ordinance.

Who must pay Kansas City earnings tax?

Kansas City residents must pay the tax on their earnings, no matter where they work. But nonresidents only have to pay the tax on the money they earn within Kansas City. That means they can get some of their e-tax money refunded if they worked from home outside Kansas City for a portion of the previous year.

What is a Form RD 105 in Kansas City MO?

Form RD-105 is an annual license application used by businesses operating in Kansas City, Mo. Form RD-103 is an annual license application used by certain industries that pay a flat rate as determined by North American Industry Classification System (NAICS) code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rd 105 kansas city for eSignature?

rd 105 kansas city is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit rd 105 kansas city in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your rd 105 kansas city, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the rd 105 kansas city in Gmail?

Create your eSignature using pdfFiller and then eSign your rd 105 kansas city immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is MO RD-105 - City of Kansas City?

MO RD-105 is a form used by residents and businesses in the City of Kansas City for reporting and complying with city tax requirements.

Who is required to file MO RD-105 - City of Kansas City?

Individuals and businesses that have tax obligations in Kansas City are required to file the MO RD-105 form.

How to fill out MO RD-105 - City of Kansas City?

To fill out the MO RD-105, carefully provide all requested information, including personal or business details, income, and any applicable deductions. Follow the instructions provided on the form.

What is the purpose of MO RD-105 - City of Kansas City?

The purpose of MO RD-105 is to provide a standardized method for residents and businesses in Kansas City to report their tax liabilities and ensure compliance with local tax regulations.

What information must be reported on MO RD-105 - City of Kansas City?

Information that must be reported on MO RD-105 includes taxpayer identification details, income amounts, deductions, exemptions, and any other specific information requested on the form.

Fill out your rd 105 kansas city online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rd 105 Kansas City is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.